Question: Hello, I would please like some help answering these questions. I have provided the first picture of the question but it does not allow me

Hello, I would please like some help answering these questions. I have provided the first picture of the question but it does not allow me to attach more pictures. I can send the rest of the questions/information

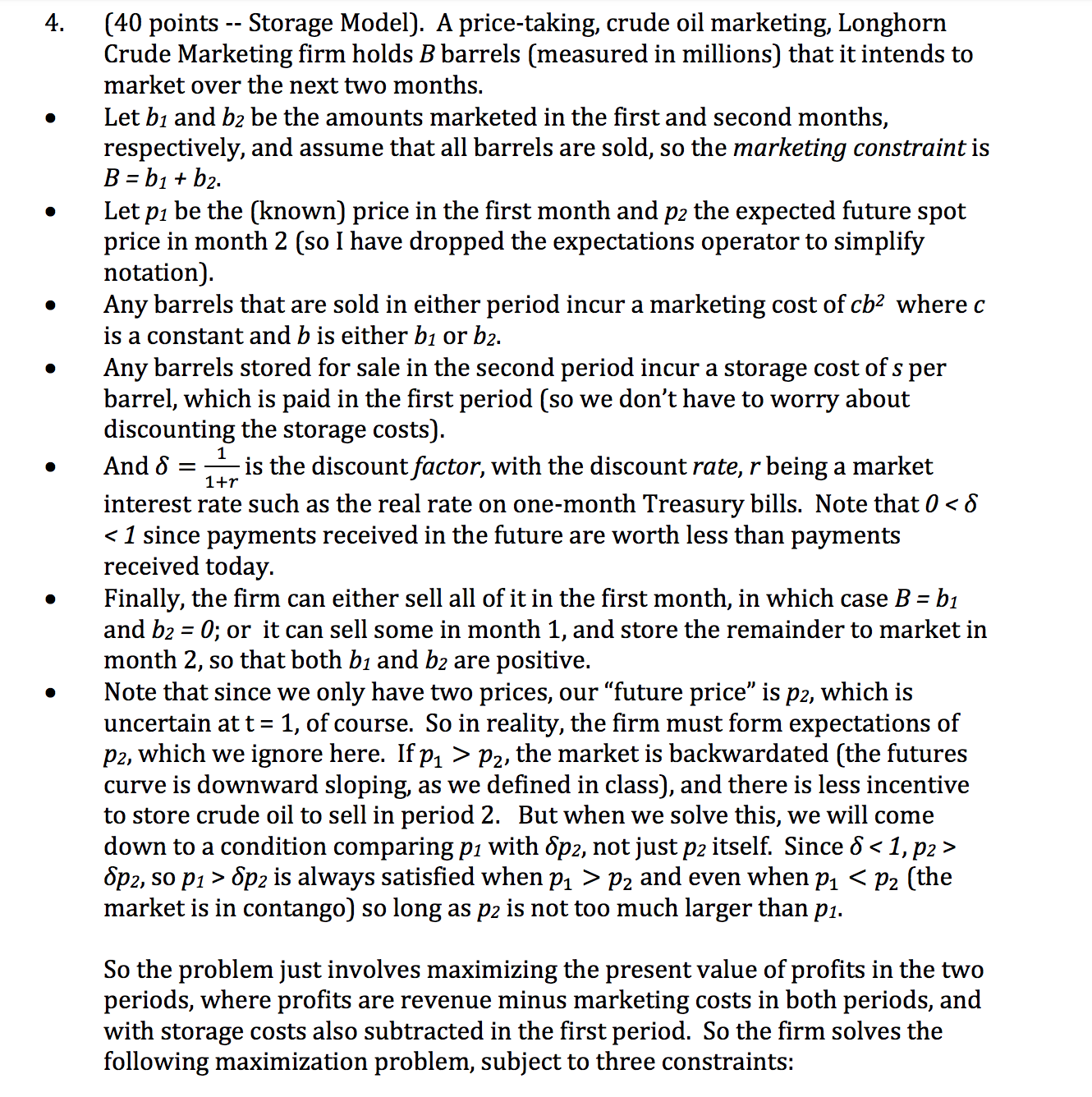

[40 points -- Storage Model]. A price-taking, crude oil marketing, Longhorn Crude Marketing firm holds B barrels [measured in millions] that it intends to market over the next two months. Let b1 and b2 be the amounts marketed in the rst and second months, respectively, and assume that all barrels are sold, so the marketing constraint is B = In + b2. Let p1 be the (known) price in the rst month and p2 the expected future spot price in month 2 [so I have dropped the expectations operator to simplify notation]. Any barrels that are sold in either period incur a marketing cost of cbz where c is a constant and b is either b1 or b2. Any barrels stored for sale in the second period incur a storage cost of 3 per barrel, which is paid in the rst period [so we don't have to worry about discounting the storage costs]. 1 . . . . . And 6 = E13 the dlscount factor, w1th the dlscount rate, r be1ng a market interest rate such as the real rate on one-month Treasury bills. Note that 0 p2, the market is backwardated [the futures curve is downward sloping, as we dened in class], and there is less incentive to store crude oil to sell in period 2. But when we solve this, we will come down to a condition comparing p1 with 6p2, not just p2 itself. Since 6 (Spa, so p1 > 6p; is always satised when p1 > p2 and even when p1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts