Question: Hello! I would appreciate your help. For income statement I have 4 columns. I am lost and I would need someone to show me exactly

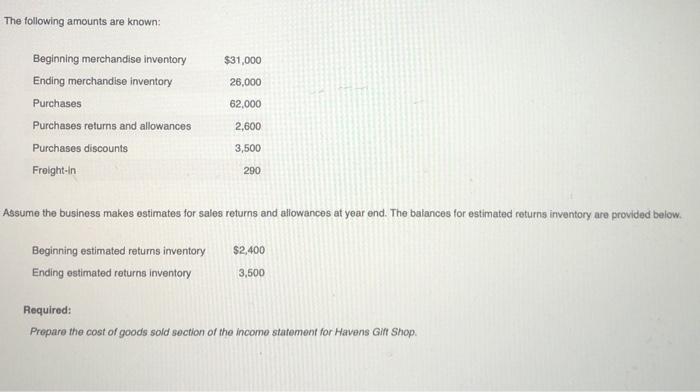

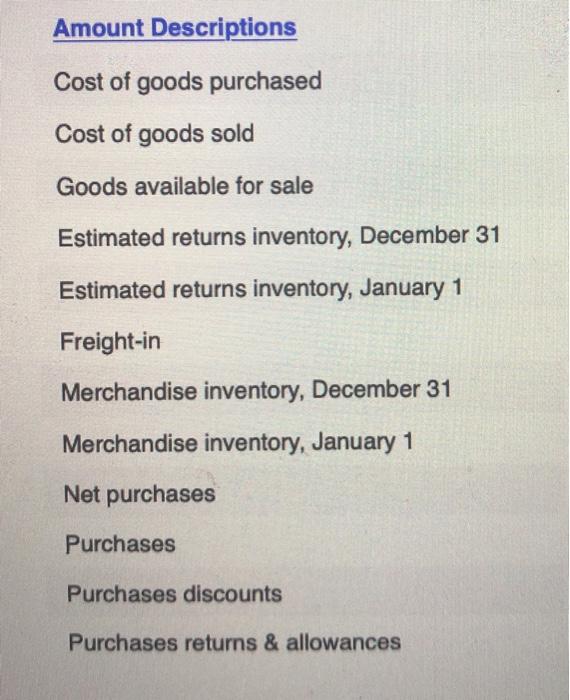

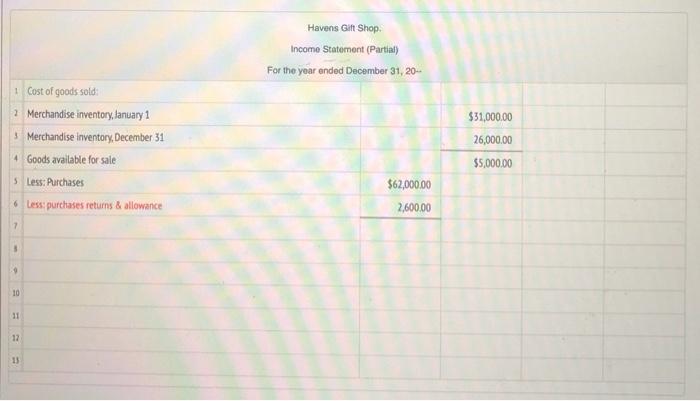

The following amounts are known: $31,000 26,000 62,000 Beginning merchandise inventory Ending merchandise inventory Purchases Purchases returns and allowances Purchases discounts Freight-in 2,600 3,500 290 Assume the business makes estimates for sales returns and allowances at year end. The balances for estimated returns inventory are provided below. $2,400 Beginning estimated returns inventory Ending ostimated returns inventory 3,500 Required: Prepare the cost of goods sold section of the income statement for Havens Gift Shop Amount Descriptions Cost of goods purchased Cost of goods sold Goods available for sale Estimated returns inventory, December 31 Estimated returns inventory, January 1 Freight-in Merchandise inventory, December 31 Merchandise inventory, January 1 Net purchases Purchases Purchases discounts Purchases returns & allowances Havens Gift Shop Income Statement (Partial) For the year ended December 31, 20 $31,000.00 1 Cost of goods sold 2 Merchandise inventory, Ianuary 1 Merchandise inventory, December 31 4 Goods available for sale 26,000.00 $5,000.00 5 Less: Purchases $62,000.00 2,600.00 Less: purchases returns & allowance 10 11 12 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts