Question: Hello! I need help with this questions: At a volume of 5,000 units, Pwerson Company incurred $32,000 in factory overhead costs, including $14,000 in fixed

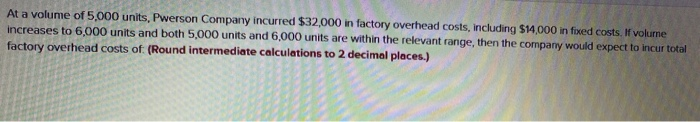

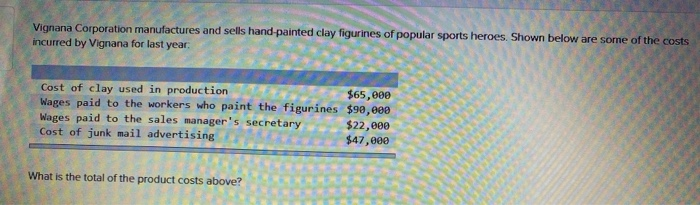

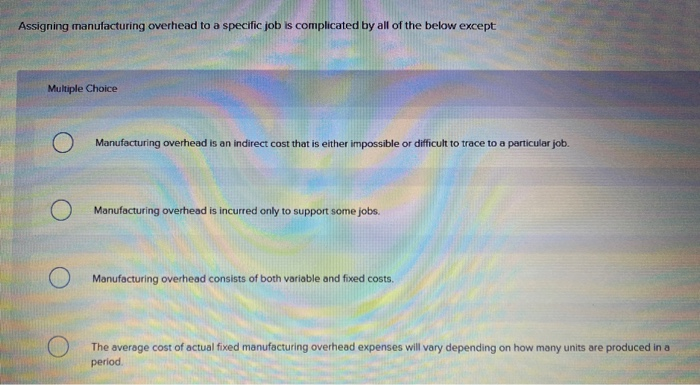

At a volume of 5,000 units, Pwerson Company incurred $32,000 in factory overhead costs, including $14,000 in fixed costs. If volume increases to 6,000 units and both 5,000 units and 6,000 units are within the relevant range, then the company would expect to incur total factory overhead costs of: (Round intermediate calculations to 2 decimal places.) Vignana Corporation manufactures and sells hand painted clay figurines of popular sports heroes Shown below are some of the costs incurred by Vignana for last year Cost of clay used in production $65,000 Wages paid to the workers who paint the figurines $90,000 Wages paid to the sales manager's secretary $22,000 Cost of junk mail advertising $47,000 What is the total of the product costs above? What is the total of the product costs above? Multiple Choice O $0 $69.000 $155.000 $159.000 Assigning manufacturing overhead to a specific job is complicated by all of the below except Multiple Choice O Manufacturing overhead is an indirect cost that is either impossible or difficult to trace to a particular job. Manufacturing overhead is incurred only to support some jobs. Manufacturing overhead consists of both variable and fixed costs, The average cost of actual fixed manufacturing overhead expenses will vary depending on how many units are produced in a period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts