Question: Hello , I need help with solving this assignment. Thank you 1. Exploring Finance: Cost of Capital Comparison Cost of Capital Comparison Conceptual Overview: Explore

Hello , I need help with solving this assignment. Thank you

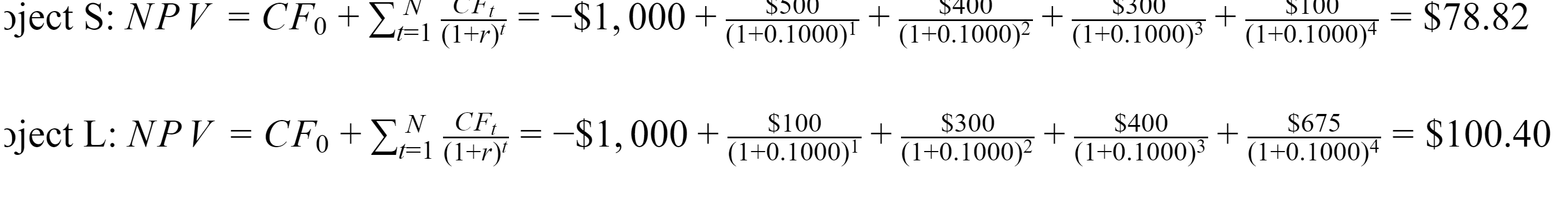

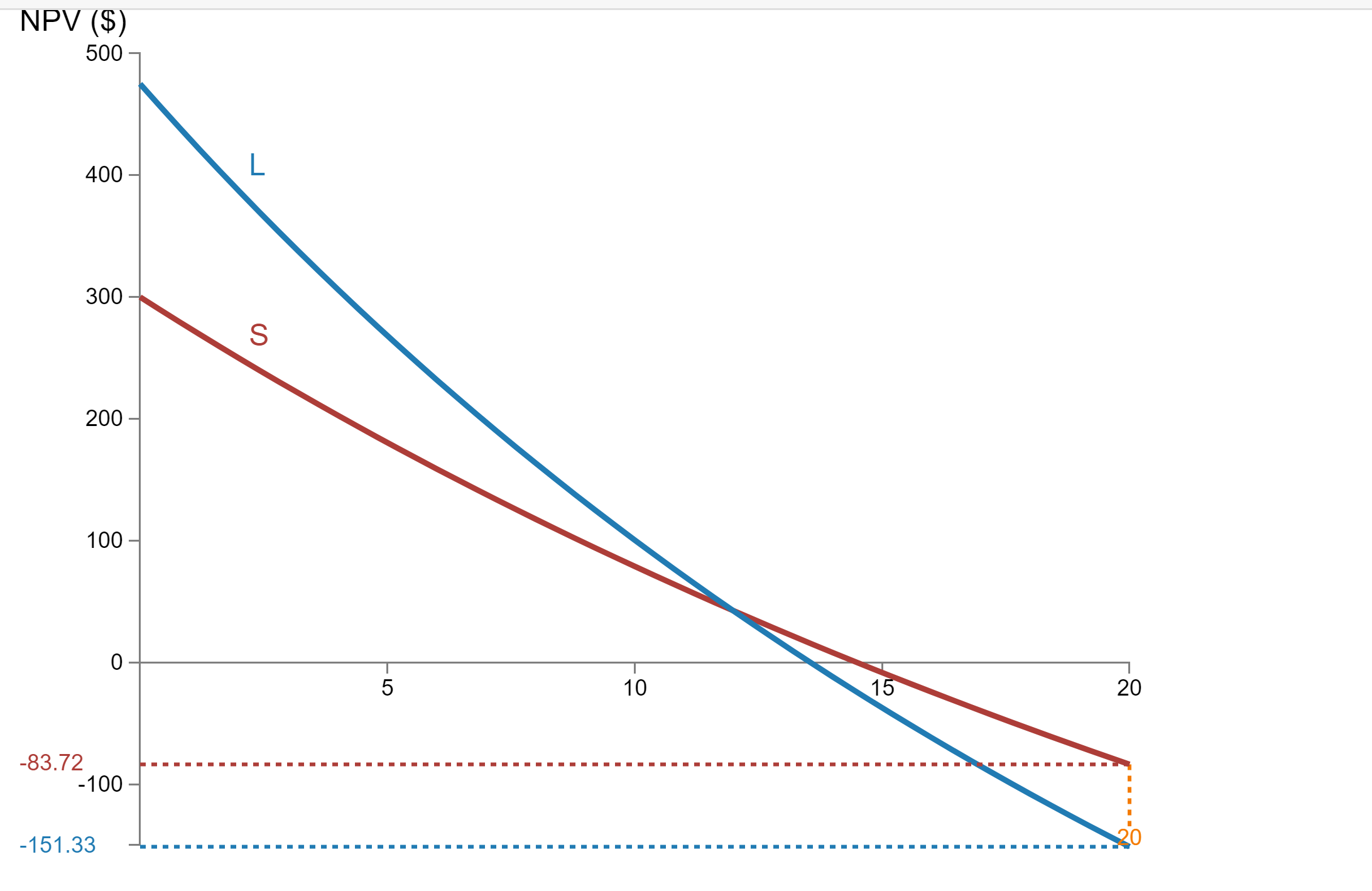

1. Exploring Finance: Cost of Capital Comparison Cost of Capital Comparison Conceptual Overview: Explore how the timing and size of cash flows affect the net present values of two alternative investments. The blue curve (labeled "L") depicts the NPV for a project with larger cash flows later of $1,000,$100,$300,$400, and $675. The red curve (labeled "S") depicts the NPV for a project with larger cash flows sooner of $1,000,$500,$400,$300, and $100. Drag on the graph either left or right to change the cost of capital interest rate at which the NPV is evaluated for the two projects. ctS:NPV=CF0+t=1N(1+r)tCFt=$1,000+(1+0.1000)1$500+(1+0.1000)2$400+(1+0.1000)3$500+(1+0.1000)4$100=$78.82ctL:NPV=CF0+t=1N(1+r)tCFt=$1,000+(1+0.1000)1$100+(1+0.1000)2$300+(1+0.1000)3$400+(1+0.1000)4$675=$100.40 Created by Gary H. McClelland, Professor Emeritus | University of Colorado Boulder (c) Cengage Learning. All Rights Reserved. 1. What is the approximate cost of capital for which the two cash flows are about equal? a. 10% b. 12% C. 13.5% d. 14.5% 2. What is the approximate internal rate of return (IRR) for the Project L cash flow? a. 10% b. 12% C. 13.5% d. 14.5% 3. What is the approximate internal rate of return (IRR) for the Project S cash flow? a. 10% b. 12% C. 13.5% d. 14.5% 4. What is the name for the point at which the two projects' NPVs are equal? a. Inflection point b. Equal NPV rate C. Crossover rate d. There is no special name for this point 5. At a cost of capital less than the point at which they cross, which project will have the higher NPV? a. Project S b. Project L c. Project S and L will have the same NPV d. Cannot determine 6. At a cost of capital greater than the point at which they cross, which project will have the higher NPV? a. Project S b. Project L c. Project S and L will have the same NPV d. Cannot determine 7. The internal rate of return (IRR) is the point at which a project's NPV equals 0 . If the cost of capital were 5% (move the slider so that is the case), then a. Project S is the better project because it has the higher IRR. b. Project L is the better project because it has the higher NPV. c. It depends because there is a conflict between IRR and NPV. 8. If the cost of capital was greater than the point at which the two projected NPVs are equal, then a. It depends because there is a conflict between IRR and NPV. b. There is no conflict because Project S has both a higher NPV and a higher IRR than Project L. c. There is no conflict because Project L has both a higher NPV and a higher IRR than Project S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts