Question: Hello! I need some help understanding what to do and how to present it. I posted previously but did not understand the response. TYIA. Here

Hello! I need some help understanding what to do and how to present it. I posted previously but did not understand the response. TYIA.

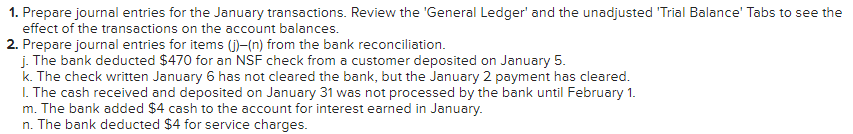

Here is the General Ledger before any data is entered into the Journal:

Bank Reconcilation before any information is added:

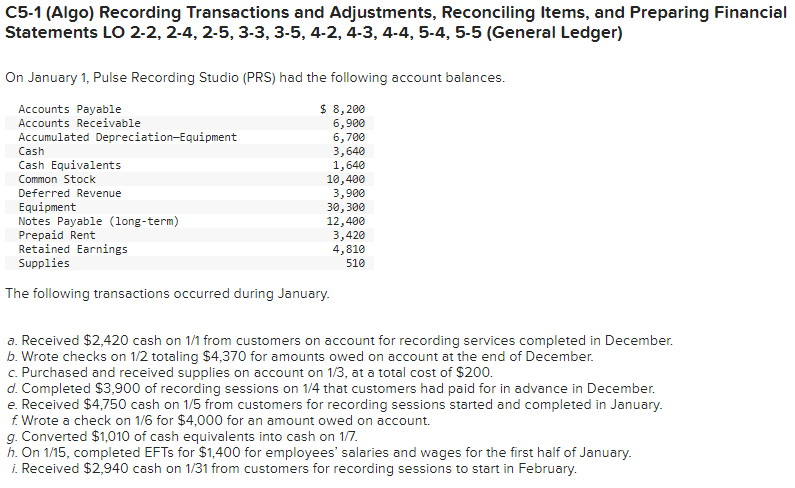

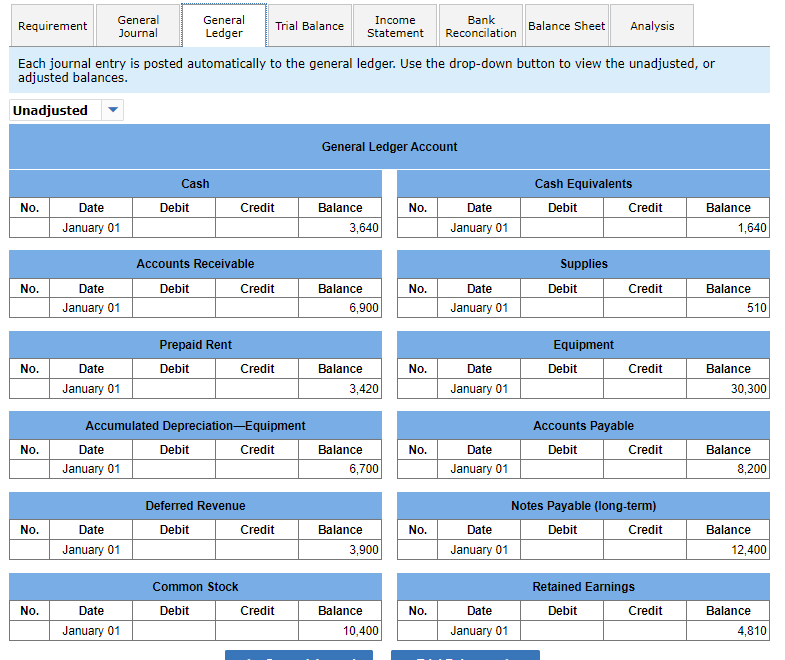

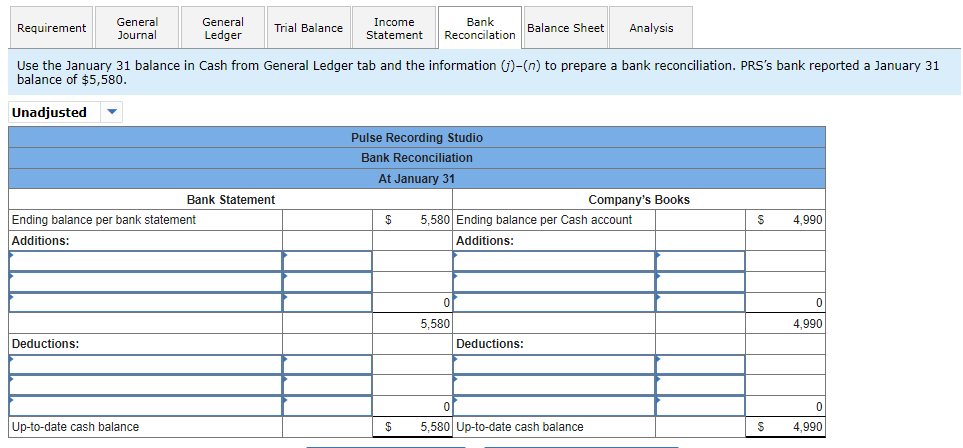

C5-1 (Algo) Recording Transactions and Adjustments, Reconciling Items, and Preparing Financial Statements LO 2-2, 2-4, 2-5, 3-3, 3-5, 4-2, 4-3, 4-4, 5-4, 5-5 (General Ledger) On January 1, Pulse Recording Studio (PRS) had the following account balances. The following transactions occurred during January. a. Received $2,420 cash on 1/1 from customers on account for recording services completed in December. b. Wrote checks on 1/2 totaling $4,370 for amounts owed on account at the end of December. c. Purchased and received supplies on account on 1/3, at a total cost of $200. d. Completed $3,900 of recording sessions on 1/4 that customers had paid for in advance in December. e. Received $4,750 cash on 1/5 from customers for recording sessions started and completed in January. f. Wrote a check on 1/6 for $4,000 for an amount owed on account. g. Converted $1,010 of cash equivalents into cash on 1/7. h. On 1/15, completed EFTs for $1,400 for employees' salaries and wages for the first half of January. i. Received $2,940 cash on 1/31 from customers for recording sessions to start in February. 1. Prepare journal entries for the January transactions. Review the 'General Ledger' and the unadjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. 2. Prepare journal entries for items (j)-(n) from the bank reconciliation. j. The bank deducted $470 for an NSF check from a customer deposited on January 5. k. The check written January 6 has not cleared the bank, but the January 2 payment has cleared. I. The cash received and deposited on January 31 was not processed by the bank until February 1. m. The bank added $4 cash to the account for interest earned in January. n. The bank deducted $4 for service charges. Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted, or idjusted balances. Use the January 31 balance in Cash from General Ledger tab and the information (j)(n) to prepare a bank reconciliation. PRS's bank reported a January 31 balance of $5,580. C5-1 (Algo) Recording Transactions and Adjustments, Reconciling Items, and Preparing Financial Statements LO 2-2, 2-4, 2-5, 3-3, 3-5, 4-2, 4-3, 4-4, 5-4, 5-5 (General Ledger) On January 1, Pulse Recording Studio (PRS) had the following account balances. The following transactions occurred during January. a. Received $2,420 cash on 1/1 from customers on account for recording services completed in December. b. Wrote checks on 1/2 totaling $4,370 for amounts owed on account at the end of December. c. Purchased and received supplies on account on 1/3, at a total cost of $200. d. Completed $3,900 of recording sessions on 1/4 that customers had paid for in advance in December. e. Received $4,750 cash on 1/5 from customers for recording sessions started and completed in January. f. Wrote a check on 1/6 for $4,000 for an amount owed on account. g. Converted $1,010 of cash equivalents into cash on 1/7. h. On 1/15, completed EFTs for $1,400 for employees' salaries and wages for the first half of January. i. Received $2,940 cash on 1/31 from customers for recording sessions to start in February. 1. Prepare journal entries for the January transactions. Review the 'General Ledger' and the unadjusted 'Trial Balance' Tabs to see the effect of the transactions on the account balances. 2. Prepare journal entries for items (j)-(n) from the bank reconciliation. j. The bank deducted $470 for an NSF check from a customer deposited on January 5. k. The check written January 6 has not cleared the bank, but the January 2 payment has cleared. I. The cash received and deposited on January 31 was not processed by the bank until February 1. m. The bank added $4 cash to the account for interest earned in January. n. The bank deducted $4 for service charges. Each journal entry is posted automatically to the general ledger. Use the drop-down button to view the unadjusted, or idjusted balances. Use the January 31 balance in Cash from General Ledger tab and the information (j)(n) to prepare a bank reconciliation. PRS's bank reported a January 31 balance of $5,580

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts