Question: Hello. I need help with the current problems. PLease show work. I tried some of these problems and I am deeply confused on how to

Hello. I need help with the current problems. PLease show work. I tried some of these problems and I am deeply confused on how to do these problems. I would appreciate any help!

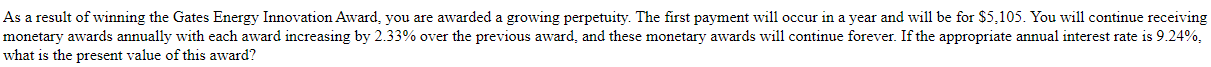

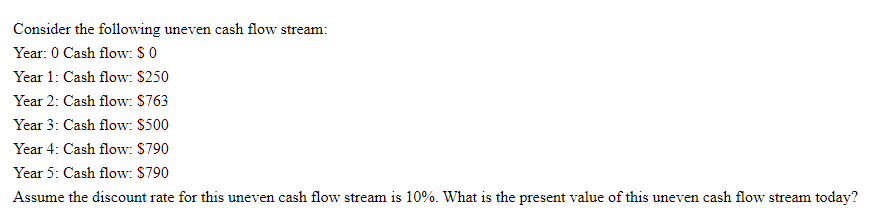

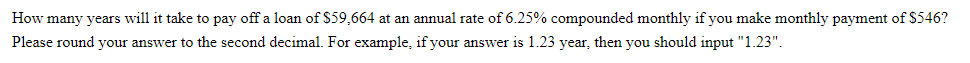

As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The first payment will occur in a year and will be for $5.105. You will continue receiving monetary awards annually with each award increasing by 2.33% over the previous award, and these monetary awards will continue forever. If the appropriate annual interest rate is 9.24%. what is the present value of this award? Consider the following uneven cash flow stream: Year: 0 Cash flow: SO Year 1: Cash flow: $250 Year 2: Cash flow: $763 Year 3: Cash flow: $500 Year 4: Cash flow: $790 Year 5: Cash flow: $790 Assume the discount rate for this uneven cash flow stream is 10%. What is the present value of this uneven cash flow stream today? How many years will it take to pay off a loan of $59,664 at an annual rate of 6.25% compounded monthly if you make monthly payment of $546? Please round your answer to the second decimal. For example, if your answer is 1.23 year, then you should input "1.23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts