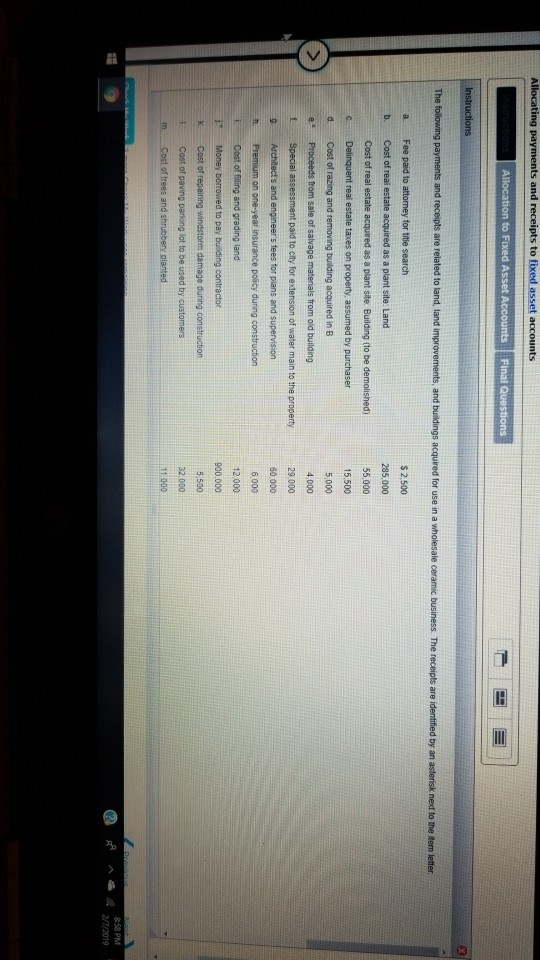

Question: Hello, I need help with this question thank you Allocating p $2,500 b. Cost of real estate acquired as a plant site Land 285,000 c

Hello, I need help with this question thank you

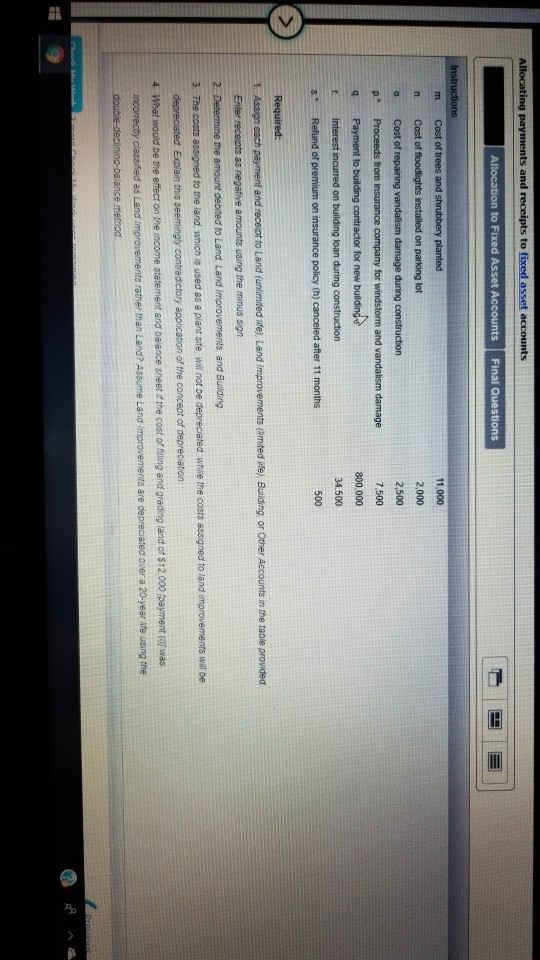

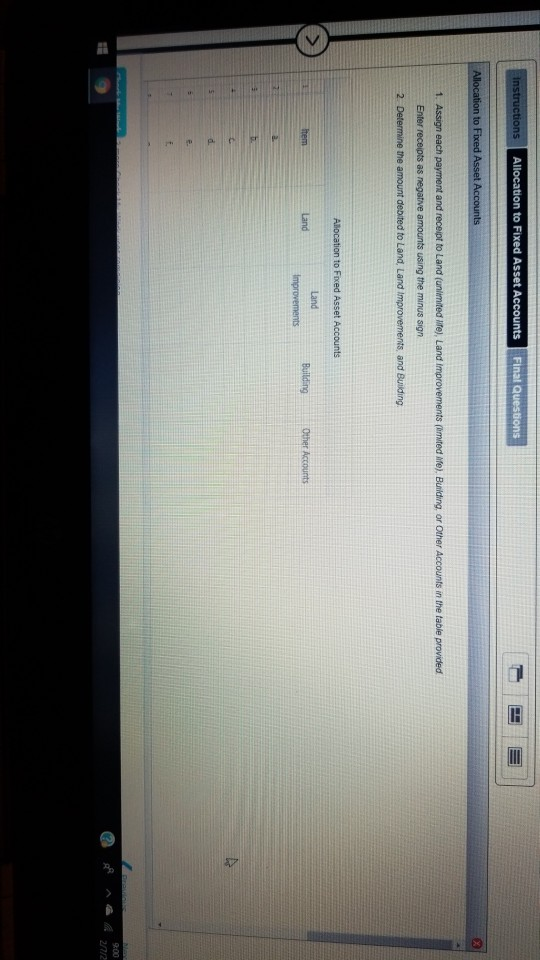

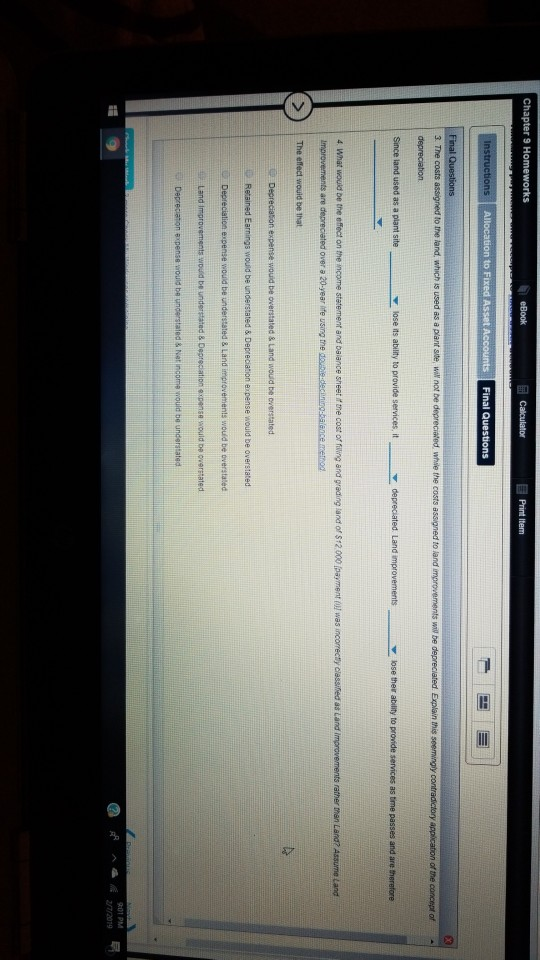

Allocating p $2,500 b. Cost of real estate acquired as a plant site Land 285,000 c Delinquent real estate taxes on property, assumed by purchaser d Cost of razing and removing building acquired in B e Proceeds trom sale of salvage materials from old building 15,500 5,000 4,000 29.000 60.000 assessment paid to city for extension of water main to the property g Architects and engineer's tees for plans and supervision Cost of repairing windstorm damage during construction n Cost of floodlights installed on parking lot o. Cost of repairing vandalism damage during construction p.. Proceeds from insurance company for windstorm and vandalism damage 2,000 2,500 800,000 500 Required: 3The costs assigned to the iand, which is used as a plant site, wil not be depreciated whie the costs assigned to land will be depreciated Explain this seemingly contradictory application of the concept of depreciation. incorrectly classified as Land Allocation to Fixed Asset Accounts Final Questions n to 1. Assign each payment and receipt to Land (unlimited ite), Land improvements (amited life). Bunildting, or Other Accounts in the table provided Enter receipts as negative amounts using the minus sign Land Land Building Other Accounts 900 Allocation to Fixed Asset Accounts Final Questions and to fix to 9-00 P 9:01 PM nr2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts