Question: Hello! I really need help with the Ch.4 closing entries for the city of Bingham project, especially the detailed (subsidiary) entries that go into each

Hello! I really need help with the Ch.4 closing entries for the city of Bingham project, especially the detailed (subsidiary) entries that go into each closing entry (for example, what subsidiary entries make up the estimated revenues to equal the amount of 4,656,250?). PLEASE NOTE: I really need help with the closing entries, but I provided all of the instructions so that you have context of my entries. However, feel free to review my entries and provide any corrections if any of them are incorrect! Below are the instructions:

![incorrect! Below are the instructions: 1. [Para. 4a-1] Property taxes were levied](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/11/673729f962c7d_473673729f935a35.jpg)

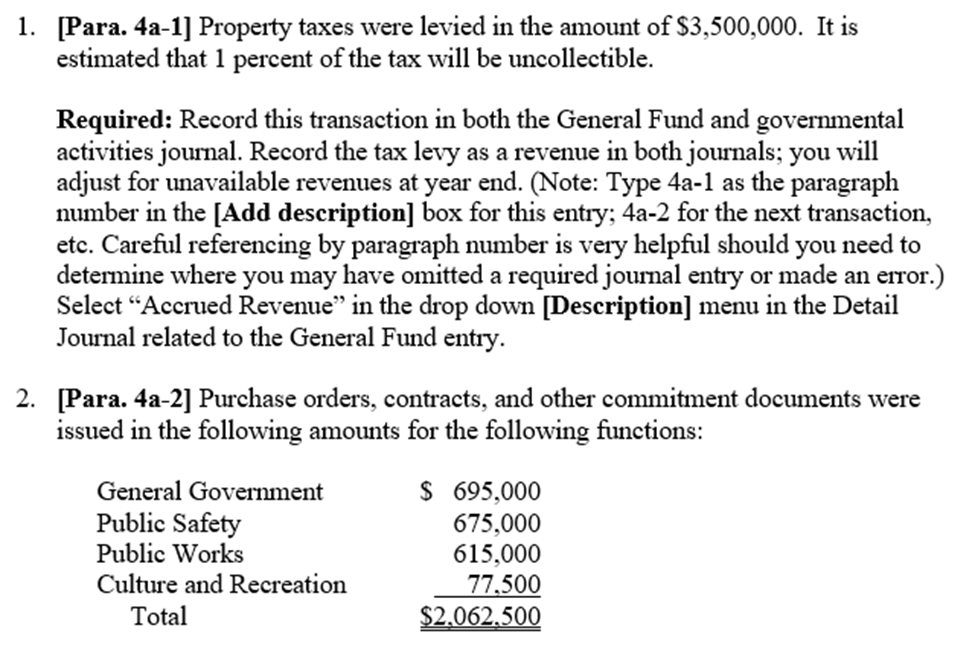

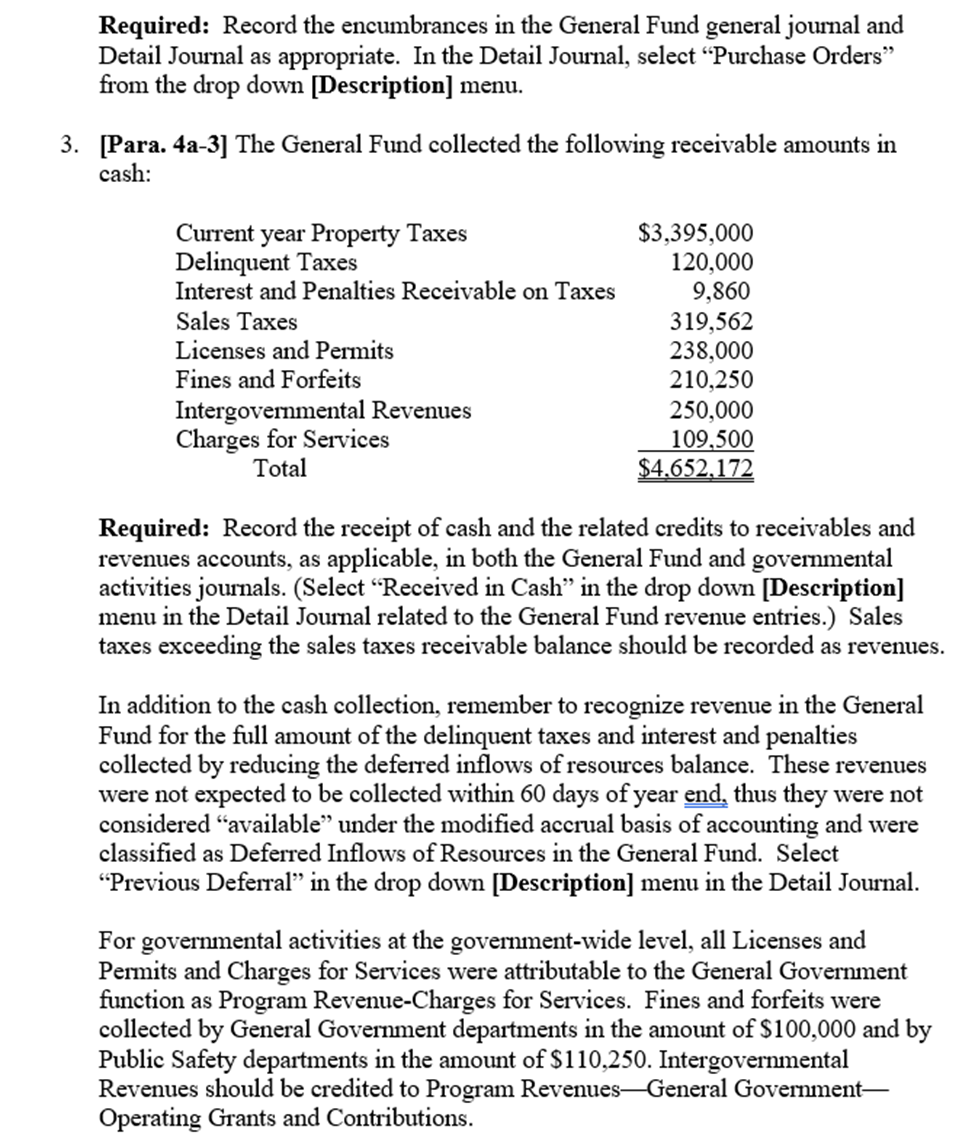

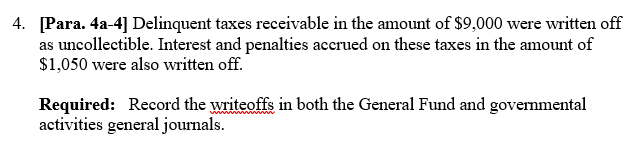

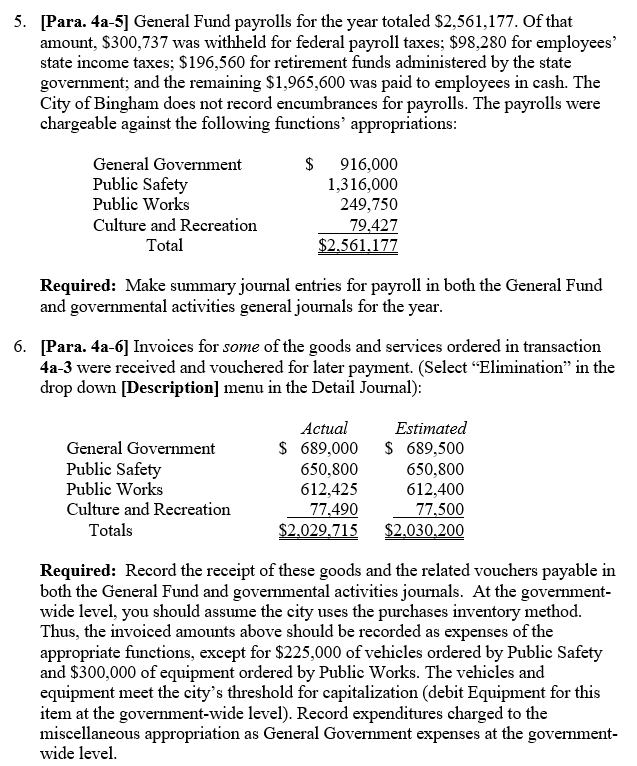

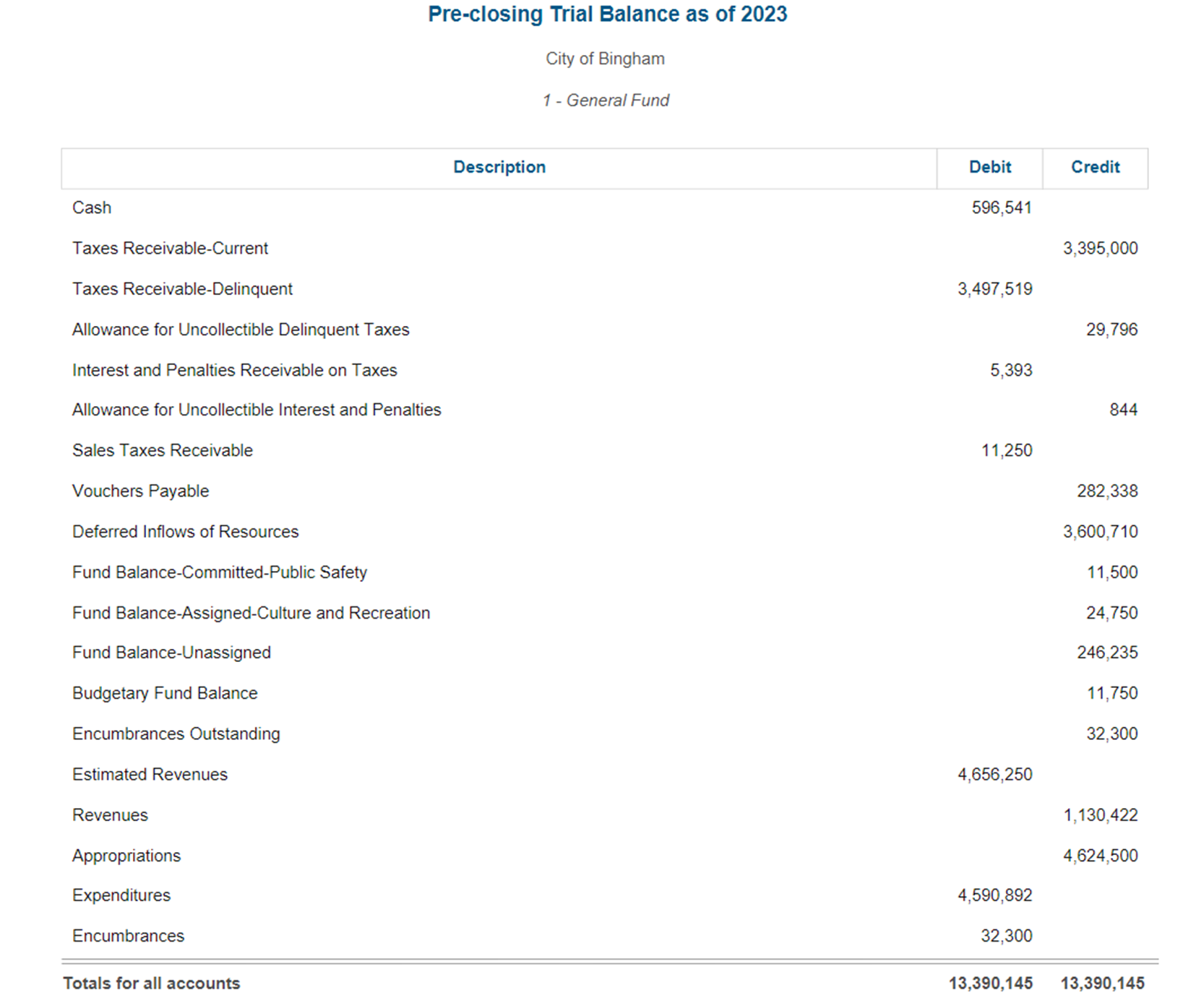

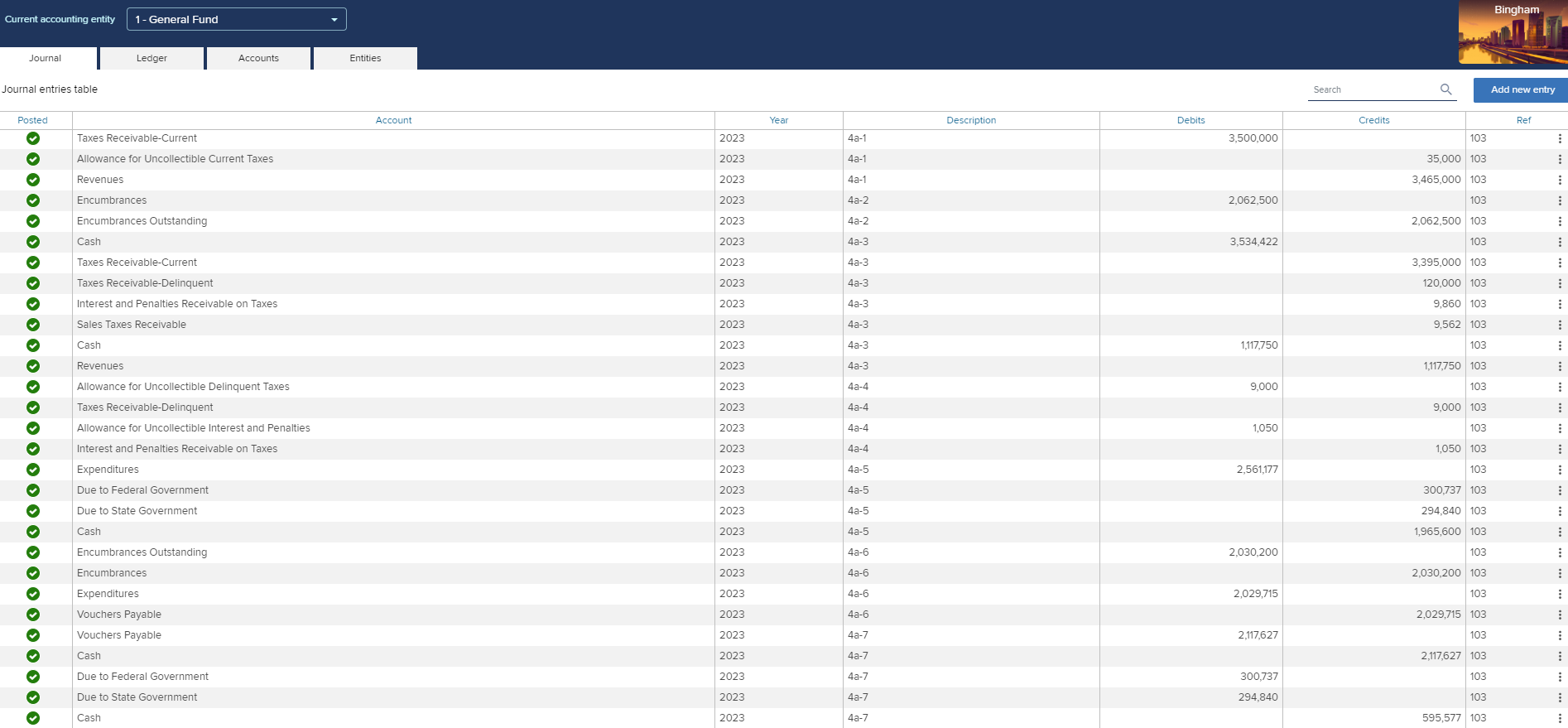

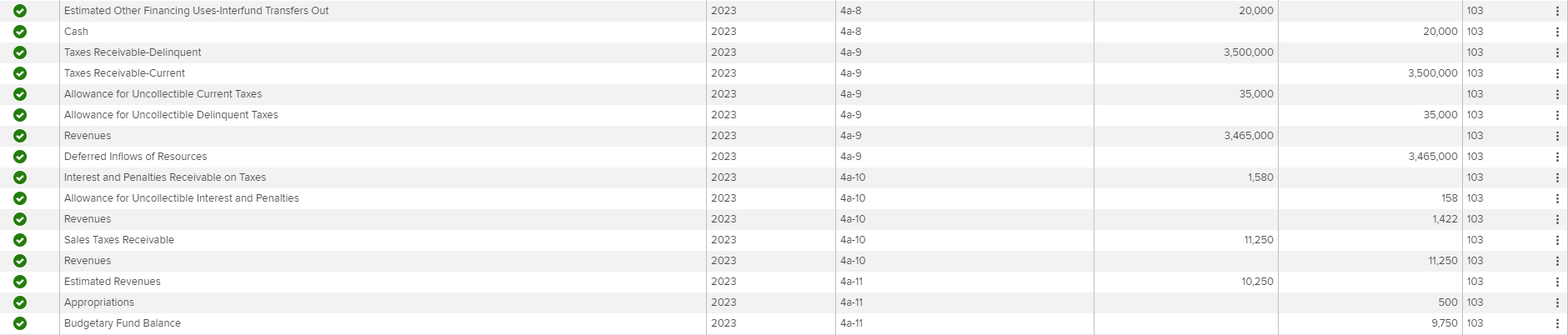

1. [Para. 4a-1] Property taxes were levied in the amount of $3.500,000. It 1s estimated that 1 percent of the tax will be uncollectible. Required: Record this transaction in both the General Fund and governmental activities journal. Record the tax levy as a revenue in both journals: you will adjust for unavailable revenues at year end. (Note: Type 4a-1 as the paragraph number in the [Add description] box for this entry: 4a-2 for the next transaction, etc. Careful referencing by paragraph number is very helpful should you need to determine where you may have omitted a required journal entry or made an error.) Select \"Accrued Revenue in the drop down [Description] menu in the Detail Journal related to the General Fund entry. 2. [Para. 4a-2] Purchase orders, contracts, and other commitment documents were 1ssued in the following amounts for the following functions: General Government $ 695.000 Public Safety 675,000 Public Works 615,000 Culture and Recreation 77.500 Total $2.062.500 Required: Record the encumbrances in the General Fund general journal and Detail Journal as appropriate. In the Detail Journal, select \"Purchase Orders from the drop down [Description] menu. [Para. 4a-3] The General Fund collected the following receivable amounts in cash: Current year Property Taxes $3,395,000 Delinquent Taxes 120,000 Interest and Penalties Receivable on Taxes 9.860 Sales Taxes 319,562 Licenses and Permits 238,000 Fines and Forfeits 210,250 Intergovernmental Revenues 250,000 Charges for Services 109.500 Total $4.652.172 Required: Record the receipt of cash and the related credits to receivables and revenues accounts, as applicable, in both the General Fund and governmental activities journals. (Select \"Received in Cash in the drop down [Description] menu in the Detail Journal related to the General Fund revenue entries.) Sales taxes exceeding the sales taxes receivable balance should be recorded as revenues. In addition to the cash collection, remember to recognize revenue in the General Fund for the full amount of the delinquent taxes and interest and penalties collected by reducing the deferred inflows of resources balance. These revenues were not expected to be collected within 60 days of year end. thus they were not considered \"available under the modified accrual basis of accounting and were classified as Deferred Inflows of Resources in the General Fund. Select \"Previous Deferral\" in the drop down [Description] menu in the Detail Journal. For governmental activities at the government-wide level, all Licenses and Permits and Charges for Services were attributable to the General Government function as Program Revenue-Charges for Services. Fines and forfeits were collected by General Government departments in the amount of $100,000 and by Public Safety departments in the amount of $110.250. Intergovernmental Revenues should be credited to Program RevenuesGeneral Government Operating Grants and Contributions. 4. [Para. 4a-4] Delinquent taxes receivable in the amount of $9.000 were written off as uncollectible. Interest and penalties accrued on these taxes in the amount of $1.050 were also written off. Required: Record the writeoffs in both the General Fund and governmental activities general journals. 5. [Para. 4a-5] General Fund payrolls for the year totaled $2.561.177. Of that amount. $300.737 was withheld for federal payroll taxes: $98,280 for employees' state income taxes: $196,560 for retirement funds administered by the state government: and the remaming $1.965,600 was paid to employees in cash. The City of Bingham does not record encumbrances for payrolls. The payrolls were chargeable against the following functions' appropriations: General Government $ 916.000 Public Safety 1.316.000 Public Works 249 750 Culture and Recreation 70.427 Total $2.561.177 Required: Make summary journal entries for payroll in both the General Fund and governmental activities general journals for the year. 6. [Para. 4a-6] Invoices for some of the goods and services ordered in transaction 4a-3 were recerved and vouchered for later payment. (Select \"Elmunation m the drop down [Deseription] menu in the Detail Journal): Actual Estimated General Government $ 689,000 689.500 Public Safety 650.800 650.800 Public Works 612.425 612.400 Culture and Recreation 77.490 77.500 Totals $2.029.715 $2.030.200 Required: Record the receipt of these goods and the related vouchers payable in both the General Fund and governmental activities journals. At the government- wide level. you should assume the city uses the purchases inventory method. Thus, the nvoiced amounts above should be recorded as expenses of the appropriate functions, except for $225,000 of vehicles ordered by Public Safety and $300,000 of equipment ordered by Public Works. The vehicles and equipment meet the city's threshold for capitalization (debit Equipment for this item at the government-wide level). Record expenditures charged to the miscellaneous appropriation as General Government expenses at the government- wide level. 7. [Para. 4a-7] The General Fund paid vouchers during the year in the amount of $2.117.627 as well as its liabilities for employees' federal and state income taxes withheld and payroll taxes. Required: Record the payment of these items in both the General Fund and governmental activities general journals. 8. 10. [Para. 4a-8] The General Fund transferred $20.000 to the debt service fund for a bond interest payment. Required: Record this transaction in the General Fund only. The transaction has no effect at the government-wide level since it occurs between two governmental activities. Do not record this transaction in the debt service fund until instructed to do so in Chapter 6 of this case. [Para. 4a-9] The balances in the current taxes recervable and related estunated uncollectibles accounts were reclassified as delinquent. Required: Record the reclassification in the General Fund and governmental activities journals. Property tax revenues should be reduced and Deferred Inflows of Resources should be recorded in the General Fund, since these revenues are considered \"unavailable under the modified accrual basis of accounting used in governmental funds. At the government-wide level, the property taxes continue to be included in current year revenue. [Para. 4a-10] Interest and penalties of $1,580 were recorded on delinquent taxes, of which $158 was estunated to be uncollectible. Sales taxes recervable of $11.250 were also recorded. Required: Interest and penalties should be recorded as Deferred Inflows of Resources, rather than interest and penalties revenue, m the General Fund. On the other hand, sales taxes are recorded as revenue in the General Fund since they will be collected shortly after year end. At the government-wide level, both the interest and penalties and sales taxes are recorded as current year revenue. 11. [Para. 4a-11] In view of unexpected revenue and expenditure developments the city council revised the budgets for the current year as shown below: Budget Adjustments Estimated Revenues: Property Tax $ 15.000 increase Sales Tax 3.750 decrease Interest and Penalties 1.000 decrease Appropriations: Culture and Recreation $ 2.000 decrease Public Safety 6,000 increase General Govermment 4,500 decrease Required: Record the budget amendments in the General Fund general journal only. Budgetary items do not affect the government-wide accounting records. (Note: Select \"Budget Amendment\" in the [Deseription] field in the Detail Journal.) 12. [Closing Entry] Following the instructions in the next paragraph, prepare and post the necessary entries to close the Estimated Revenues, Appropriations. and Estimated Other Financing Uses accounts to Budgetary Fund Balance: and Revenues, Expenditures, and Other Financing Uses to Fund Balance Unassigned. Because the City of Bingham honors all outstanding encumbrances at year-end. it 1s not necessary to close Encumbrances to Encumbrances Outstanding at year-end since encumbrances do not affect the General Fund balance sheet or statement of revenues, expenditures, and changes in fund balances. However, if you would like to avoid having these accounts appear in the post-closing trial balance, you can opt to close Encumbrances to Encumbrances Outstanding. If the accounts are closed, they would need to be reestablished at the beginning of the next year, although entries are not required in this problem for the next year. To close the temporary accounts, you must click on the box for [Clesing Entry], \"Closing Entry\" checkbox will appear next to the [Add credit] ficld. Be sure the checkmark in the box for [Closing Entry] is showing as selected before closing UsesInterfund Transfers Out and Other Financing UsesInterfund Transfers Out, you will be sent to the Detail Journal where you must close each individual budgetary or operating statement account. To determine the closing amounts for both General Ledger and subsidiary ledger accounts. you should first print the pre-closing version of these ledgers for vear 2023 from the [Reports] menu. At year-end, an analysis by the city's finance department determined the following constramts on resources in the General Fund. Prepare the appropriate journal entry in the General Fund to reclassify amounts between Fund Balance Unassigned and the fund balance accounts corresponding to the constraints shown below. (Note: You should consider the beginning of year balances in fund balance accounts in calculating the amounts to be reclassified.) Account Amount Fund BalanceCommittedPublic Safety $20.300 Fund BalanceAssigned Public Works 19,500 Pre-closing Trial Balance as of 2023 City of Bingham 1 - General Fund Description Debit Credit Cash 596,541 Taxes Receivable-Current 3,395,000 Taxes Receivable-Delinquent 3,497,519 Allowance for Uncollectible Delinquent Taxes 29,796 Interest and Penalties Receivable on Taxes 5,393 Allowance for Uncollectible Interest and Penalties 844 Sales Taxes Receivable 11,250 Vouchers Payable 282,338 Deferred Inflows of Resources 3,600,710 Fund Balance-Committed-Public Safety 11,500 Fund Balance-Assigned-Culture and Recreation 24,750 Fund Balance-Unassigned 246,235 Budgetary Fund Balance 11,750 Encumbrances Outstanding 32,300 Estimated Revenues 4,656,250 Revenues 1,130,422 Appropriations 4,624,500 Expenditures 4,590,892 Encumbrances 32,300 Totals for all accounts 13,390,145 13,390,145Bingham Current accounting entity 1 - General Fund Journal Ledger Accounts Entities Search Q Add new entry Journal entries table Description Debits Credits Ref Posted Account Year 103 2023 4a-1 3,500,000 Taxes Receivable-Current 4a-1 35,000 103 Allowance for Uncollectible Current Taxes 2023 2023 4a-1 3,465,000 103 Revenues 103 2023 4a-2 2,062,500 Encumbrances 2023 4a-2 2,062,500 103 Encumbrances Outstanding 103 2023 4a-3 3,534,422 Cash Taxes Receivable-Current 2023 4a-3 3,395,000 103 120,000 103 Taxes Receivable-Delinquent 2023 4a-3 4a-3 9,860 103 Interest and Penalties Receivable on Taxes 2023 9,562 103 Sales Taxes Receivable 2023 4a-3 1,117,750 103 4a-3 Cash 2023 1,117,750 103 Revenues 2023 4a-3 103 2023 4a-4 9,000 Allowance for Uncollectible Delinquent Taxes 4a-4 9,000 103 Taxes Receivable-Delinquent 2023 103 Allowance for Uncollectible Interest and Penalties 2023 4a-4 1,050 1,050 103 Interest and Penalties Receivable on Taxes 2023 4a-4 4a-5 2,561,177 103 2023 Expenditures 4a-5 300,737 103 Due to Federal Government 2023 4a-5 294,840 103 Due to State Government 2023 2023 4a-5 1,965,600 103 Cash 103 Encumbrances Outstanding 2023 4a-6 2,030,200 2023 4a-6 2,030,200 103 Encumbrances 103 4a-6 2,029,715 Expenditures 2023 2023 4a-6 2,029,715 103 Vouchers Payable 103 2023 4a-7 2,117,627 Vouchers Payable 2023 4a-7 2,117,627 103 Cash 103 Due to Federal Government 2023 4a-7 300,737 294,840 103 2023 4a-7 Due to State Government 4a-7 595,577 103 Cash 202320,000 103 2023 4a-8 Estimated Other Financing Uses-Interfund Transfers Out 20,000 103 2023 4a-8 ... ... 103 Cash 2023 4a-9 3,500,000 Taxes Receivable-Delinquent 3,500,000 103 2023 4a-9 Taxes Receivable-Current 4a-9 35,000 103 2023 Allowance for Uncollectible Current Taxes 35,000 103 2023 4a-9 Allowance for Uncollectible Delinquent Taxes 3,465,000 103 2023 43-9 3,465,000 103 ... Revenues 2023 4a-9 Deferred Inflows of Resources 4a-10 1,580 103 2023 Interest and Penalties Receivable on Taxes 158 103 2023 4a-10 Allowance for Uncollectible Interest and Penalties 1,422 103 2023 4a-10 ... Revenues 11,250 103 2023 4a-10 Sales Taxes Receivable 11,250 103 2023 4a-10 Revenues 10,250 103 2023 4a-11 Estimated Revenues 500 103 2023 4a-11 Appropriations 9,750 103 2023 4a-11 Budgetary Fund Balance

Step by Step Solution

There are 3 Steps involved in it

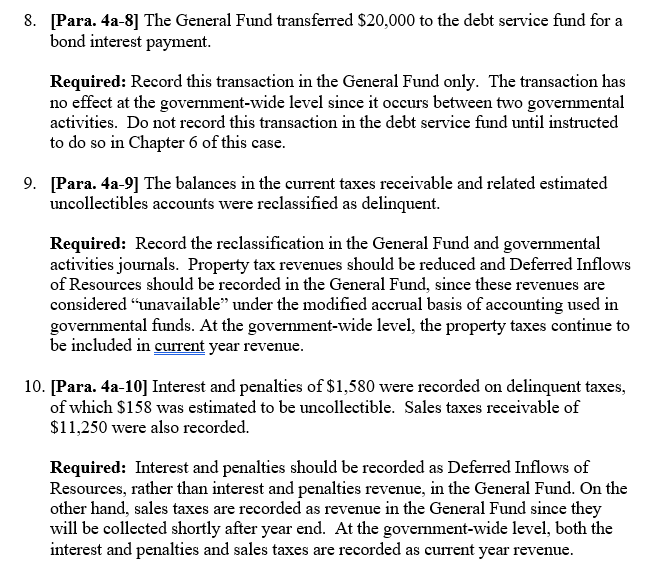

Get step-by-step solutions from verified subject matter experts