Question: Hello, I ONLY need help figuring out 3 different parts. I need help calculating the payback period. I need help with the question Draw the

Hello, I ONLY need help figuring out 3 different parts. I need help calculating the payback period. I need help with the question "Draw the NPV profile for Project A & B, how might a change in the cost of capital produce a conflict between the NPV and IRR ranking of these two projects?" And I need help with the last question, "What is the cross rate for both projects?"

Please solve these 3 questions in Excel showing the steps/formulas. THANK YOU.

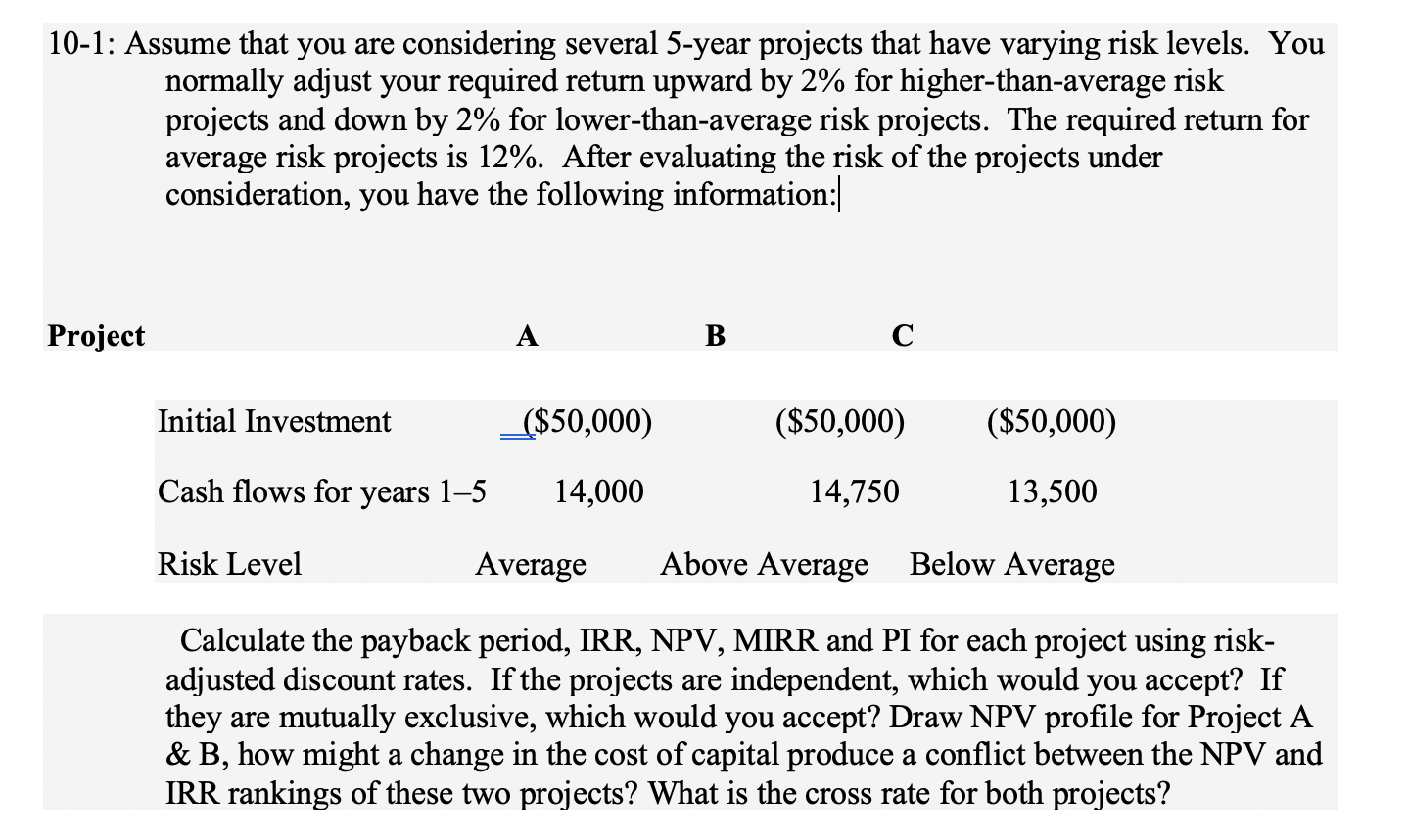

10-1: Assume that you are considering several 5-year projects that have varying risk levels. You normally adjust your required return upward by 2% for higher-than-average risk projects and down by 2% for lower-than-average risk projects. The required return for average risk projects is 12%. After evaluating the risk of the projects under consideration, you have the following information: Project A B Initial Investment ($50,000) ($50,000) ($50,000) Cash flows for years 15 14,000 14,750 13,500 Risk Level Average Above Average Below Average Calculate the payback period, IRR, NPV, MIRR and PI for each project using risk- adjusted discount rates. If the projects are independent, which would you accept? If they are mutually exclusive, which would you accept? Draw NPV profile for Project A & B, how might a change in the cost of capital produce a conflict between the NPV and IRR rankings of these two projects? What is the cross rate for both projects? 10-1: Assume that you are considering several 5-year projects that have varying risk levels. You normally adjust your required return upward by 2% for higher-than-average risk projects and down by 2% for lower-than-average risk projects. The required return for average risk projects is 12%. After evaluating the risk of the projects under consideration, you have the following information: Project A B Initial Investment ($50,000) ($50,000) ($50,000) Cash flows for years 15 14,000 14,750 13,500 Risk Level Average Above Average Below Average Calculate the payback period, IRR, NPV, MIRR and PI for each project using risk- adjusted discount rates. If the projects are independent, which would you accept? If they are mutually exclusive, which would you accept? Draw NPV profile for Project A & B, how might a change in the cost of capital produce a conflict between the NPV and IRR rankings of these two projects? What is the cross rate for both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts