Question: Hello I need help with this exercice, I tried to complete it, but don't know if these are correct EA2. LO 15.3 The partnership of

Hello I need help with this exercice, I tried to complete it, but don't know if these are correct

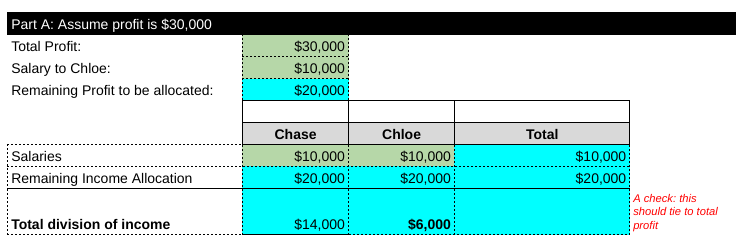

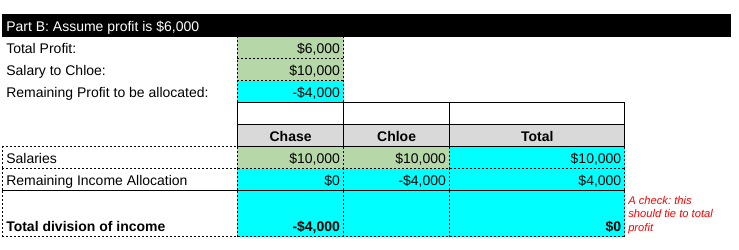

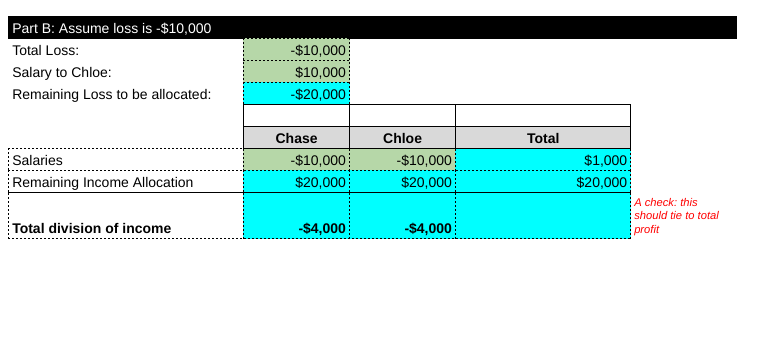

EA2. LO 15.3 The partnership of Chase and Chloe shares profits and losses in a 70:30 ratio respectively after Chloe receives a $10,000 salary. Prepare a schedule showing how the profit and loss should be divided, assuming the profit or loss for the year is:

A. $30,000

B. $6,000

C. ($10,000)

Part A

part c

Part A: Assume profit is $30,000 A check: this should tie to total Part B: Assume profit is $6,000 Total Profit: Salary to Chloe: Remaining Profit to be allocated: Salaries Remaining Income Allocation should tie to total Total division of income $4,000 Part B: Assume loss is $10,000 Total Loss: Salary to Chloe: Remaining Loss to be allocated: Salaries Remaining Income Allocation \begin{tabular}{|r|r|r|} \hline$10,000 & \multicolumn{2}{|c|}{} \\ \hline$10,000 & \multicolumn{2}{|c|}{ Total } \\ \hline & & \\ \hline Chase & Chloe & $1,000 \\ \hline$10,000 & $10,000 & $20,000 \\ \hline$20,000 & $20,000 & \\ \hline & & \\ \hline \end{tabular} A check: this should tie to total Total division of income $4,000$4,000 profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts