Question: Hello, I need help with the following question for a managerial accounting class: ROI and Residual Income Misteree Books manufactures both paperback and hardback books.

Hello, I need help with the following question for a managerial accounting class:

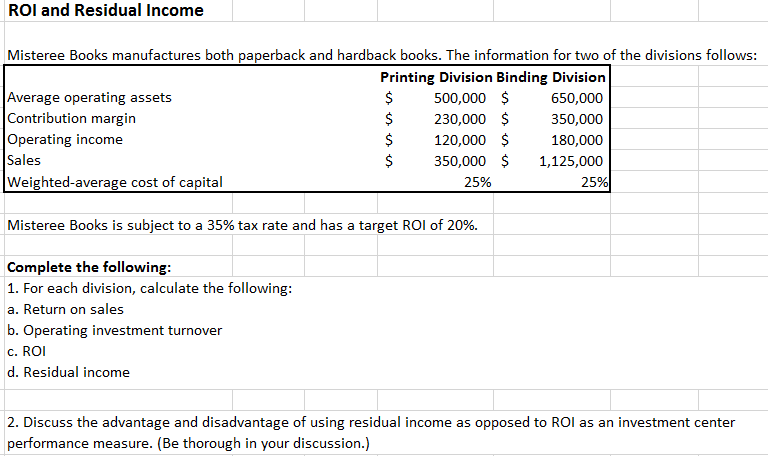

ROI and Residual Income Misteree Books manufactures both paperback and hardback books. The information for two of the divisions follows: Average operating assets Contribution margin Operating income Sales Weighted-average cost of capital Printing Division Binding Division $ 500,000 $650,000 230,000 $350,000 180,000 $350,000 $ 1,125,000 25% $120,000 $ 25% Misteree Books is subject to a 35% tax rate and has a target ROI of 20%. Complete the following 1. For each division, calculate the following: a. Return on sales b. Operating investment turnover c. ROI d. Residual income 2. Discuss the advantage and disadvantage of using residual income as opposed to ROI as an investment center performance measure. (Be thorough in your discussion.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts