Question: Hello, I need help with this question: Required information (The following information applies to the questions displayed below) In early January 2018, NewTech purchases computer

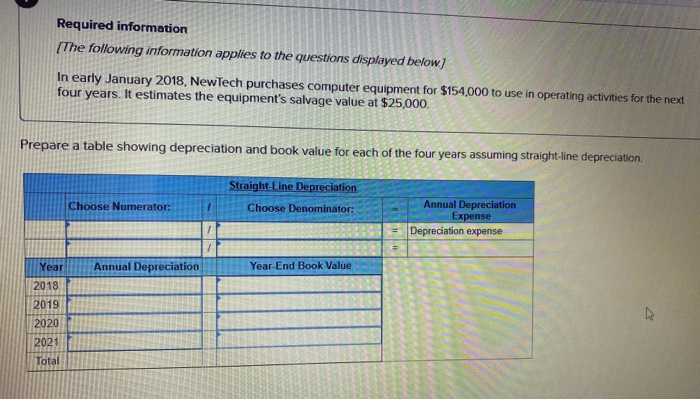

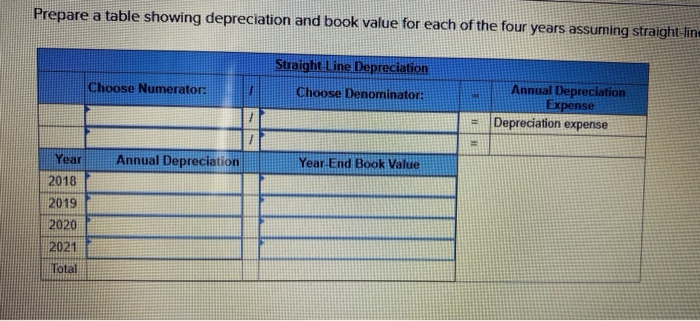

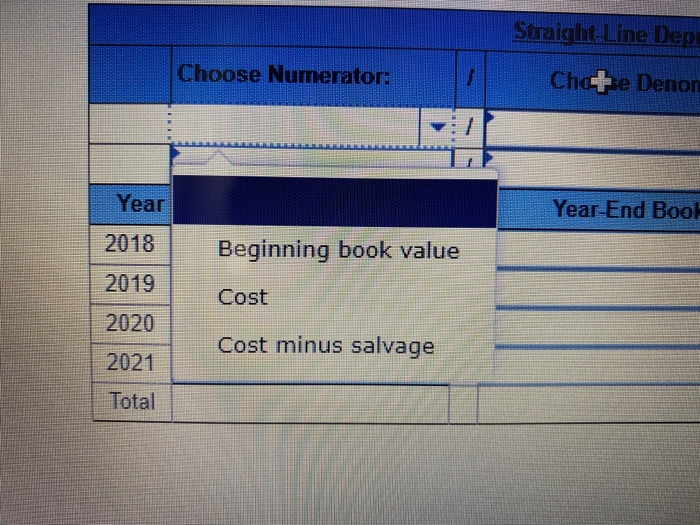

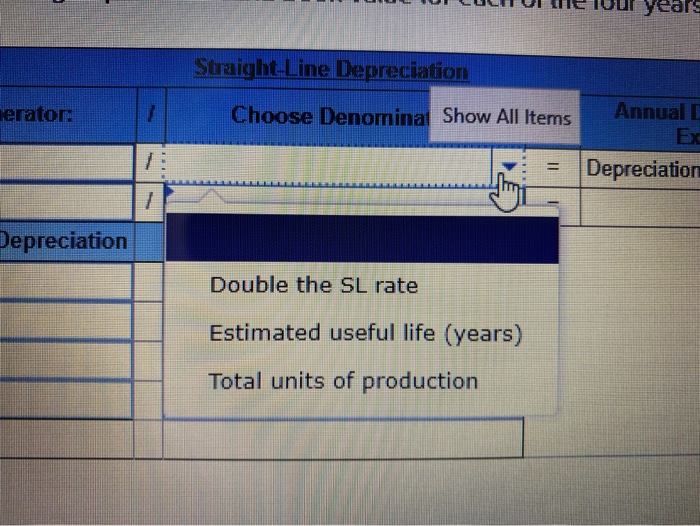

Required information (The following information applies to the questions displayed below) In early January 2018, NewTech purchases computer equipment for $154,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $25,000. Prepare a table showing depreciation and book value for each of the four years assuming straight-line depreciation. Choose Numerator: Straight-Line Depreciation Choose Denominator: S SS Annual Depreciation Expense Depreciation expense - Annual Depreciation Year End Book Value Year 2018 2019 2020 2021 LLLLL Total Prepare a table showing depreciation and book value for each of the four years assuming straight-lin Straight Line Depreciation Choose Denominator: GOOSO Numerator Annual Depreciation Expense Depreciation expense Year Annual Depreciation Year End Book Value 2018 2019 2020 2021 Total Straight-Line Dep. Chete Denor Choose Numerator: JU Year Year-End Boo! 2018 Beginning book value 2019 Cost 2020 Cost minus salvage 2021 Total MUL IUI LULUI Meur years Straight-Line Depreciation lerator: Choose Denominal Show All Items Annual C Ex Depreciation Depreciation Double the SL rate Estimated useful life (years) Total units of production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts