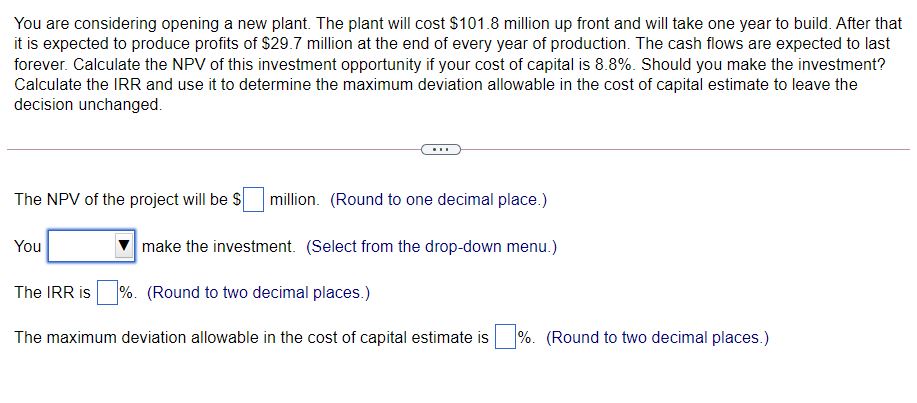

Question: Hello! I'm having some trouble with this practice question. Any help is greatly appreciated. (Drop down is Should or Should not) You are considenng opening

Hello! I'm having some trouble with this practice question. Any help is greatly appreciated. (Drop down is "Should" or "Should not")

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts