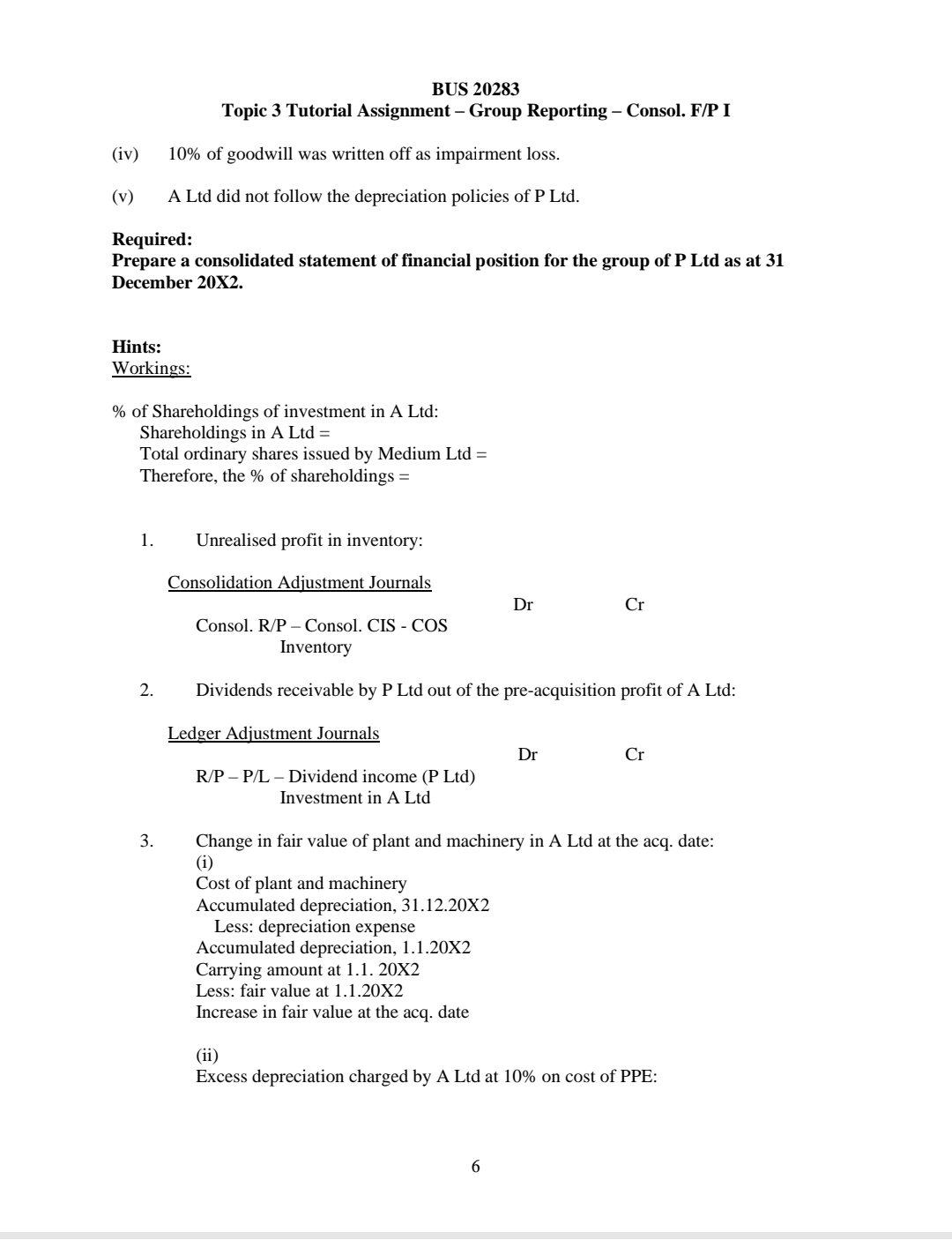

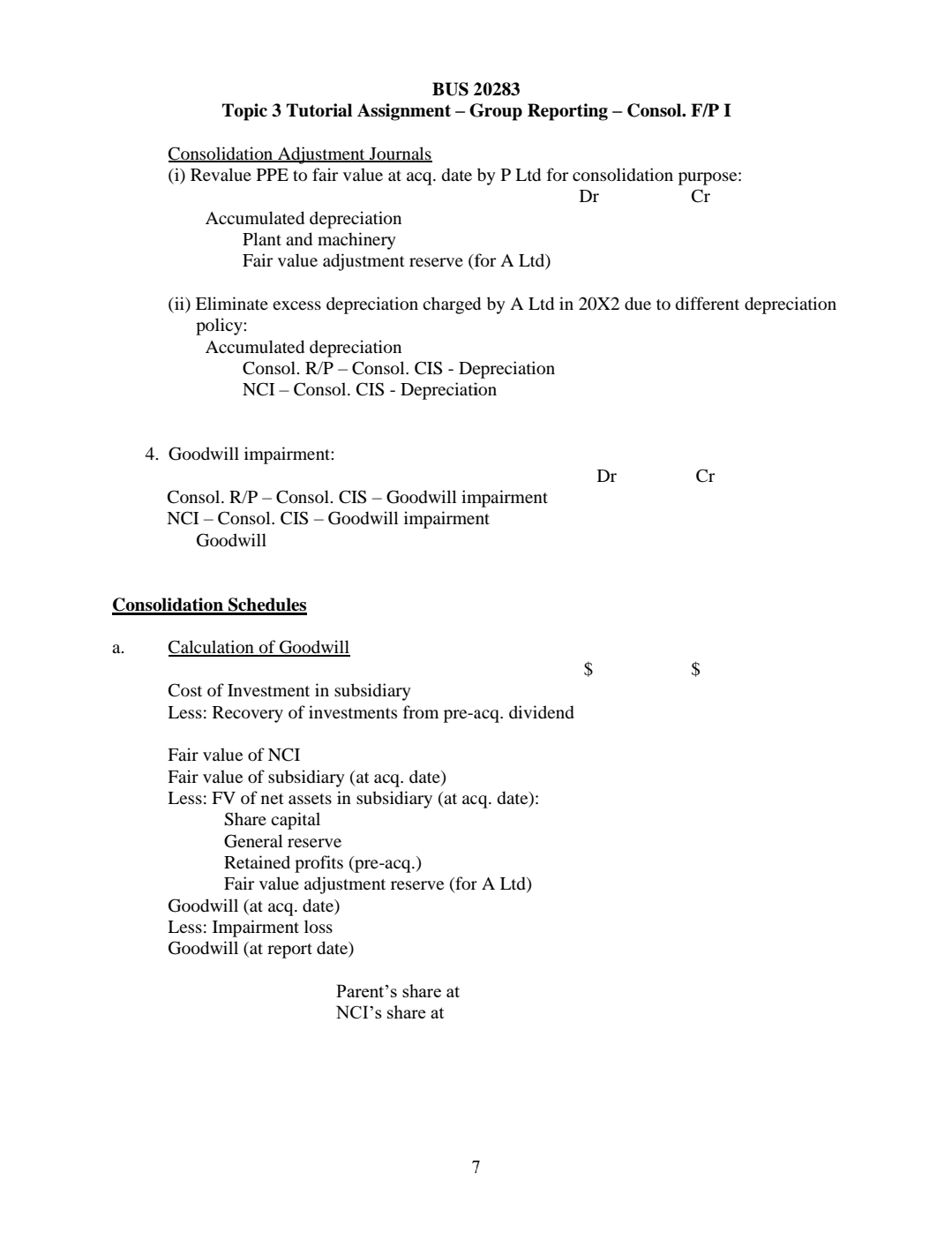

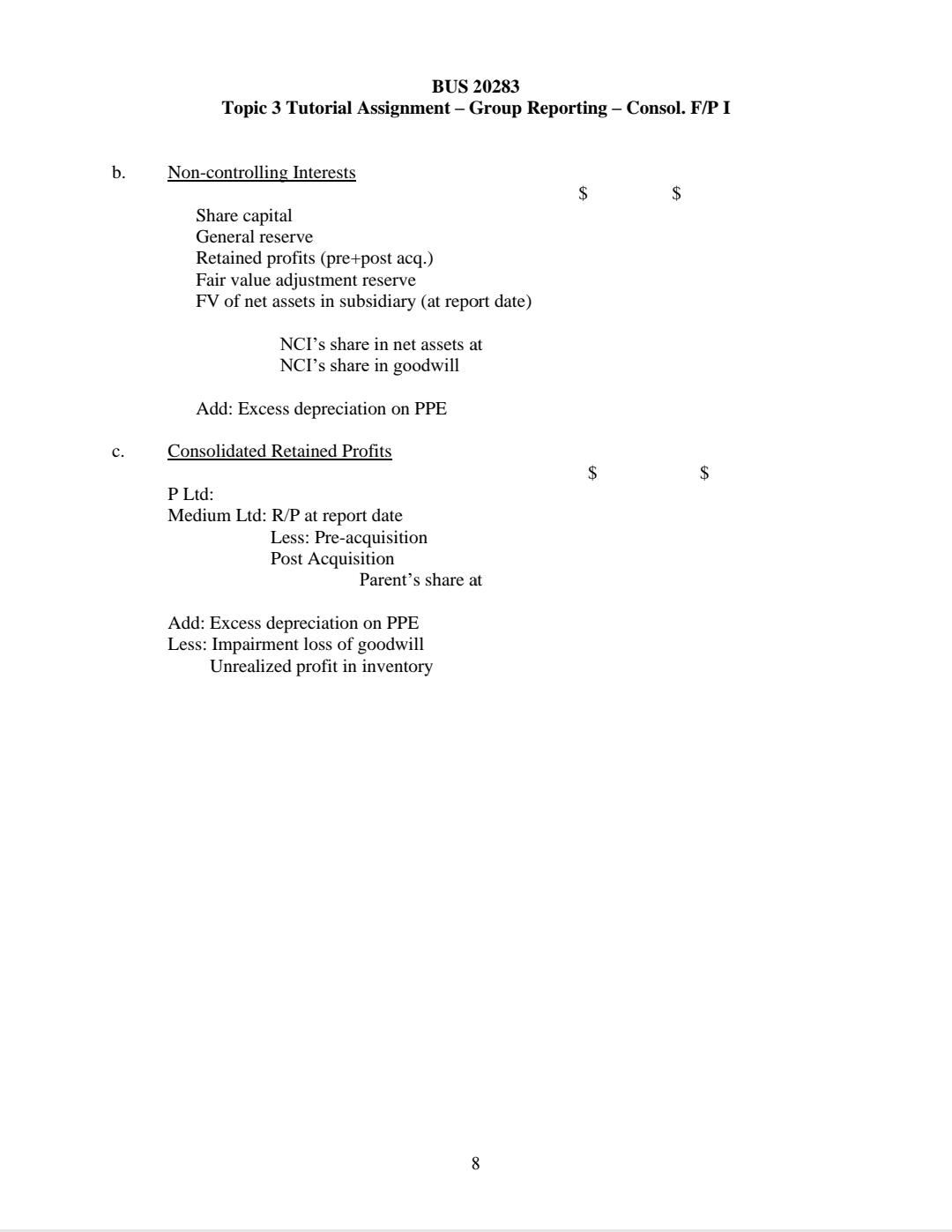

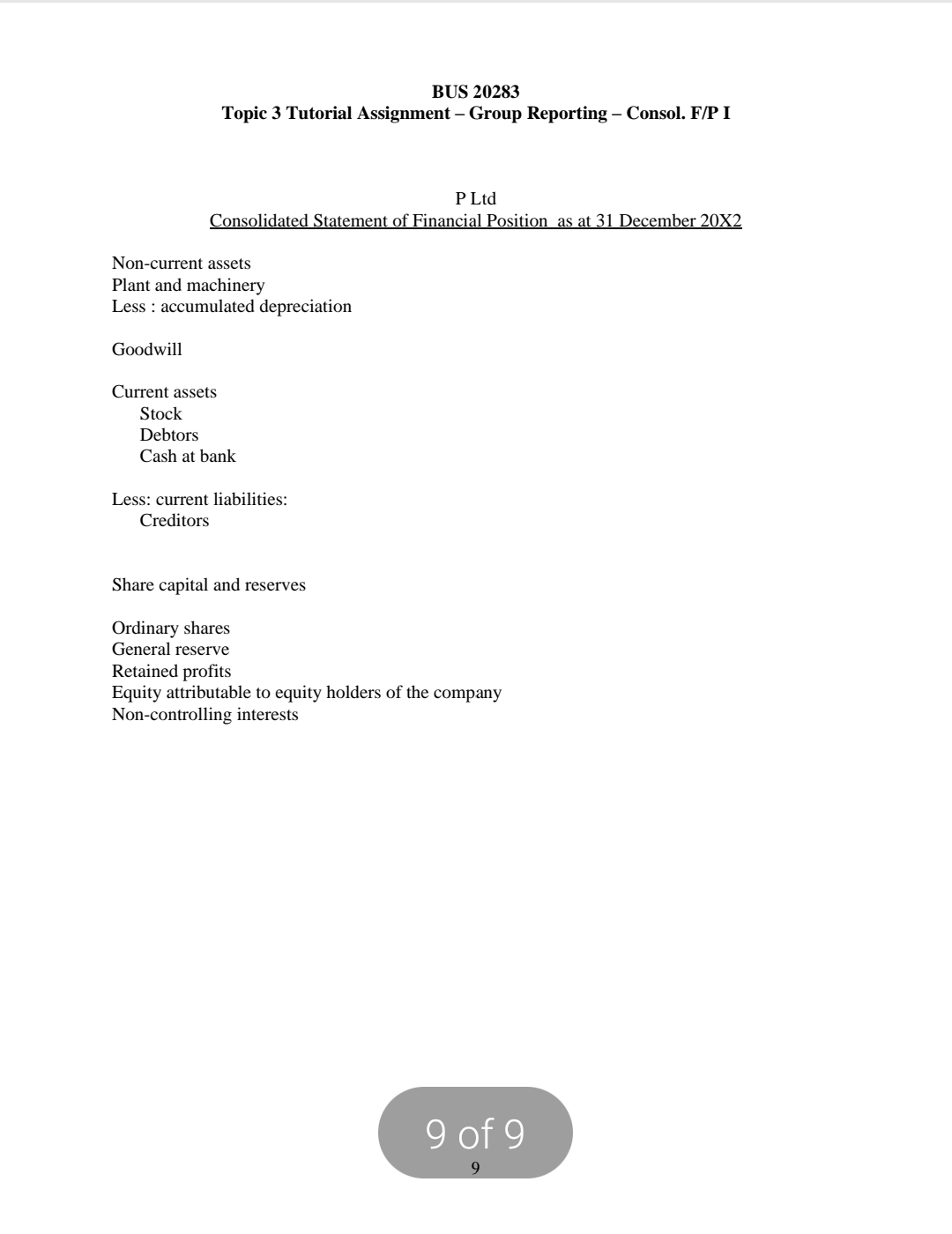

Question: Hello, i would like to ask for explanation on how to do this. Thanks BUS 20283 Topic 3 Tutorial Assignment Group Reporting Consol. FIP 1

Hello, i would like to ask for explanation on how to do this. Thanks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock