Question: Hello I need help with this question Use the following information for Garrett Company for the next two questions. Estimated manufacturing overhead S 240,000 Factory

Hello I need help with this question

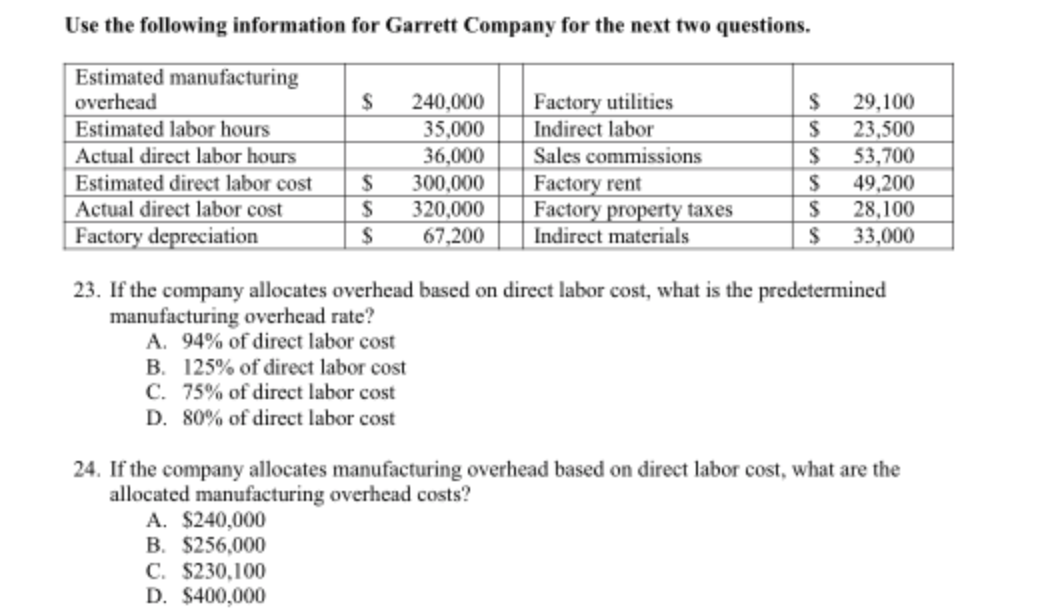

Use the following information for Garrett Company for the next two questions. Estimated manufacturing overhead S 240,000 Factory utilities $ 29,100 Estimated labor hours 35.000 Indirect labor S 23,500 Actual direct labor hours 36,000 Sales commissions S 53,700 Estimated direct labor cost S 300.000 Factory rent S 49,200 Actual direct labor cost 320.000 Factory property taxes S 28,100 Factory depreciation 67,200 Indirect materials S 33,000 23. If the company allocates overhead based on direct labor cost, what is the predetermined manufacturing overhead rate? A. 94% of direct labor cost B. 125% of direct labor cost C. 75% of direct labor cost D. 80% of direct labor cost 24. If the company allocates manufacturing overhead based on direct labor cost, what are the allocated manufacturing overhead costs? A. $240,000 B. $256.000 C. $230,100 D. $400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts