Question: Hello, I need some help solving this problem for accounting. Thank you. Required Information Problem 6-31 (LO 6-1) (Algo) [The following information applies to the

Hello, I need some help solving this problem for accounting. Thank you.

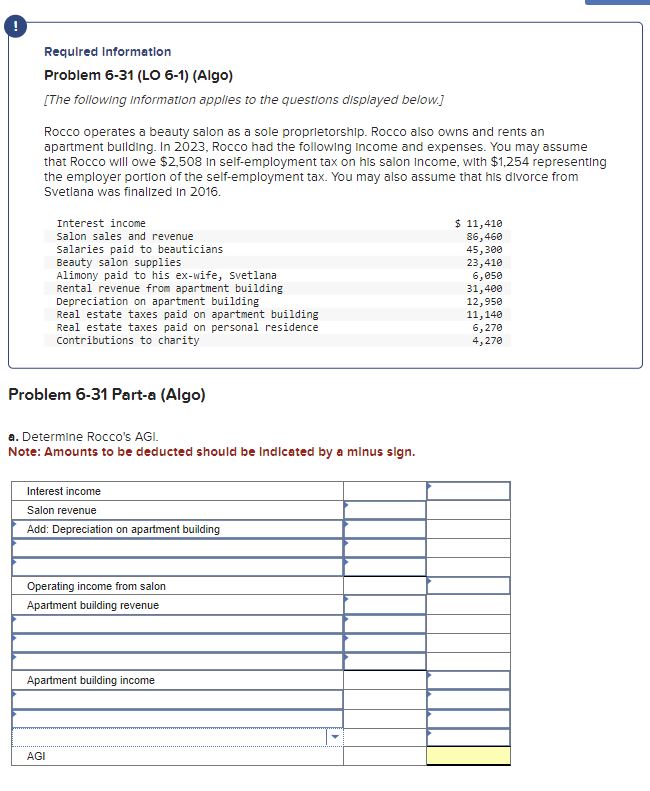

Required Information Problem 6-31 (LO 6-1) (Algo) [The following information applies to the questions displayed below.] Rocco operates a beauty salon as a sole proprletorship. Rocco also owns and rents an apartment bullding. In 2023, Rocco had the following Income and expenses. You may assume that Rocco will owe $2,508 in self-employment tax on his salon income, with $1,254 representing the employer portion of the self-employment tax. You may also assume that his divorce from Svetlana was finalized in 2016. Problem 6-31 Part-a (Algo) a. Determine Rocco's AGI. Note: Amounts to be deducted should be Indlcated by a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts