Question: Hello I need help with the attached 9. Now let's consider moral hazard. From the following table find the probability of a high return for

Hello I need help with the attached

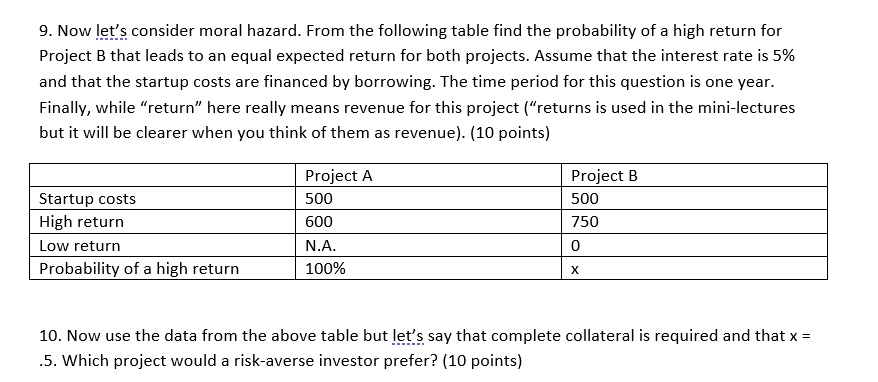

9. Now let's consider moral hazard. From the following table find the probability of a high return for Project B that leads to an equal expected return for both projects. Assume that the interest rate is 5% and that the startup costs are financed by borrowing. The time period for this question is one year. Finally, while "return" here really means revenue for this project ("returns is used in the mini-lectures but it will be clearer when you think of them as revenue). (10 points) Project A Project B Startup costs 500 500 High return 600 750 Low return N.A. 0 Probability of a high return 100% X 10. Now use the data from the above table but let's say that complete collateral is required and that x = .5. Which project would a risk-averse investor prefer? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts