Question: Hello. I need help with the following question please. The Financial Accounting Standards Board (FASB) eliminated the use of pooling-of-interests method for the accounting of

Hello. I need help with the following question please.

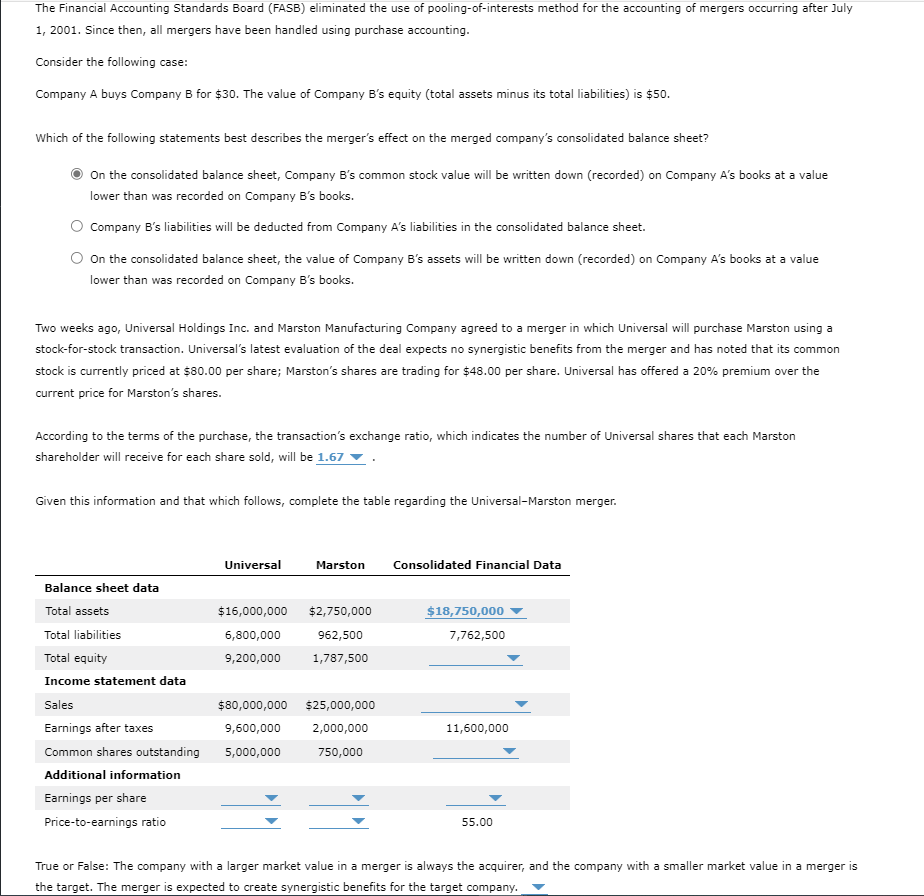

The Financial Accounting Standards Board (FASB) eliminated the use of pooling-of-interests method for the accounting of mergers occurring after July 1, 2001. Since then, all mergers have been handled using purchase accounting. Consider the following case: Company A buys Company B for $30. The value of Company B's equity (total assets minus its total liabilities) is $50. Which of the following statements best describes the merger's effect on the merged company's consolidated balance sheet? On the consolidated balance sheet, Company B's common stock value will be written down (recorded) on Company A's books at a value lower than was recorded on Company B's books. Company B's liabilities will be deducted from Company A's liabilities in the consolidated balance sheet. On the consolidated balance sheet, the value of Company B's assets will be written down (recorded) on Company A's books at a value lower than was recorded on Company B's books. Two weeks ago, Universal Holdings Inc. and Marston Manufacturing Company agreed to a merger in which Universal will purchase Marston using a stock-for-stock transaction. Universal's latest evaluation of the deal expects no synergistic benefits from the merger and has noted that its common stock is currently priced at $80.00 per share; Marston's shares are trading for $48.00 per share. Universal has offered a 20% premium over the current price for Marston's shares. According to the terms of the purchase, the transaction's exchange ratio, which indicates the number of Universal shares that each Marston shareholder will receive for each share sold, will be Given this information and that which follows, complete the table regarding the Universal-Marston merger. True or False: The company with a larger market value in a merger is always the acquirer, and the company with a smaller market is the target. The merger is expected to create synergistic benefits for the target company. The Financial Accounting Standards Board (FASB) eliminated the use of pooling-of-interests method for the accounting of mergers occurring after July 1, 2001. Since then, all mergers have been handled using purchase accounting. Consider the following case: Company A buys Company B for $30. The value of Company B's equity (total assets minus its total liabilities) is $50. Which of the following statements best describes the merger's effect on the merged company's consolidated balance sheet? On the consolidated balance sheet, Company B's common stock value will be written down (recorded) on Company A's books at a value lower than was recorded on Company B's books. Company B's liabilities will be deducted from Company A's liabilities in the consolidated balance sheet. On the consolidated balance sheet, the value of Company B's assets will be written down (recorded) on Company A's books at a value lower than was recorded on Company B's books. Two weeks ago, Universal Holdings Inc. and Marston Manufacturing Company agreed to a merger in which Universal will purchase Marston using a stock-for-stock transaction. Universal's latest evaluation of the deal expects no synergistic benefits from the merger and has noted that its common stock is currently priced at $80.00 per share; Marston's shares are trading for $48.00 per share. Universal has offered a 20% premium over the current price for Marston's shares. According to the terms of the purchase, the transaction's exchange ratio, which indicates the number of Universal shares that each Marston shareholder will receive for each share sold, will be Given this information and that which follows, complete the table regarding the Universal-Marston merger. True or False: The company with a larger market value in a merger is always the acquirer, and the company with a smaller market is the target. The merger is expected to create synergistic benefits for the target company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts