Question: Hello, I need help with this one please. I need help with the bottom section please where it said value is p(npv The last box

Hello, I need help with this one please.

I need help with the bottom section please where it said value is p(npv The last box which is the long box, i am ok with.

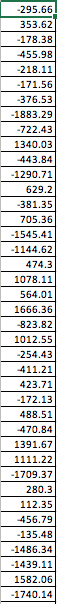

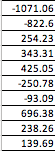

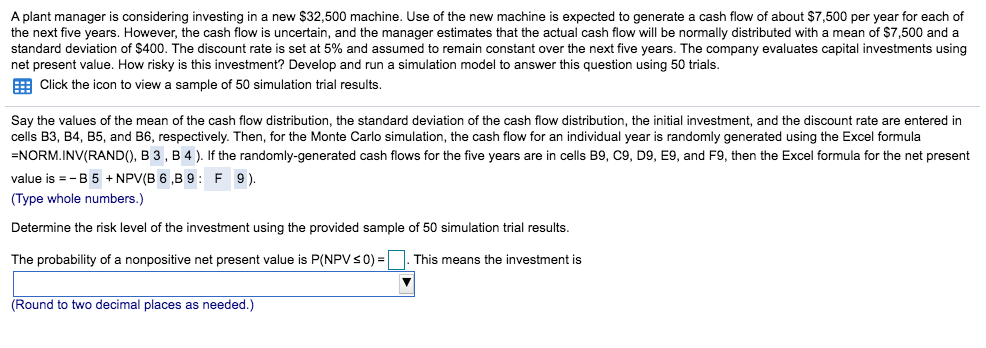

\f\fA plant manager is considering investing in a new $32,500 machine. Use of the new machine is expected to generate a cash flow of about $7,500 per year for each of the next five years. However, the cash flow is uncertain, and the manager estimates that the actual cash flow will be normally distributed with a mean of $7,500 and a standard deviation of $400. The discount rate is set at 5% and assumed to remain constant over the next five years. The company evaluates capital investments using net present value. How risky is this investment? Develop and run a simulation model to answer this question using 50 trials. Click the icon to view a sample of 50 simulation trial results. Say the values of the mean of the cash flow distribution, the standard deviation of the cash flow distribution, the initial investment, and the discount rate are entered in cells B3, B4, B5, and B6, respectively. Then, for the Monte Carlo simulation, the cash flow for an individual year is randomly generated using the Excel formula =NORM.INV(RAND(), B 3 , B 4 ). If the randomly-generated cash flows for the five years are in cells B9, C9, D9, E9, and F9, then the Excel formula for the net present value is = - B 5 + NPV(B 6 ,B 9 : F 9). (Type whole numbers.) Determine the risk level of the investment using the provided sample of 50 simulation trial results. The probability of a nonpositive net present value is P(NPV s 0) = . This means the investment is (Round to two decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts