Question: Hello, I'm currently having trouble solving this finance problem. I've attached the problem and any necessary info below. Thank you for your time and help.

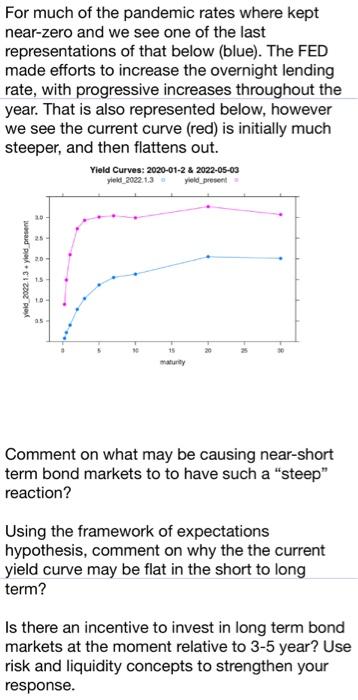

For much of the pandemic rates where kept near-zero and we see one of the last representations of that below (blue). The FED made efforts to increase the overnight lending rate, with progressive increases throughout the year. That is also represented below, however we see the current curve (red) is initially much steeper, and then flattens out. Yield Curves: 2020-01-2 & 2022-05-03 yield_2022.13 yold present yield 2002. 13. yield present Comment on what may be causing near-short term bond markets to to have such a "steep" reaction? Using the framework of expectations hypothesis, comment on why the the current yield curve may be flat in the short to long term? Is there an incentive to invest in long term bond markets at the moment relative to 3-5 year? Use risk and liquidity concepts to strengthen your response. For much of the pandemic rates where kept near-zero and we see one of the last representations of that below (blue). The FED made efforts to increase the overnight lending rate, with progressive increases throughout the year. That is also represented below, however we see the current curve (red) is initially much steeper, and then flattens out. Yield Curves: 2020-01-2 & 2022-05-03 yield_2022.13 yold present yield 2002. 13. yield present Comment on what may be causing near-short term bond markets to to have such a "steep" reaction? Using the framework of expectations hypothesis, comment on why the the current yield curve may be flat in the short to long term? Is there an incentive to invest in long term bond markets at the moment relative to 3-5 year? Use risk and liquidity concepts to strengthen your response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts