Question: Hello, I need some help figuring out this problem and all I ask is for work to be shown if possible because I would like

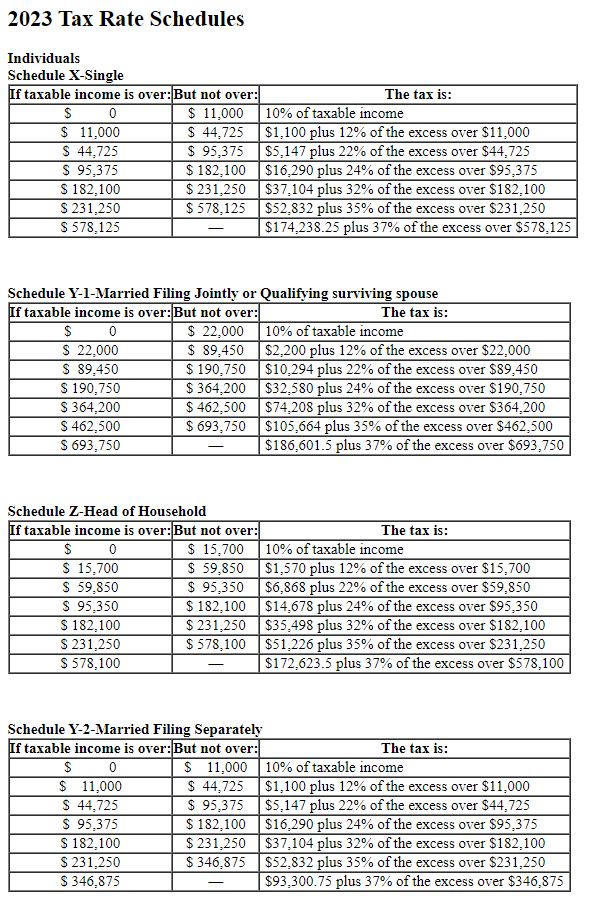

Hello, I need some help figuring out this problem and all I ask is for work to be shown if possible because I would like to use this for future reference since I was stumped on this problem the whole day. Thank you! I apologize I forgot to post a picture for the 2023 tax rate schedules. I have added it below. Thanks again!

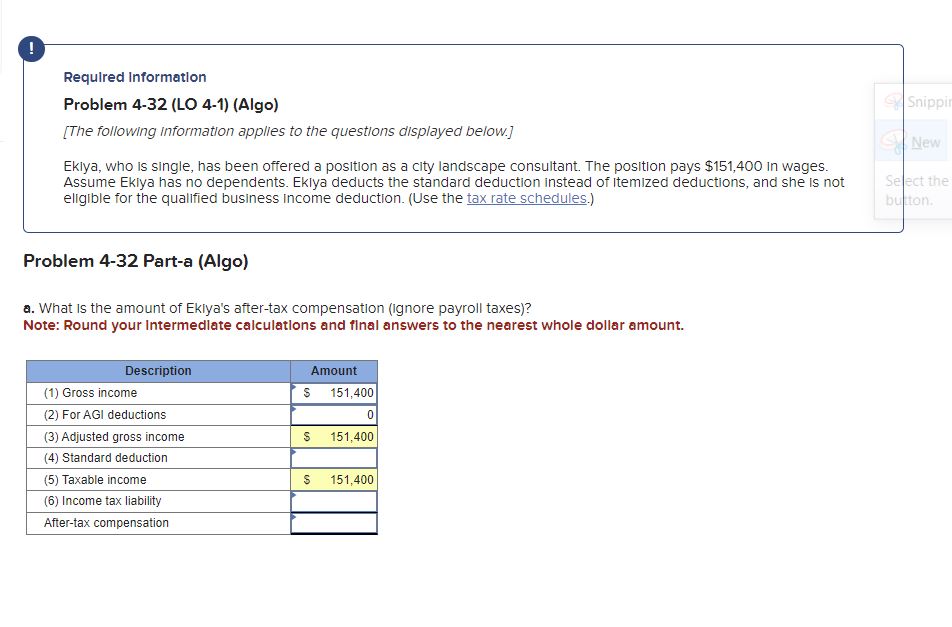

Required Information Problem 4-32 (LO 4-1) (Algo) [The following information applies to the questions displayed below.] Eklya, who is single, has been offered a position as a city landscape consultant. The position pays $151,400 in wages. Assume Ekiya has no dependents. Eklya deducts the standard deduction instead of Itemized deductions, and she is not eligible for the qualified business income deduction. (Use the tax rate schedules.) Problem 4-32 Part-a (Algo) a. What is the amount of Eklya's after-tax compensation (Ignore payroll taxes)? Note: Round your Intermedlate calculations and flnal answers to the nearest whole dollar amount. 2023 Tax Rate Schedules Individuals Schedule X-Single Srhorulo V_1_Marriad Filina Inintlv or Oualifvina curvivina cnnuco

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts