Question: hello, if u can answer these 3 short questions ty Exercise 9-4A (Algo) Inventory turnover LO 9-2 Selected financial information for Finch Company for Year

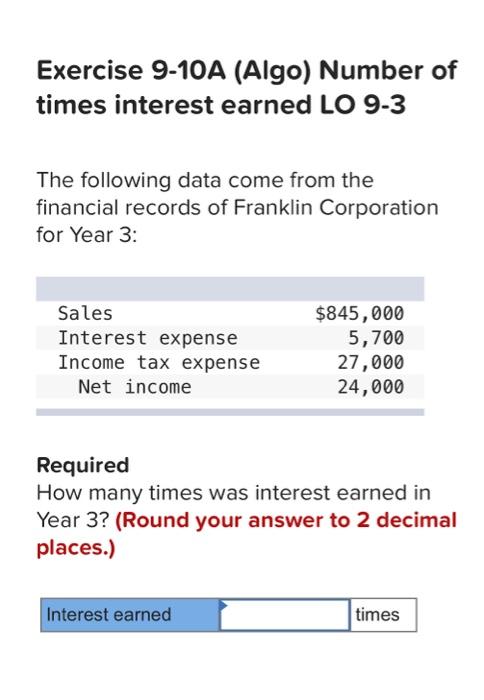

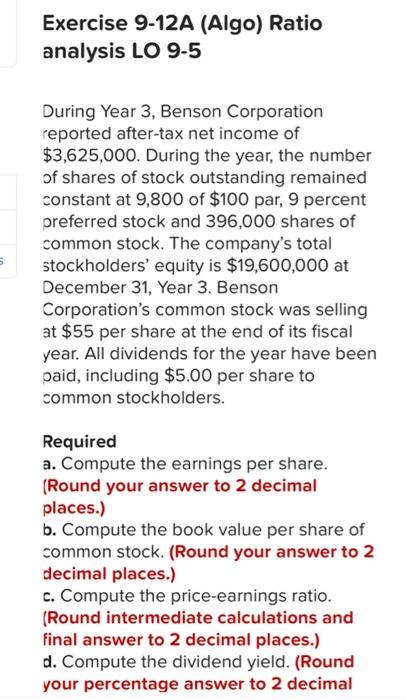

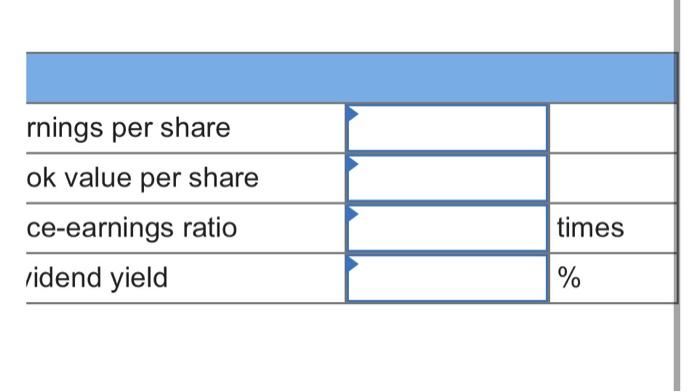

Exercise 9-4A (Algo) Inventory turnover LO 9-2 Selected financial information for Finch Company for Year 4 follows: $2,000,000 1,400,000 Sales Cost of goods sold Merchandise inventory Beginning of year End of year 155,000 199,000 Required Assuming that the merchandise inventory buildup was relatively constant, how many times did the merchandise inventory turn over during Year 4? (Round your answer to 2 decimal places.) Merchandise inventory turnover Exercise 9-10A (Algo) Number of times interest earned LO 9-3 The following data come from the financial records of Franklin Corporation for Year 3: Sales Interest expense Income tax expense Net income $845,000 5,700 27,000 24,000 Required How many times was interest earned in Year 3? (Round your answer to 2 decimal places.) Interest earned times Exercise 9-12A (Algo) Ratio analysis LO 9-5 5 During Year 3, Benson Corporation reported after-tax net income of $3,625,000. During the year, the number of shares of stock outstanding remained constant at 9,800 of $100 par, 9 percent preferred stock and 396,000 shares of common stock. The company's total stockholders' equity is $19,600,000 at December 31, Year 3. Benson Corporation's common stock was selling at $55 per share at the end of its fiscal year. All dividends for the year have been paid, including $5.00 per share to common stockholders. Required a. Compute the earnings per share. (Round your answer to 2 decimal places.) b. Compute the book value per share of common stock. (Round your answer to 2 decimal places.) c. Compute the price-earnings ratio. (Round intermediate calculations and final answer to 2 decimal places.) d. Compute the dividend yield. (Round your percentage answer to 2 decimal rnings per share ok value per share ce-earnings ratio vidend yield times %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts