Question: Hello, I need your help with this problem and I need to fill out all the blanks. Thanks for your help. Martinez, Inc. acquired a

Hello, I need your help with this problem and I need to fill out all the blanks.

Thanks for your help.

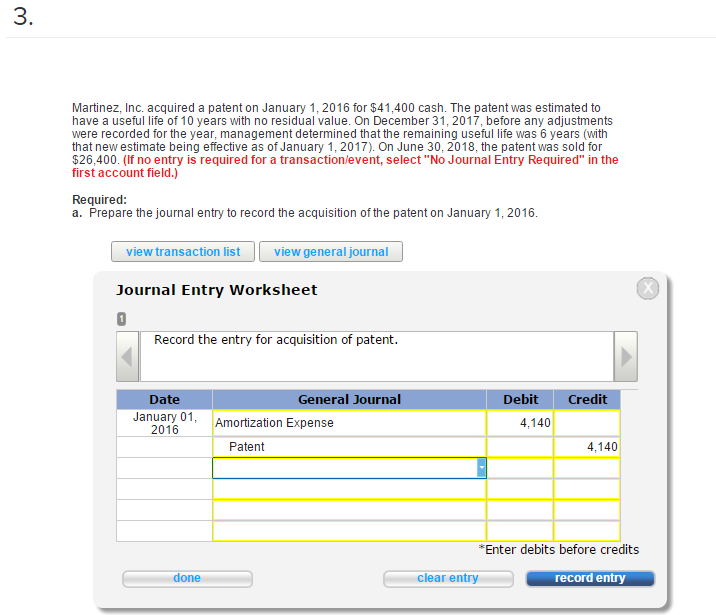

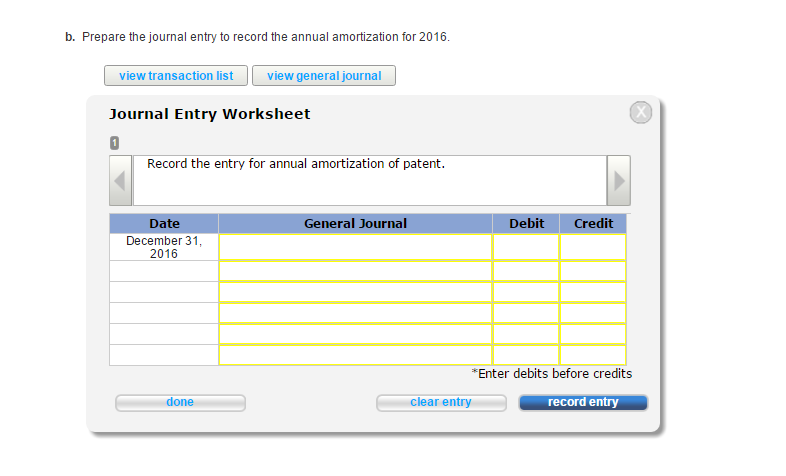

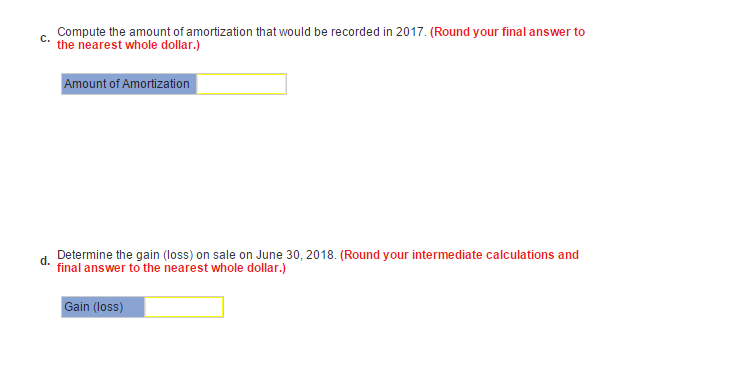

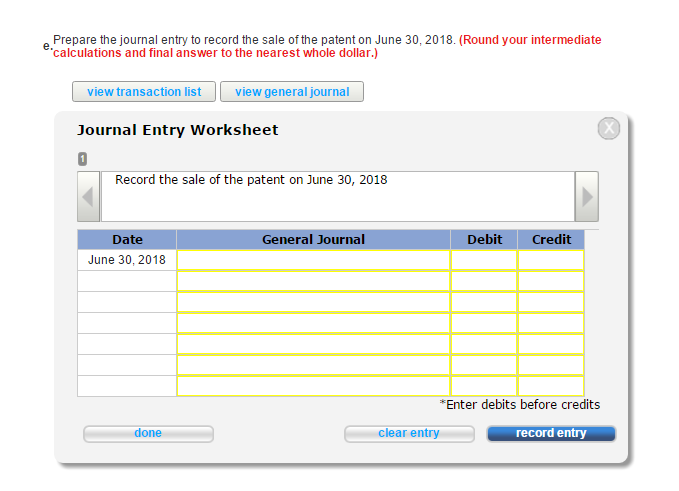

Martinez, Inc. acquired a patent on January 1 2016 for $41,400 cash. The patent was estimated to have a useful life of 10 years with no residual value. On December 31, 2017, before any adjustments were recorded for the year, management determined that the remaining useful life was 6 years (with that ne westimate being effective as of January 1 2017). On June 30, 2018, the patent was sold for $26,400. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Required: a. Prepare the journal entry to record the acquisition of the patent on January 1, 2016. view transaction list view general journal Journal Entry Worksheet Record the entry for acquisition of patent. Date General Journal Debit Credit January 01, Amortization Expense 4,140 4,140 Patent *Enter debits before credits done clear entry record entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts