Question: Hello, I need help with this one question that involves excel (screenshot included). I need to find the answers using excel formulas. The issue is

Hello,

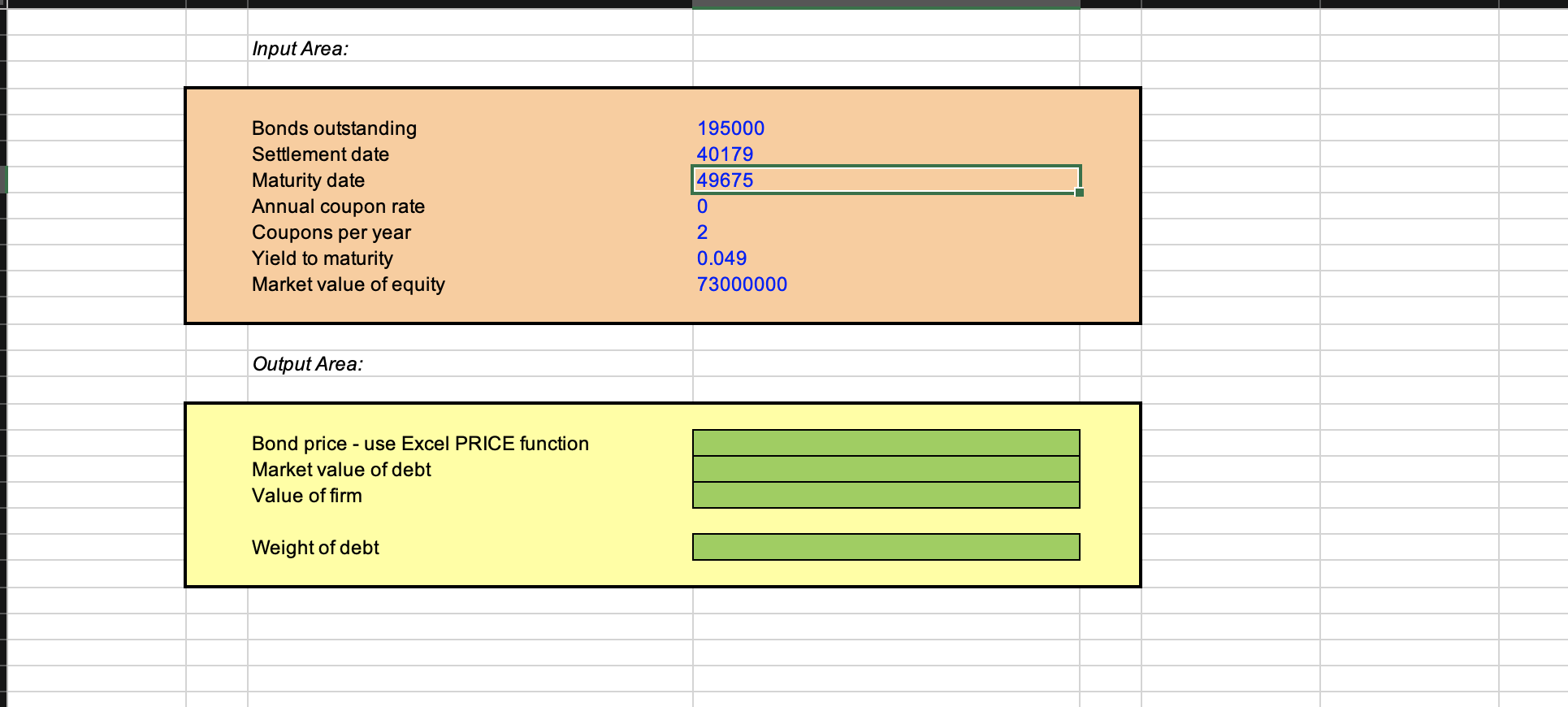

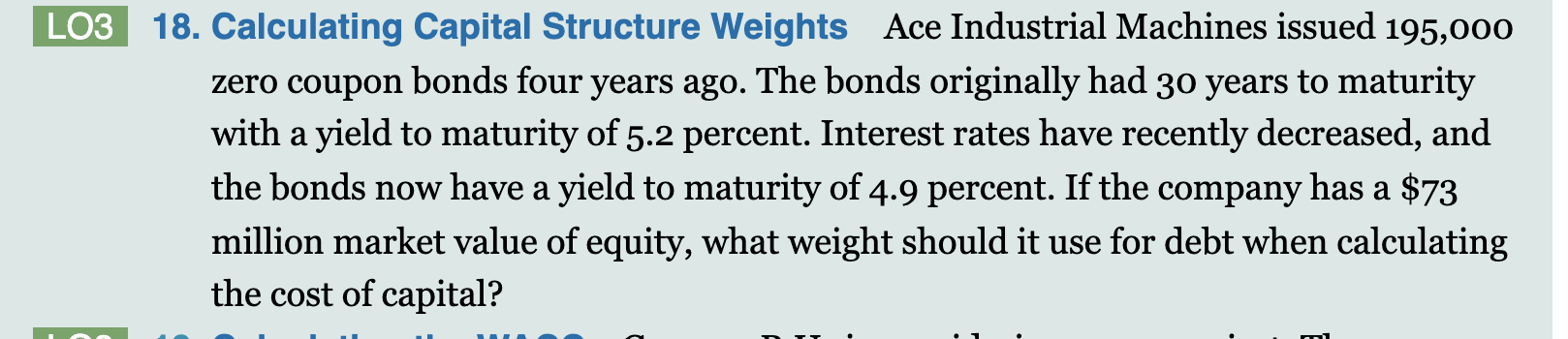

I need help with this one question that involves excel (screenshot included). I need to find the answers using excel formulas. The issue is that for the maturity date and settlement date the formula is a date but it is not showing in the cells as a date it is showing as a number. I tried to format it as a date but it won't change in the cell regardless. The formula I am trying to use is PRICE(settlement, maturity, rate, yld, redemption, frequency, [basis]). I am also not sure what number to uses for "redemption" in the formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts