Question: Hello, I would like to get the solution and the answer of this question. I am in a hurry, so quick response will be appreciated.

Hello,

I would like to get the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you.

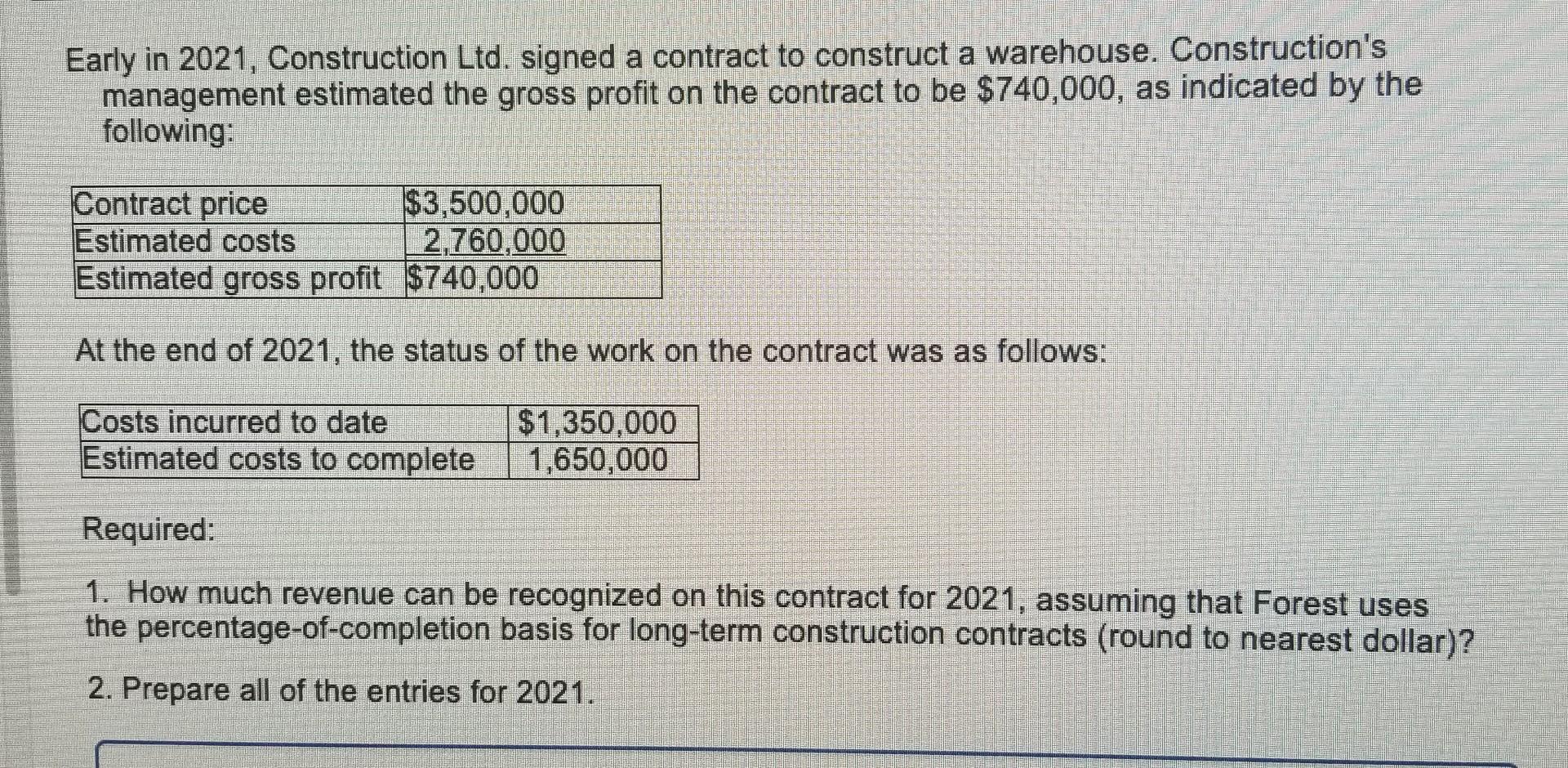

Early in 2021, Construction Ltd. signed a contract to construct a warehouse. Construction's management estimated the gross profit on the contract to be $740,000, as indicated by the following: Contract price $3,500,000 Estimated costs 2,760,000 Estimated gross profit $740,000 At the end of 2021, the status of the work on the contract was as follows: Costs incurred to date Estimated costs to complete $1,350,000 1,650,000 Required: 1. How much revenue can be recognized on this contract for 2021, assuming that Forest uses the percentage-of-completion basis for long-term construction contracts (round to nearest dollar)? 2. Prepare all of the entries for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts