Question: Hello. I need help with solving everything. Thanks. Note disclosures provide the following information: A. Explain the accounting policies that the company is using. B.

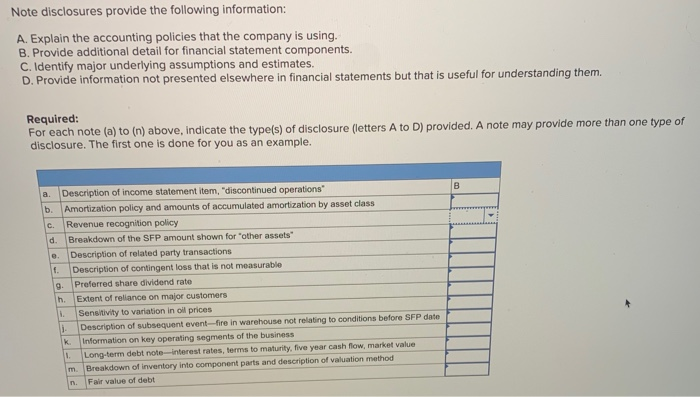

Note disclosures provide the following information: A. Explain the accounting policies that the company is using. B. Provide additional detail for financial statement components. C. Identify major underlying assumptions and estimates. D. Provide information not presented elsewhere in financial statements but that is useful for understanding them. Required: For each note (a) to (n) above, indicate the type(s) of disclosure (letters A to D) provided. A note may provide more than one type of disclosure. The first one is done for you as an example. B a. Description of income statement item, "discontinued operations b. Amortization policy and amounts of accumulated amortization by asset class c. Revenue recognition policy d Breakdown of the SFP amount shown for other assets" Description of related party transactions f Description of contingent loss that is not measurable 9 Preferred share dividend rate Ih Extent of reliance on major customers 1 Sensitivity to variation in oil prices Description of subsequent event-fire in warehouse not relating to conditions before SFP date K Information on key operating segments of the business 1. Long-term debt note-interest rates, terms to maturity, five year cash flow, market value Breakdown of inventory into component parts and description of valuation method Fair value of debt m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts