Question: hello, I need this back before 10:30 tonight PRACTICE 1 - Decision Making Under Uncertainty only! A stock market advisory service offers three investments portfolios

hello,

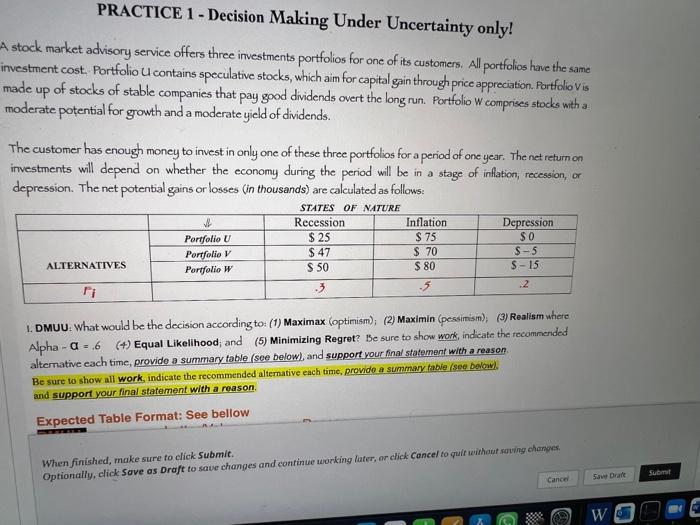

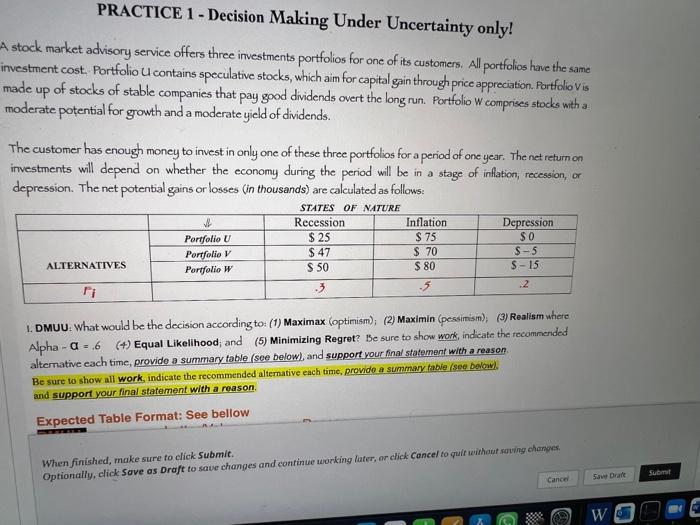

PRACTICE 1 - Decision Making Under Uncertainty only! A stock market advisory service offers three investments portfolios for one of its customers. All portfolios have the same nvestment cost. Portfolio 4 contains speculative stocks, which aim for capital gain through price appreciation. Portfolio V is made up of stocks of stable companies that pay good dividends overt the long run. Portfolio W comprises stocks with a moderate potential for growth and a moderate yield of dividends. The customer has enough money to invest in only one of these three portfolios for a period of one year. The net return on investments will depend on whether the economy during the period will be in a stage of inflation, recession, or depression. The net potential gains or losses (in thousands) are calculated as follows: 1. DMUU: What would be the decision according to: (1) Maximax (optinism); (2) Maximin (pessimism); (3) Realism where Apha a=6 (4) Equal Likelihood a and (5) Minimizing Regret? Be sure to show work, indicate the recominended alternative each time, provide a summary table (see below), and support your final statement with a reason. Be sure to show all work, indicate the recommended alternative each time, provide a summary table (see bolom. and support your final statement with a reason. Expected Table Format: See bellow When finished, make sure to click Submic. Optionally, click Save as Draft to save changes and continue working later, or chick Cancel to quif without saving chamges. PRACTICE 1 - Decision Making Under Uncertainty only! A stock market advisory service offers three investments portfolios for one of its customers. All portfolios have the same nvestment cost. Portfolio 4 contains speculative stocks, which aim for capital gain through price appreciation. Portfolio V is made up of stocks of stable companies that pay good dividends overt the long run. Portfolio W comprises stocks with a moderate potential for growth and a moderate yield of dividends. The customer has enough money to invest in only one of these three portfolios for a period of one year. The net return on investments will depend on whether the economy during the period will be in a stage of inflation, recession, or depression. The net potential gains or losses (in thousands) are calculated as follows: 1. DMUU: What would be the decision according to: (1) Maximax (optinism); (2) Maximin (pessimism); (3) Realism where Apha a=6 (4) Equal Likelihood a and (5) Minimizing Regret? Be sure to show work, indicate the recominended alternative each time, provide a summary table (see below), and support your final statement with a reason. Be sure to show all work, indicate the recommended alternative each time, provide a summary table (see bolom. and support your final statement with a reason. Expected Table Format: See bellow When finished, make sure to click Submic. Optionally, click Save as Draft to save changes and continue working later, or chick Cancel to quif without saving chamges I need this back before 10:30 tonight

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock