Question: Hello, I need some help figuring out the maximum contribution value for this accounting problem. All I ask is for work to be shown so

Hello, I need some help figuring out the maximum contribution value for this accounting problem. All I ask is for work to be shown so that I may see what I did wrong. Thank you!

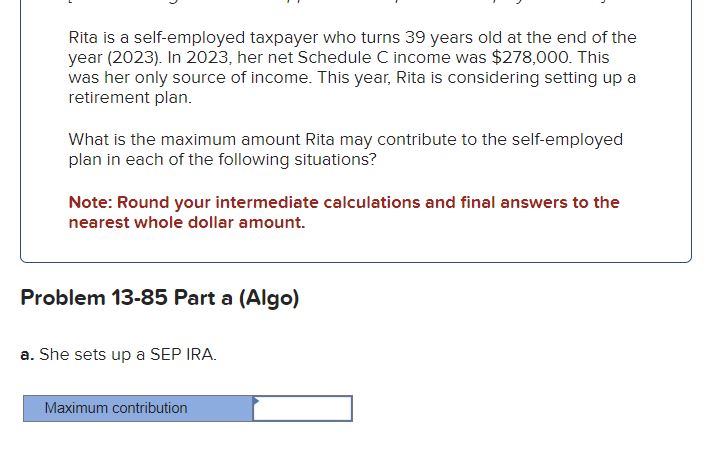

Rita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $278, 000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part a (Algo) a. She sets up a SEP IRA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts