Question: Hello, I need help with solving this assignment. Thank you 6. Inflation, interest rates, and exchange rates Relative inflation rates affect interest rates, exchange rates,

Hello, I need help with solving this assignment. Thank you

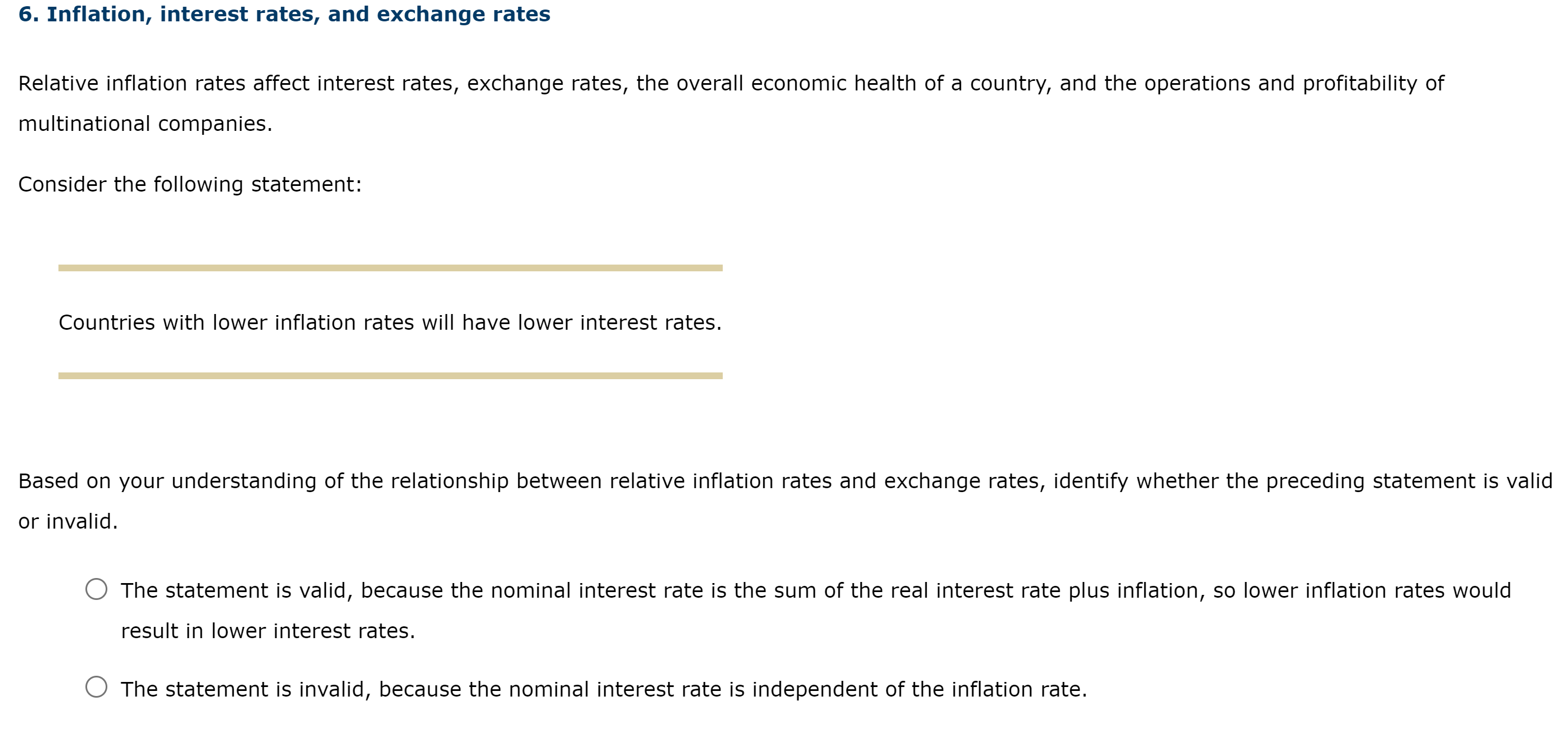

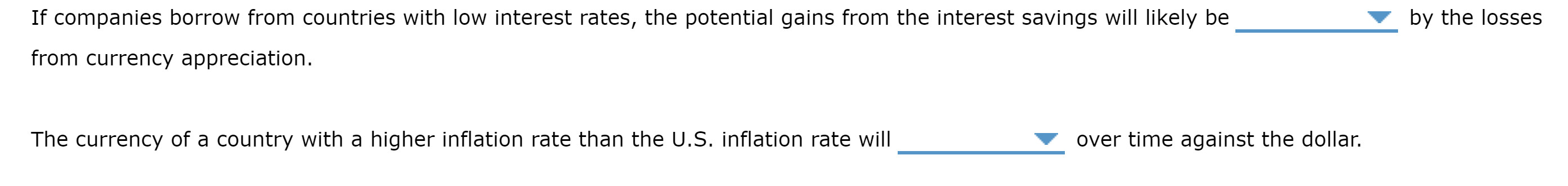

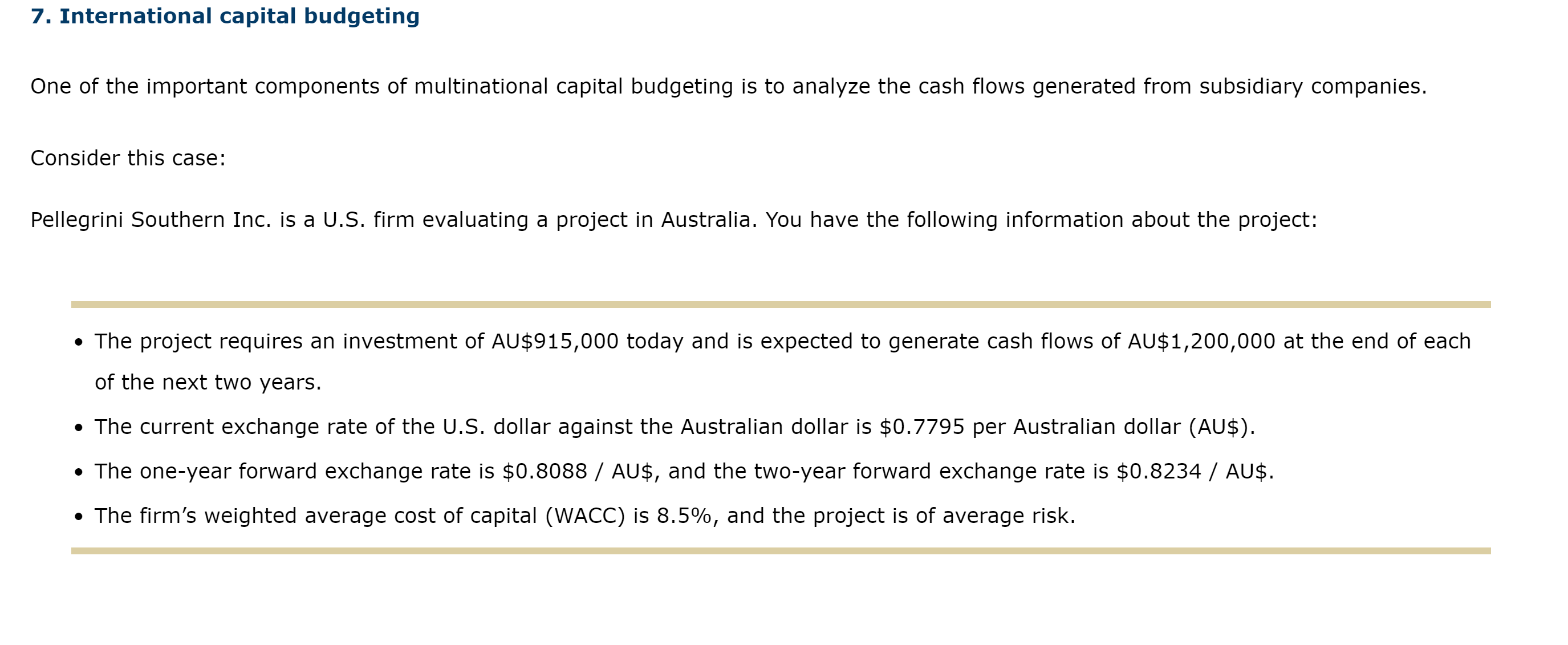

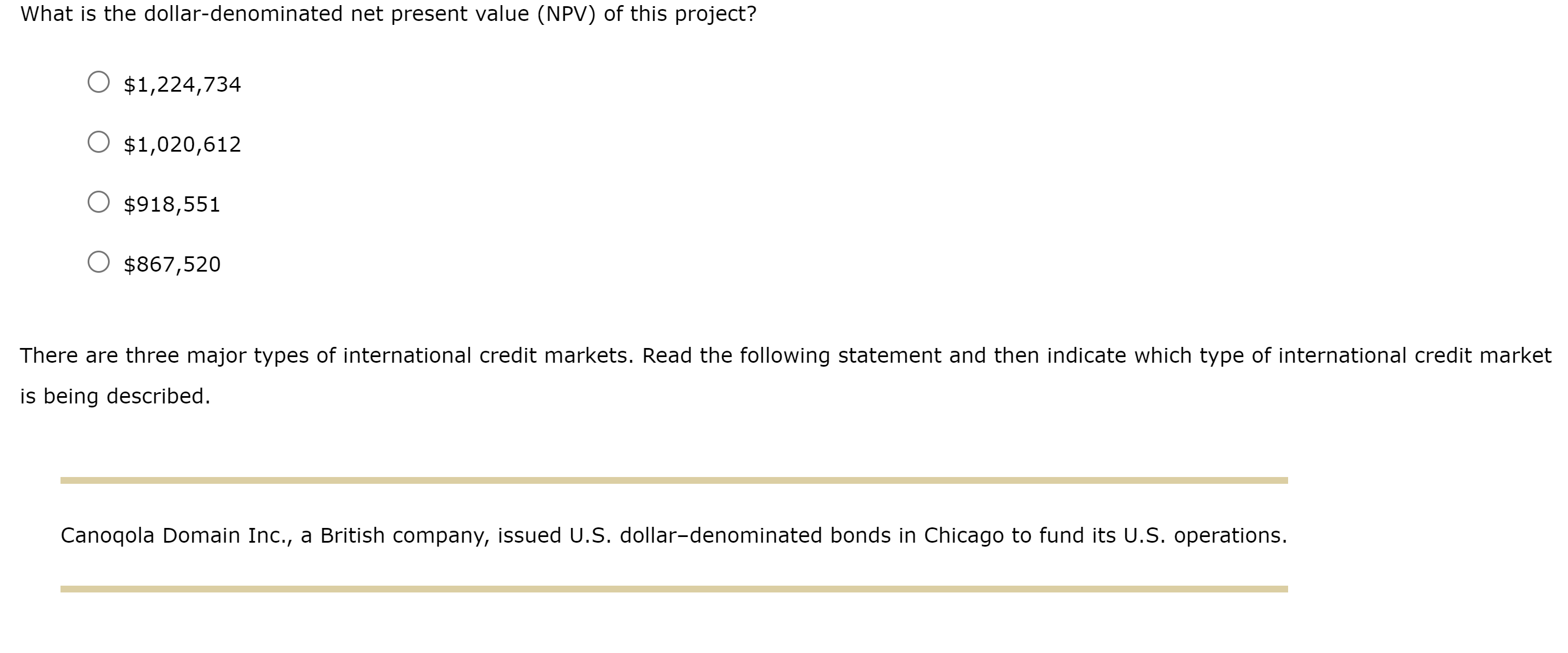

6. Inflation, interest rates, and exchange rates Relative inflation rates affect interest rates, exchange rates, the overall economic health of a country, and the operations and profitability of multinational companies. Consider the following statement: Countries with lower inflation rates will have lower interest rates. Based on your understanding of the relationship between relative inflation rates and exchange rates, identify whether the preceding statement is valid or invalid. The statement is valid, because the nominal interest rate is the sum of the real interest rate plus inflation, so lower inflation rates would result in lower interest rates. The statement is invalid, because the nominal interest rate is independent of the inflation rate. Eurobond Eurocredit Foreign bond If companies borrow from countries with low interest rates, the potential gains from the interest savings will likely be by the losses from currency appreciation. The currency of a country with a higher inflation rate than the U.S. inflation rate will over time against the dollar. There are three major types of international credit markets. Read the following statement and then indicate which type of international credit market is being described. Canoqola Domain Inc., a British company, issued U.S. dollar-denominated bonds in Chicago to fund its U.S. operations. 7. International capital budgeting One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Consider this case: Pellegrini Southern Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project: - The project requires an investment of AU \$915,000 today and is expected to generate cash flows of AU\$1,200,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7795 per Australian dollar (AU\$). - The one-year forward exchange rate is \$0.8088 / AU\$, and the two-year forward exchange rate is \$0.8234 / AU\$. - The firm's weighted average cost of capital (WACC) is 8.5%, and the project is of average risk. 6. Inflation, interest rates, and exchange rates Relative inflation rates affect interest rates, exchange rates, the overall economic health of a country, and the operations and profitability of multinational companies. Consider the following statement: Countries with lower inflation rates will have lower interest rates. Based on your understanding of the relationship between relative inflation rates and exchange rates, identify whether the preceding statement is valid or invalid. The statement is valid, because the nominal interest rate is the sum of the real interest rate plus inflation, so lower inflation rates would result in lower interest rates. The statement is invalid, because the nominal interest rate is independent of the inflation rate. Eurobond Eurocredit Foreign bond If companies borrow from countries with low interest rates, the potential gains from the interest savings will likely be by the losses from currency appreciation. The currency of a country with a higher inflation rate than the U.S. inflation rate will over time against the dollar. There are three major types of international credit markets. Read the following statement and then indicate which type of international credit market is being described. Canoqola Domain Inc., a British company, issued U.S. dollar-denominated bonds in Chicago to fund its U.S. operations. 7. International capital budgeting One of the important components of multinational capital budgeting is to analyze the cash flows generated from subsidiary companies. Consider this case: Pellegrini Southern Inc. is a U.S. firm evaluating a project in Australia. You have the following information about the project: - The project requires an investment of AU \$915,000 today and is expected to generate cash flows of AU\$1,200,000 at the end of each of the next two years. The current exchange rate of the U.S. dollar against the Australian dollar is $0.7795 per Australian dollar (AU\$). - The one-year forward exchange rate is \$0.8088 / AU\$, and the two-year forward exchange rate is \$0.8234 / AU\$. - The firm's weighted average cost of capital (WACC) is 8.5%, and the project is of average risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts