Question: Hello! I need help with this one and with solution please, thank you! On December 31, 20xx, you have completed your first full year in

Hello! I need help with this one and with solution please, thank you!

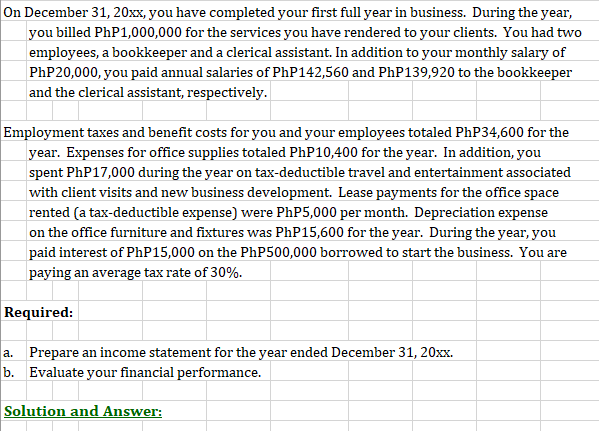

On December 31, 20xx, you have completed your first full year in business. During the year, you billed PhP1,000,000 for the services you have rendered to your clients. You had two employees, a bookkeeper and a clerical assistant. In addition to your monthly salary of PhP20,000, you paid annual salaries of PhP142,560 and PhP139,920 to the bookkeeper and the clerical assistant, respectively. Employment taxes and benefit costs for you and your employees totaled PhP34,600 for the year. Expenses for office supplies totaled PhP10,400 for the year. In addition, you spent PhP17,000 during the year on tax-deductible travel and entertainment associated with client visits and new business development. Lease payments for the office space rented (a tax-deductible expense) were PhP5,000 per month. Depreciation expense on the office furniture and fixtures was PhP15,600 for the year. During the year, you paid interest of PhP15,000 on the PhP500,000 borrowed to start the business. You are paying an average tax rate of 30%. Required: a. Prepare an income statement for the year ended December 31, 20xx. b. Evaluate your financial performance. Solution and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts