Question: Hello, I need some guidance on my attempt of my Capital Budgeting assignment. If any one can double check to see if I am missing

Hello,

I need some guidance on my attempt of my Capital Budgeting assignment. If any one can double check to see if I am missing anything or offer suggestions on improvements would be greatly appreciated.

I am currently having difficulty uploading the excel sheet so I have included a screen shot.

Many thanks

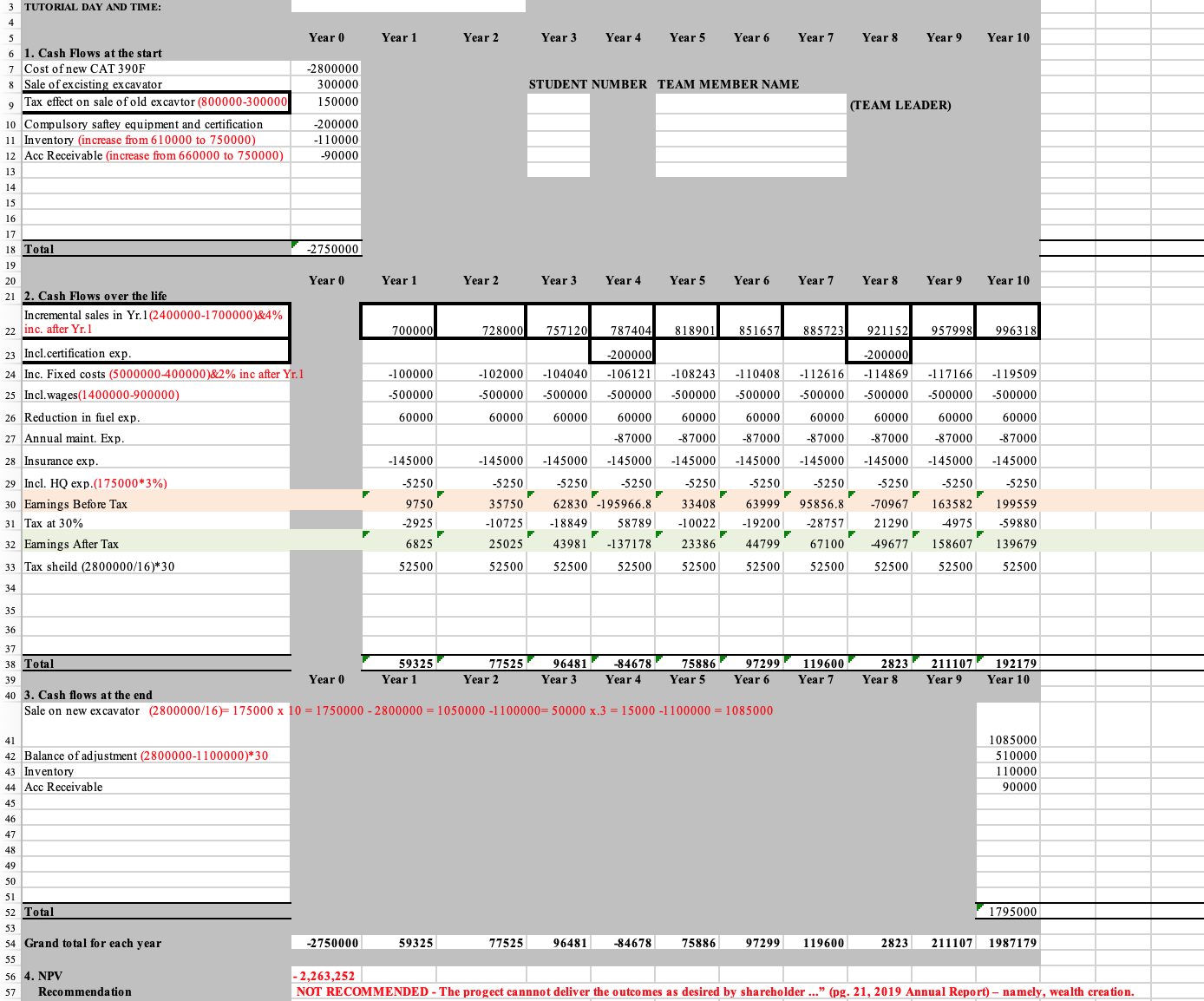

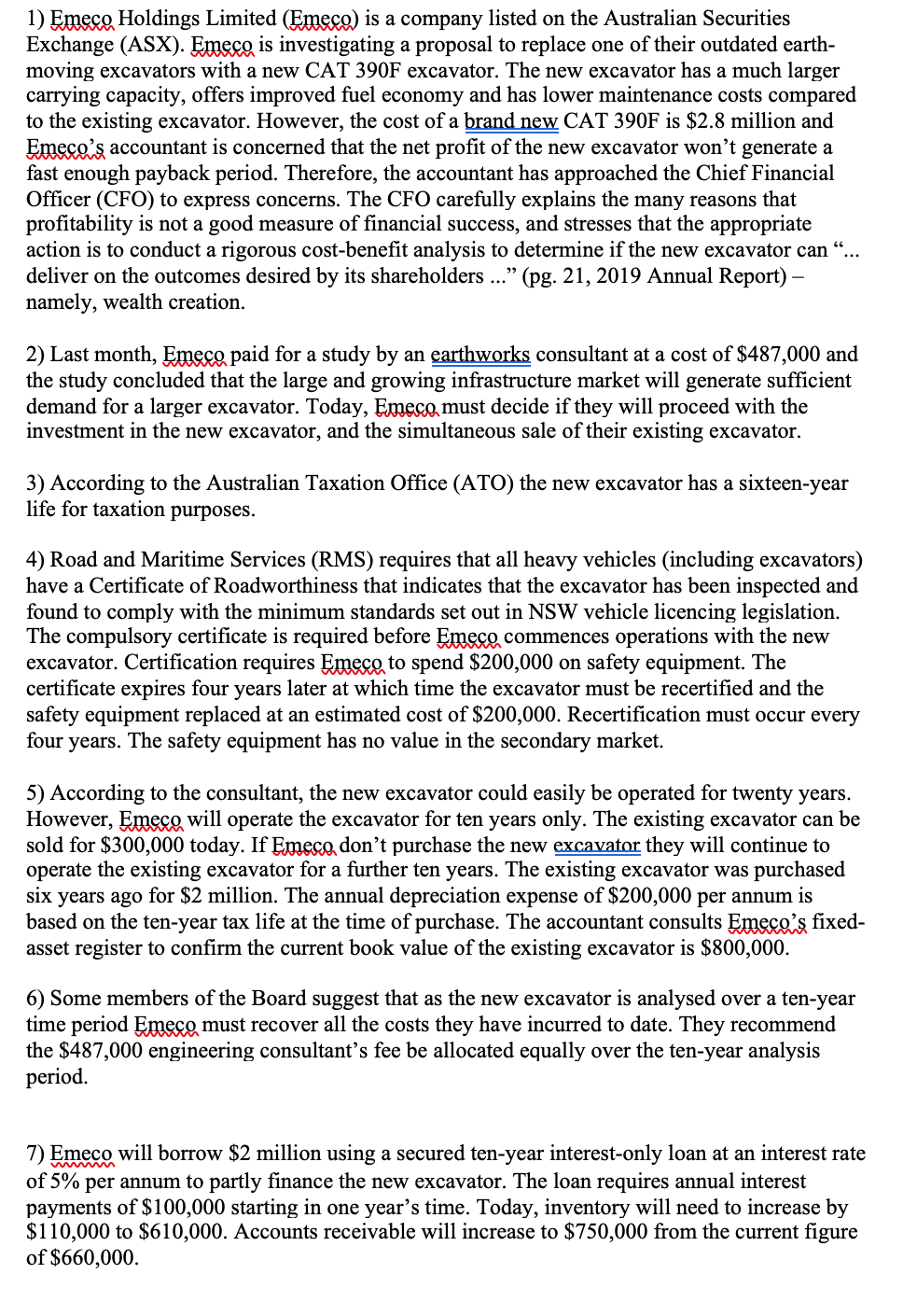

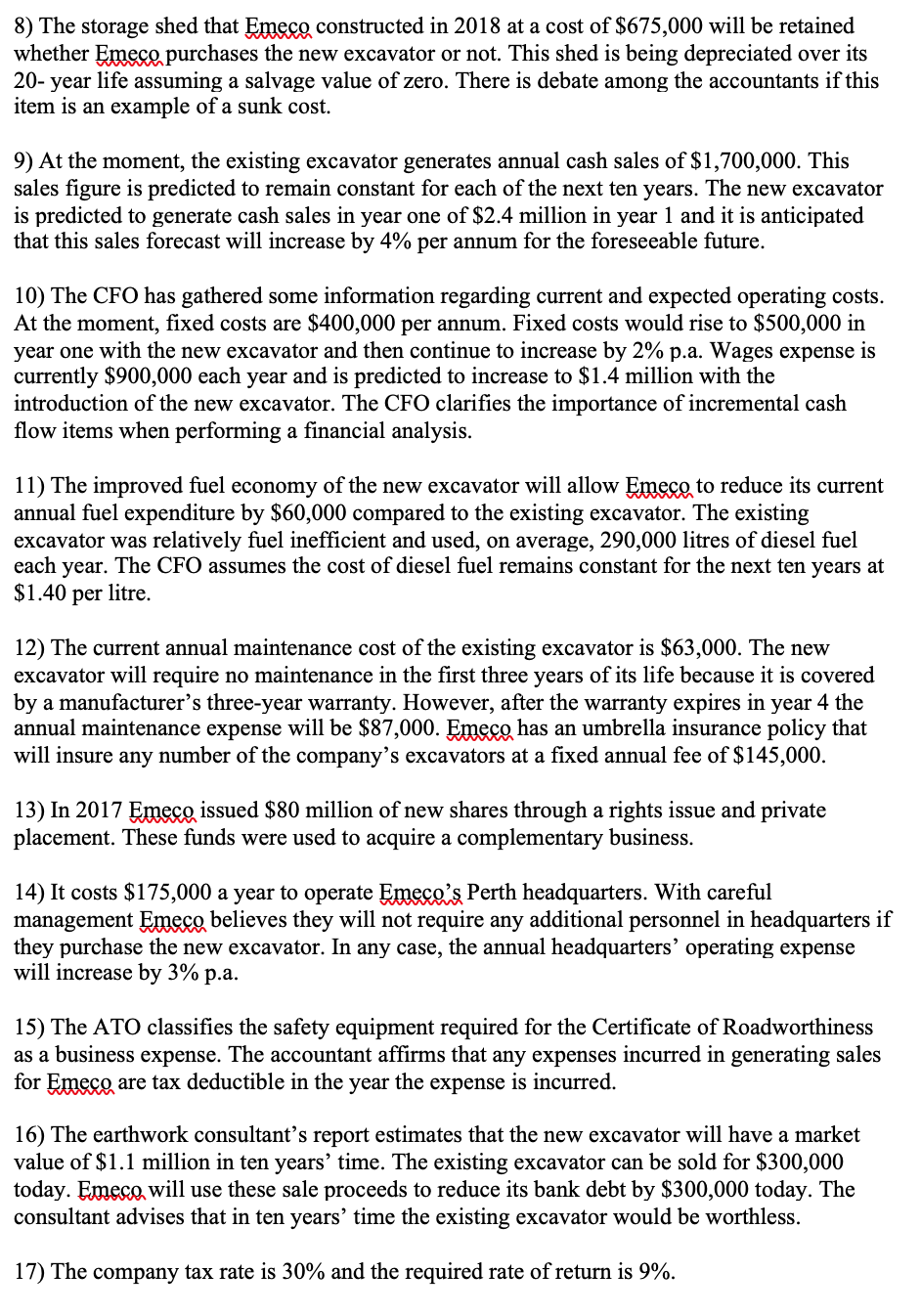

TUTORIAL DAY AND TIME: Year 0 Year 1 Year 2 Year 3 Year 4 Year 6 Year 7 6 1. Cash Flows at the start Year 8 Year 9 Year 10 Cost of new CAT 390F -2800000 Sale of excisting excavator 300000 STUDENT NUMBER TEAM MEMBER NAME 9 Tax effect on sale of old excavtor (800000-300000 150000 (TEAM LEADER) Compulsory saftey equipment and certification 200000 11 Inventory (increase from 610000 to 750000) -1 10000 12 Acc Receivable (increase from 660000 to 750000) 90000 13 Total -2750000 21 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 2. Cash Flows over the life Incremental sales in Yr. 1 (2400000-1700000)&4% 22 inc. after Yr. 1 700000 728000 757120 787404 818901 851657 885723 921152 957998 996318 Incl. certification exp. -200000 -20000 Inc. Fixed costs (5000000-400000)&2% inc after Yr. 1 -100000 -102000 -104040 -106121 -108243 -1 10408 -1 12616 -1 14869 -117166 -1 19509 25 Incl. wages(1400000-900000) -500000 500000 -500000 -500000 -500000 -500000 -500000 -500000 -500000 -500000 26 Reduction in fuel exp. 60000 60000 60000 60000 60000 60000 60000 60000 60000 60000 7 Annual maint. Exp. -87000 -87000 -87000 87000 87000 -87000 -87000 28 Insurance exp. -145000 -145000 -145000 -145000 -145000 -145000 -145000 -145000 -145000 -145000 29 Incl. HQ exp.(175000*3%) 5250 5250 5250 -5250 -5250 -5250 -5250 -5250 -5250 -5250 30 Earnings Before Tax 9750 35750 62830 -195966.8 33408 63999 95856.8 -70967 163582 199559 31 Tax at 30% -2925 -10725 -18849 58789 -10022 -19200 -28757 21290 4975 -59880 32 Earnings After Tax 6825 25025 43981 -137178 23386 44799 67100 49677 158607 139679 33 Tax sheild (2800000/16)*30 52500 52500 52500 52500 52500 52500 52500 52500 52500 52500 34 35 36 37 38 7 59325 77525 96481 -84678 75886 97299 119600 2823 211107 39 192179 Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 40 3. Cash flows at the end Sale on new excavator (2800000/16)- 175000 x 10 = 1750000 - 2800000 = 1050000 -1100000= 50000 x.3 = 15000 -1100000 = 1085000 41 1085000 42 Balance of adjustment (2800000-1 100000)*30 510000 43 Inventory 1 10000 44 Acc Receivable 45 90000 46 47 48 Total 1795000 54 Grand total for each year -2750000 59325 77525 96481 -84678 75886 97299 119600 2823 211107 1987179 55 56 4. NPV 57 -2,263,252 Recommendation NOT RECOMMENDED - The progect cannnot deliver the outcomes as desired by shareholder ..." (pg. 21, 2019 Annual Report) - namely, wealth creation.1) WHoldings Limited (m is a company listed on the Australian Securities Exchange (ASX). m is investigating a proposal to replace one of their outdated earth- moving excavators with a new CAT 390F excavator. The new excavator has a much larger carrying capacity, offers improved fuel economy and has lower maintenance costs compared to the existing excavator. However, the cost of a brandm CAT 390F is $2.8 million and 5113325293 accountant is concerned that the net prot of the new excavator won't generate a fast enough payback period. Therefore, the accountant has approached the Chief Financial Ofcer (CFO) to express concerns. The CFO carefully explains the many reasons that protability is not a good measure of nancial success, and stresses that the appropriate action is to conduct a rigorous cost-benet analysis to determine if the new excavator can\"... deliver on the outcomes desired by its shareholders ...\" (pg. 21, 2019 Annual Report) namely, wealth creation. 2) Last month, Wpaid for a study by an eatthmorks consultant at a cost of $487,000 and the study concluded that the large and growing infrastructure market will generate sufcient demand for a larger excavator. Today, momust decide if they will proceed with the investment in the new excavator, and the simultaneous sale of their existing excavator. 3) According to the Australian Taxation Ofce (ATO) the new excavator has a sixteen-year life for taxation purposes. 4) Road and Maritime Services (RMS) requires that all heavy vehicles (including excavators) have a Certicate of Roadworthiness that indicates that the excavator has been inspected and found to comply with the minimum standards set out in NSW vehicle licencing legislation. The compulsory certicate is required before Wcommences operations with the new excavator. Certication requires mm spend $200,000 on safety equipment. The certicate expires four years later at which time the excavator must be recertied and the safety equipment replaced at an estimated cost of $200,000. Recertication must occur every four years. The safety equipment has no value in the secondary market. 5) According to the consultant, the new excavator could easily be operated for twenty years. However, WWI] operate the excavator for ten years only. The existing excavator can be sold for $300,000 today. If Ememdon't purchase the new excaxatoi: they will continue to operate the existing excavator for a further ten years. The existing excavator was purchased six years ago for $2 million. The annual depreciation expense of $200,000 per annum is based on the ten-year tax life at the time of purchase. The accountant consults m xed- asset register to conrm the current book value of the existing excavator is $800,000. 6) Some members of the Board suggest that as the new excavator is analysed over a ten-year time period Wmust recover all the costs they have incurred to date. They recommend the $487,000 engineering consultant's fee be allocated equally over the ten-year analysis period. 'r') Emeco will borrow $2 million using a secured ten-year interest-only loan at an interest rate of 5% per annum to partly nance the new excavator. The loan requires annual interest payments of $100,000 starting in one year's time. Today, inventory will need to increase by $110,000 to $610,000. Accounts receivable will increase to $750,000 from the current gure of $660,000. 8) The storage shed that Woonsnucted in 2018 at a cost of $676,000 will be retained whether Wpurchases the new excavator or not. This shed is being depreciated over its 20- year life assuming a salvage value of zero. There is debate among the accountants if this item is an example of a sunk cost. 9) At the moment, the existing excavator generates annual cash sales of $1,700,000. This sales gure is predicted to remain constant for each of the next ten years. The new excavator is predicted to generate cash sales in year one of $2.4 million in year 1 and it is anticipated that this sales forecast will increase by 4% per annum for the foreseeable future. 10) The CFO has gathered some information regarding current and expected operating costs. At the moment, xed costs are $400,000 per annum. Fixed costs wculd rise to $500,000 in year one with the new excavator and then centinue to increase by 2% p.a. Wages expense is currently $900,000 each year and is predicted to increase to $1.4 million with the introduction of the new excavator. The CFO claries the importance of incremental cash ow items when performing a nancial analysis. 1 1) The improved fuel ecOnomy of the new excavator will allow mm reduce its current annual fuel expenditure by $60,000 compared to the existing excavator. The existing excavator was relatively fuel inefcient and used, on average, 290,000 litres of diesel fuel each year. The CFO assumes the cost of diesel iel remains constant for the next ten years at $1.40 per litre. 12) The current annual maintenance cost of the existing excavator is $63,000. The new excavator will require no maintenance in the rst three years of its life because it is covered by a manufacturer's three-year warranty. However, after the warranty expires in year 4 the annual maintenance expense will be $87,000. Whas an umbrella insurance policy that will insure any number of the company's excavators at a xed annual fee of $145,000. 13) In 201'? Wismed $80 million of new shares through a rights issue and private placement. These funds were used to acquire a complementary business. 14) It costs $175,000 a year to operate m3 Perth headquarters. With careJl management mbelieves they will not require any additional persOnnel in headquarters if they purchase the new excavator. In any case, the annual headquarters' operating expense will increase by 3% pa. 15) The ATO classies the safety equipment required for the Certicate of Roadworthiness as a business expense. The accountant afrms that any expenses incurred in generating sales for Ware tax deductible in the year the expense is incurred. 16) The earthwork consultant's report estimates that the new excavator will have a market value of $1.1 million in ten years' time. The existing excavator can be sold for $300,000 today. Emmwill use these sale proceeds to reduce its bank debt by $300,000 today. The consultant advises that in ten years' time the existing excavator would be worthless. 17) The company tax rate is 30% and the required rate of return is 9%