Question: Hello. I want to solve this. I need your help 7. From the Black-Scholes PDE with the stock price model in Eq.(2), the European call

Hello. I want to solve this. I need your help

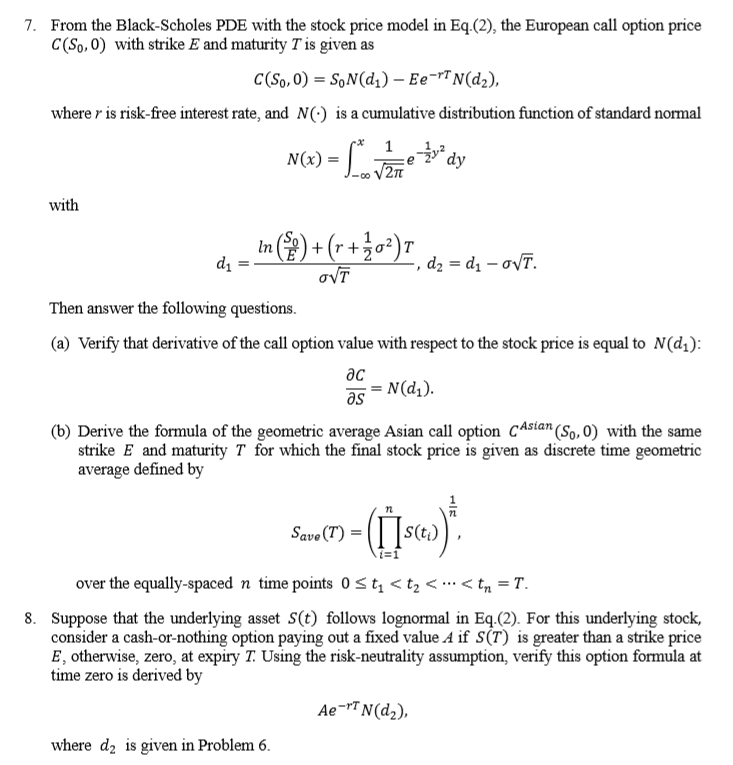

7. From the Black-Scholes PDE with the stock price model in Eq.(2), the European call option price C(So, 0) with strike E and maturity T is given as C(So, 0) = SON(dj) - Ee-YTN(d2), where / is risk-free interest rate, and N(.) is a cumulative distribution function of standard normal N ( x ) = Lovme zudy with d1 = - In ( $ ) + (r+202 )I dy = di- ONT. OVT Then answer the following questions. (a) Verify that derivative of the call option value with respect to the stock price is equal to N(dj): ac as = N(d1). (b) Derive the formula of the geometric average Asian call option CAsian (So, 0) with the same strike E and maturity T for which the final stock price is given as discrete time geometric average defined by Save (T) = over the equally-spaced n time points 0 S t,

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts