Question: Hello I need to know how can I do this 2 questions on the financial calculator provide explanation in financial calculator steps thanks It a

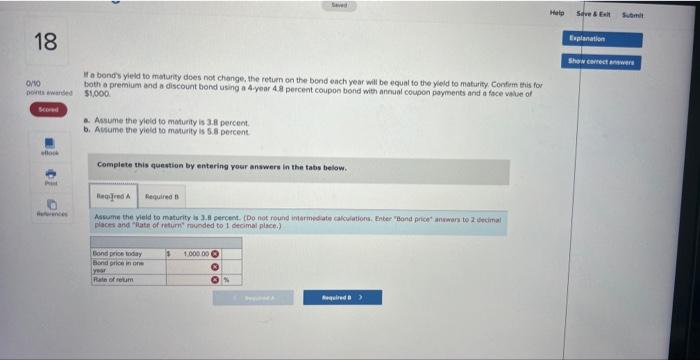

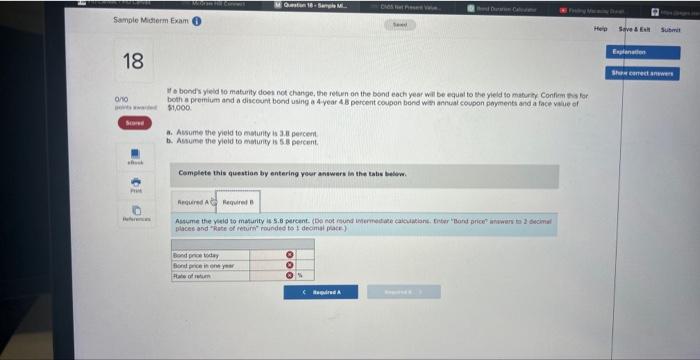

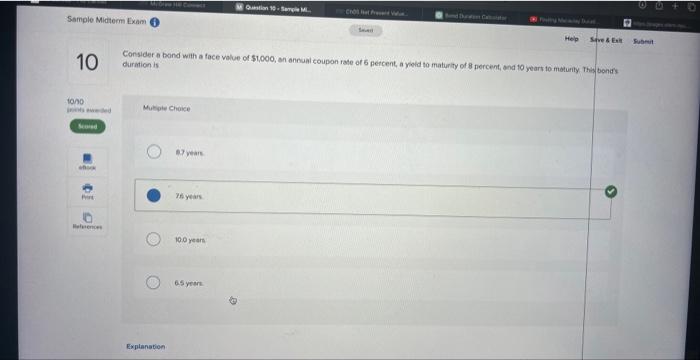

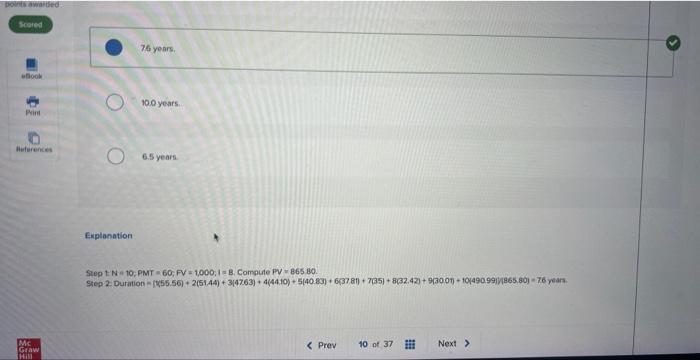

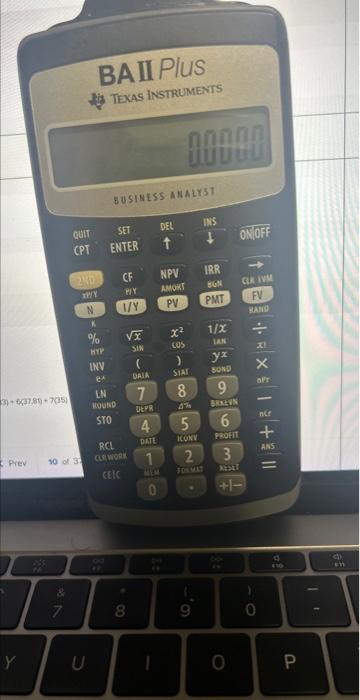

It a bonds ylekd to maturity does not change, the retuen on the bend each year will be equal to the yeld to maturity Confim this for both a premium and a discount bond using a 4 year 4.8 percent coupon bond with annabl coupon poyments and a face value of 51,000 a. Acsume the yleid to moturity is 3.8 percent b. Actume the yieid to maturity is 5. . percent. Complete this question by entering your answers in the tabs below. places and "llate of return" rivoded to I decimal plsce.) If o bend s yyedd to maturity does not change, the retwen on the bond each year wil be equal to the yield to maturity Confiem his for both a premium and a diaceunt bond using a 4 year t is percent coupon bend war arnuat coupon peyments and a face yaue of $1,000 a. Assume the yield to matuity is 3.8 percert. b. Assume the yleld to meturiy is 5 is pertent. Cemplete this queutios by entering yoer answers in the tatis bedew. places and "Rate of teturn" roundes to t deomal pace) Consider a band with a face value of $1,000, an annuai coupon rate of 6 percent, a yold to maturity of 8 percent, and 10 years to moturity This bonds durition is Mukpin choice ex vear. 7 syears 10.0 yeare 6.5 yeert 76 years. 700 years: 6.5 years Explanation Step IN=10;PMT=60;FV=1,000,1=B, compuie PPV=865.80. Step 2: Duration =(x55.56)+2(51.44)+3(47.63)+4(44.10)+5(40.83)+6(37.81)+7(35)+8(32.42)+9(30.07+10(490.991/1865.80j=76 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts