Question: Hello, I need help with solving this assignment. Thank you 5. Bank loans Short-term financing through bank loans Consider this case: Chez Quis Inc. needs

Hello, I need help with solving this assignment. Thank you

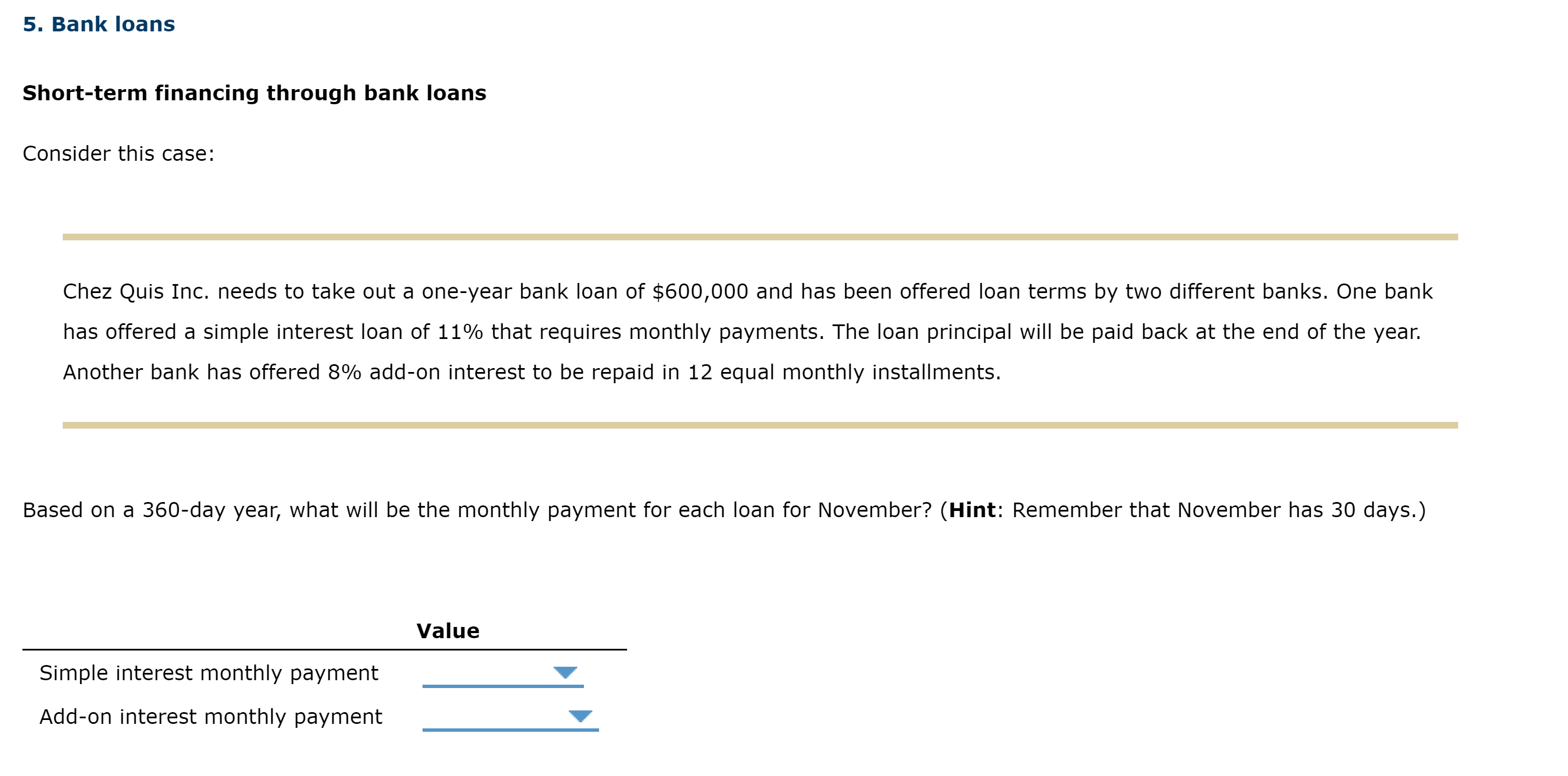

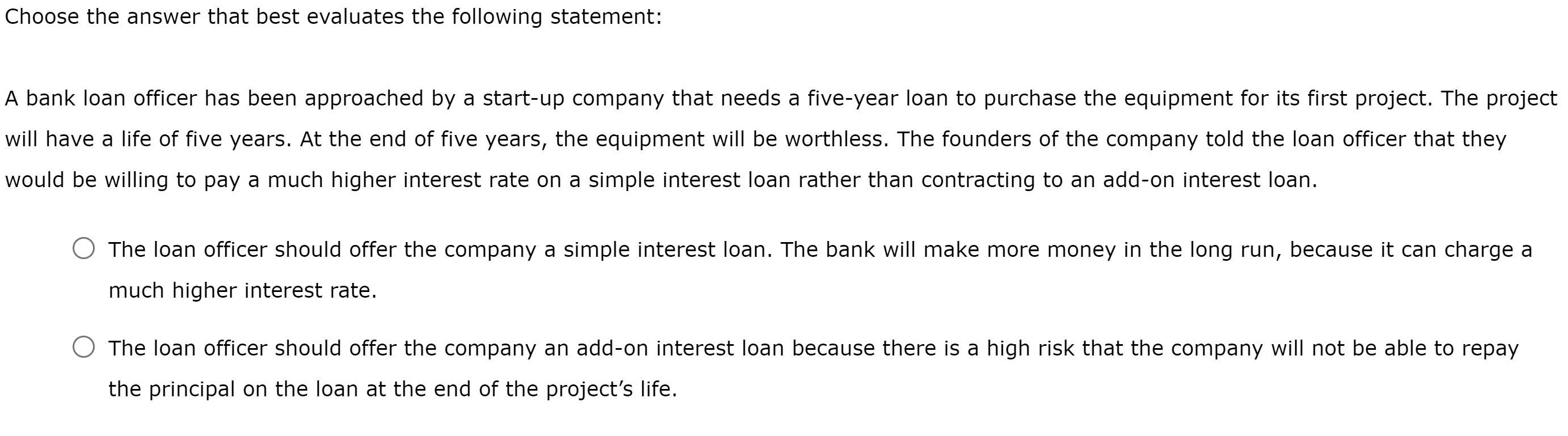

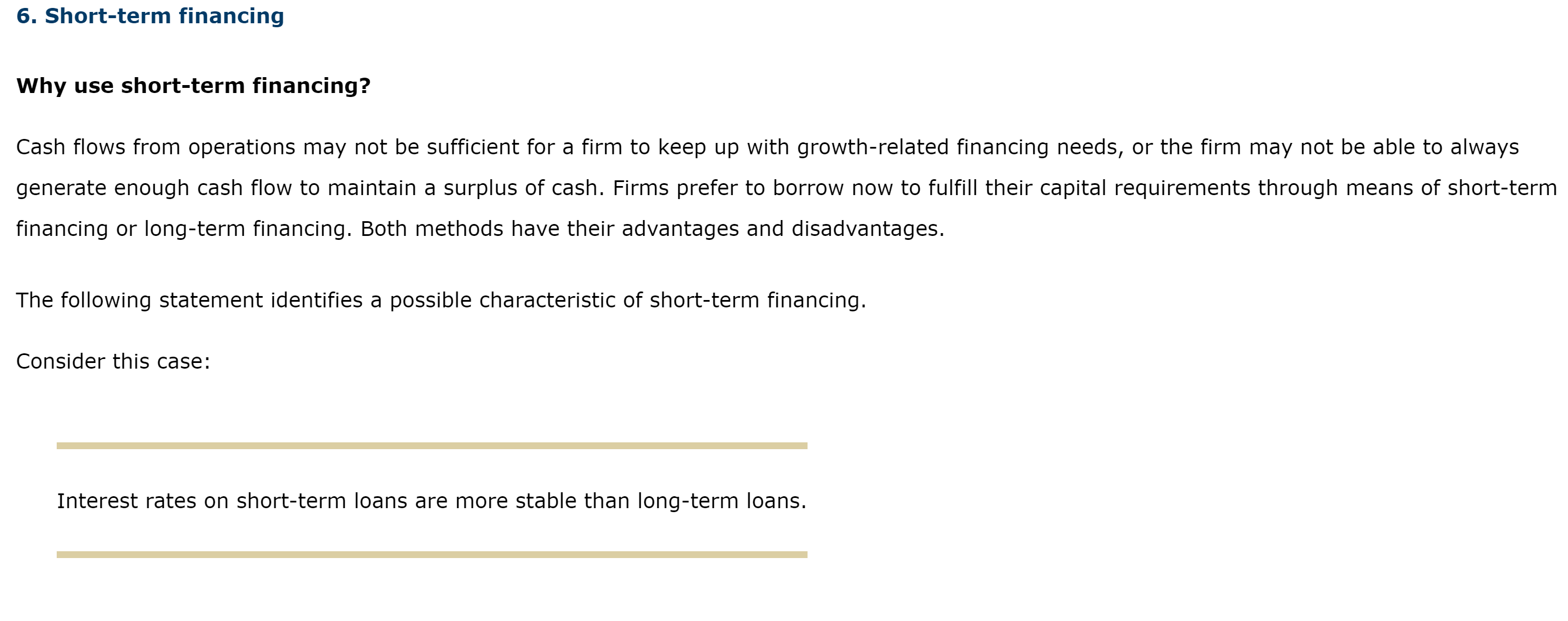

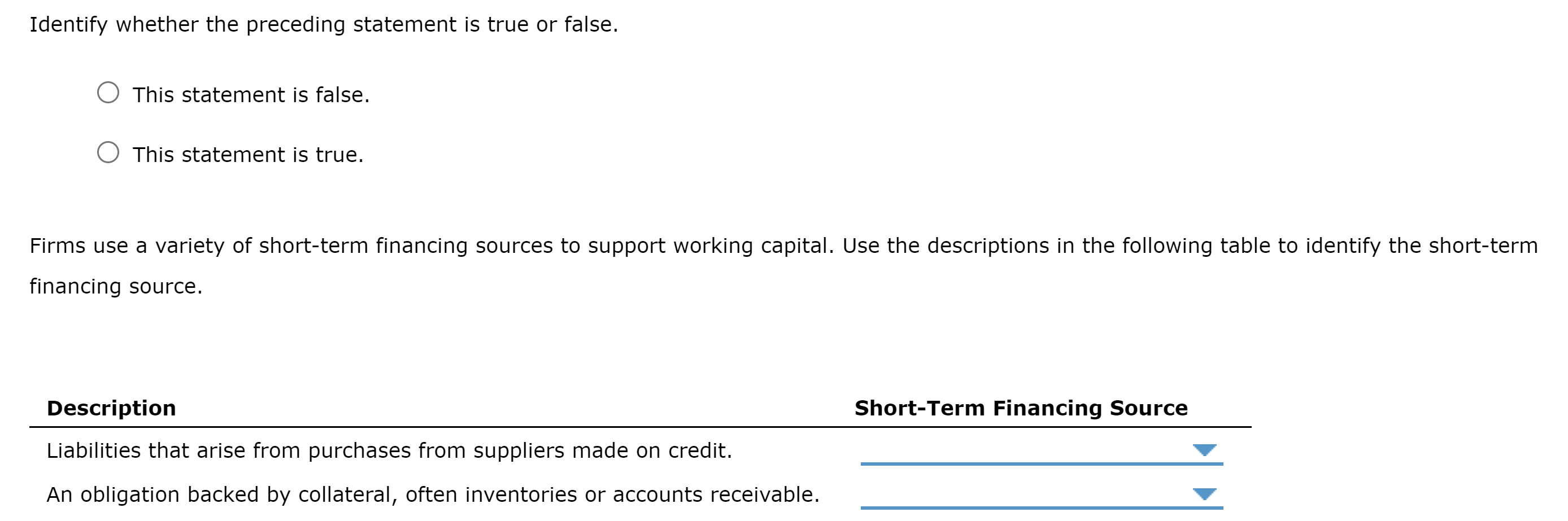

5. Bank loans Short-term financing through bank loans Consider this case: Chez Quis Inc. needs to take out a one-year bank loan of \$600,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 11% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 8% add-on interest to be repaid in 12 equal monthly installments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment Identify whether the preceding statement is true or false. This statement is false. This statement is true. Firms use a variety of short-term financing sources to support working capital. Use the descriptions in the following table to identify the short-term financing source. Description Liabilities that arise from purchases from suppliers made on credit. An obligation backed by collateral, often inventories or accounts receivable. Short-Term Financing Source 6. Short-term financing Why use short-term financing? Cash flows from operations may not be sufficient for a firm to keep up with growth-related financing needs, or the firm may not be able to always generate enough cash flow to maintain a surplus of cash. Firms prefer to borrow now to fulfill their capital requirements through means of short-term financing or long-term financing. Both methods have their advantages and disadvantages. The following statement identifies a possible characteristic of short-term financing. Consider this case: Interest rates on short-term loans are more stable than long-term loans. Choose the answer that best evaluates the following statement: A bank loan officer has been approached by a start-up company that needs a five-year loan to purchase the equipment for its first project. The project will have a life of five years. At the end of five years, the equipment will be worthless. The founders of the company told the loan officer that they would be willing to pay a much higher interest rate on a simple interest loan rather than contracting to an add-on interest loan. The loan officer should offer the company a simple interest loan. The bank will make more money in the long run, because it can charge a much higher interest rate. The loan officer should offer the company an add-on interest loan because there is a high risk that the company will not be able to repay the principal on the loan at the end of the project's life

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts