Question: Hello! I need some help with a few accounting exercises. Please show all work/steps taken so that I can use it for practice as well

Hello! I need some help with a few accounting exercises. Please show all work/steps taken so that I can use it for practice as well as a reference for future problems. Thank you so much!

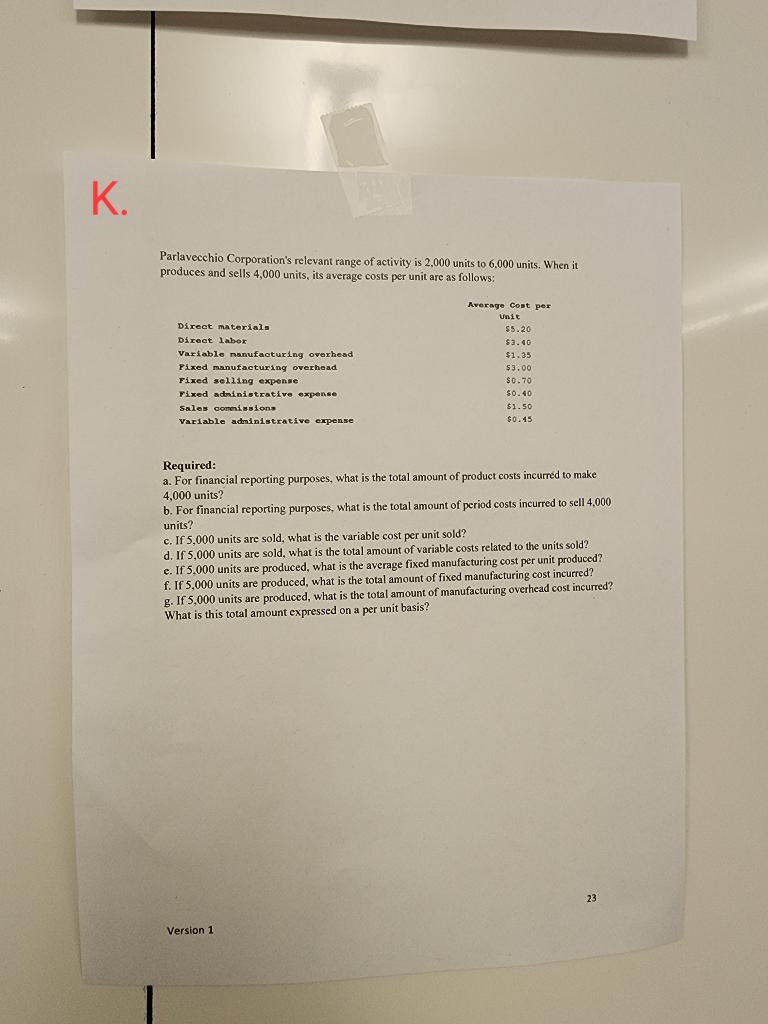

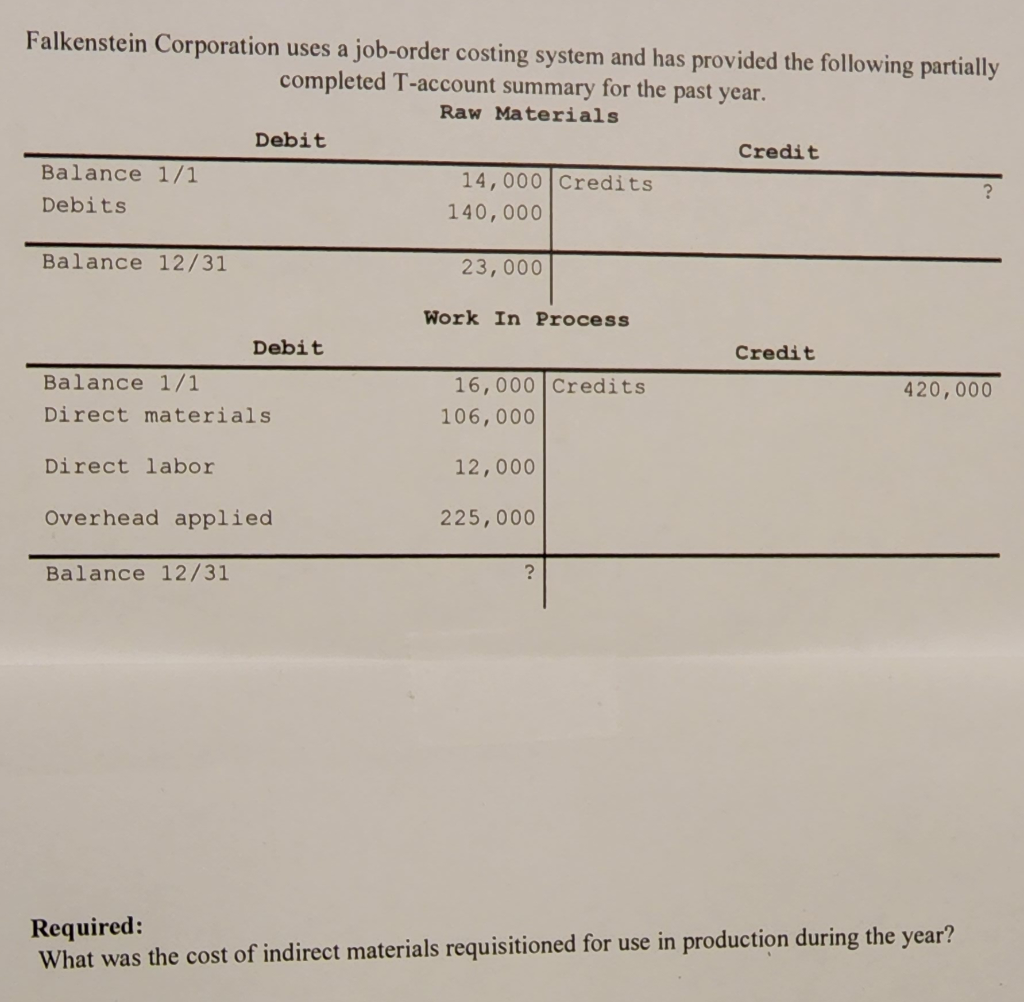

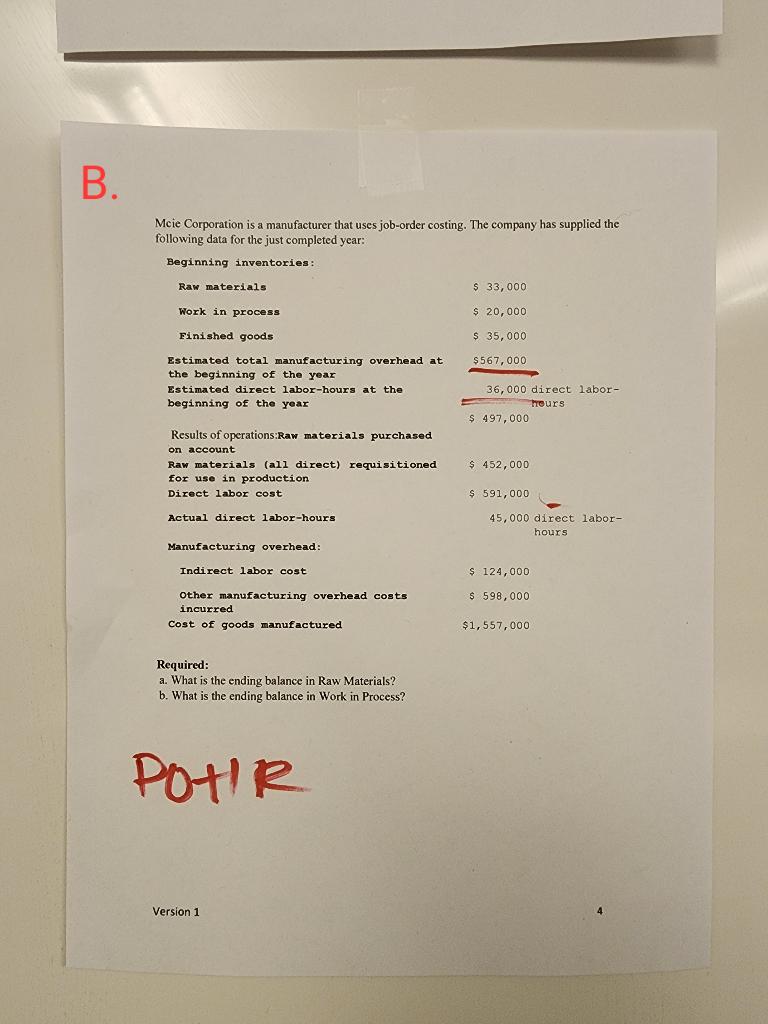

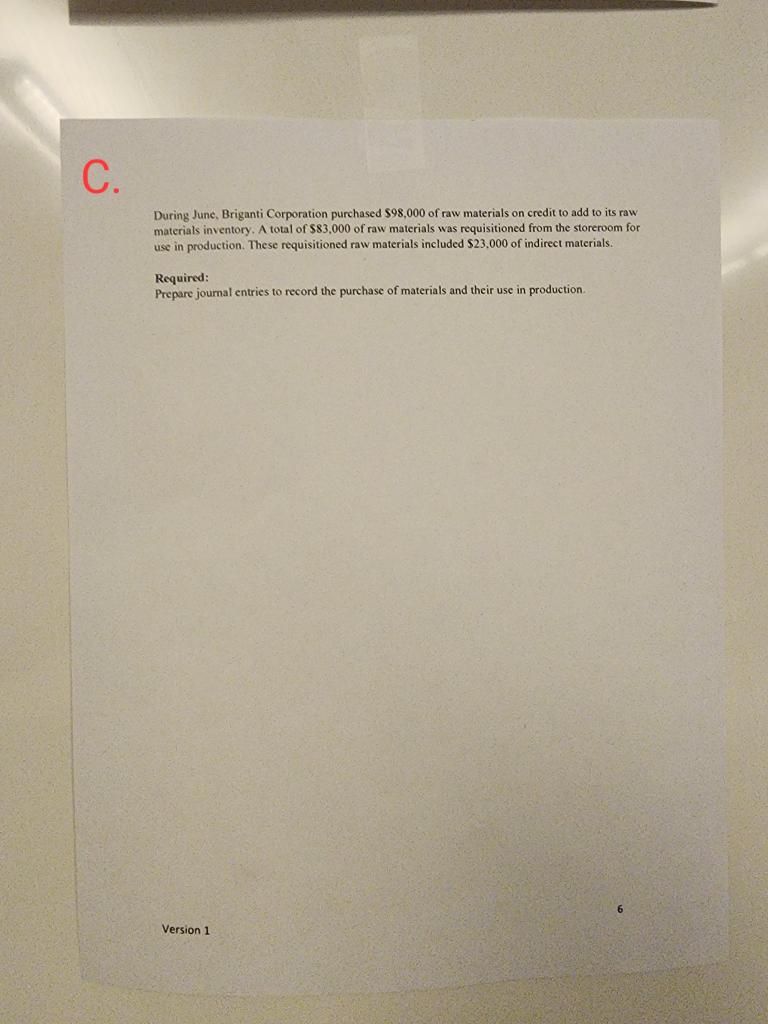

Parlavecchio Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows: Required: a. For financial reporting purposes, what is the total amount of product costs incurred to make 4,000 units? b. For financial reporting purposes, what is the total amount of period costs incurred to sell 4,000 units? c. If 5,000 units are sold, what is the variable cost per unit sold? d. If 5,000 units are sold, what is the total amount of variable costs related to the units sold? e. If 5,000 units are produced, what is the average fixed manufacturing cost per unit produced? f. If 5,000 units are produced, what is the total amount of fixed manufacturing cost incurred? g. If 5,000 units are produced, what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis? Falkenstein Corporation uses a job-order costing system and has provided the following partially completed T-account summary for the past year. Required: What was the cost of indirect materials requisitioned for use in production during the year? Mcie Corporation is a manufacturer that uses job-order costing. The company has supplied the following data for the just completed year: During June, Briganti Corporation purchased $98,000 of raw materials on credit to add to its raw materials inventory. A total of $83,000 of raw materials was requisitioned from the storeroom for use in production. These requisitioned raw materials included $23,000 of indirect materials. Required: Prepare joumal entries to record the purchase of materials and their use in production

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts