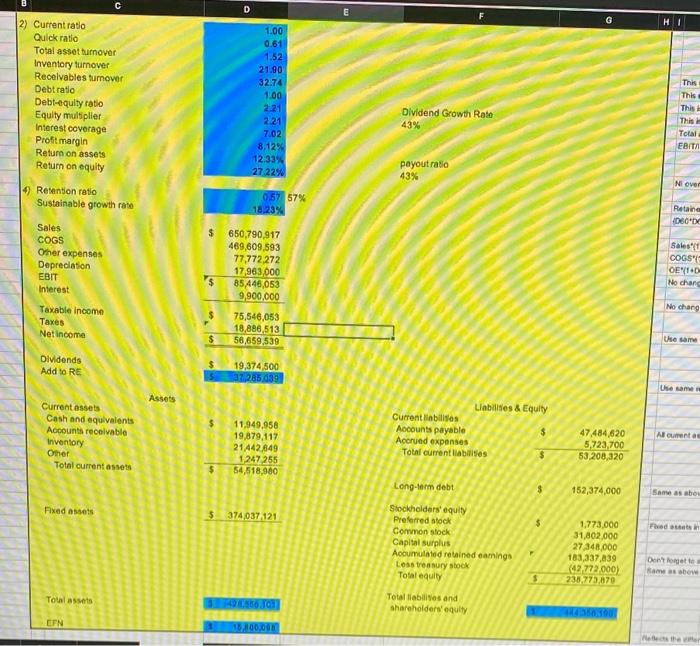

Question: hello, im having trouble with this excel sheet and would love some help on if im calculating them right. i think my retention ratio and

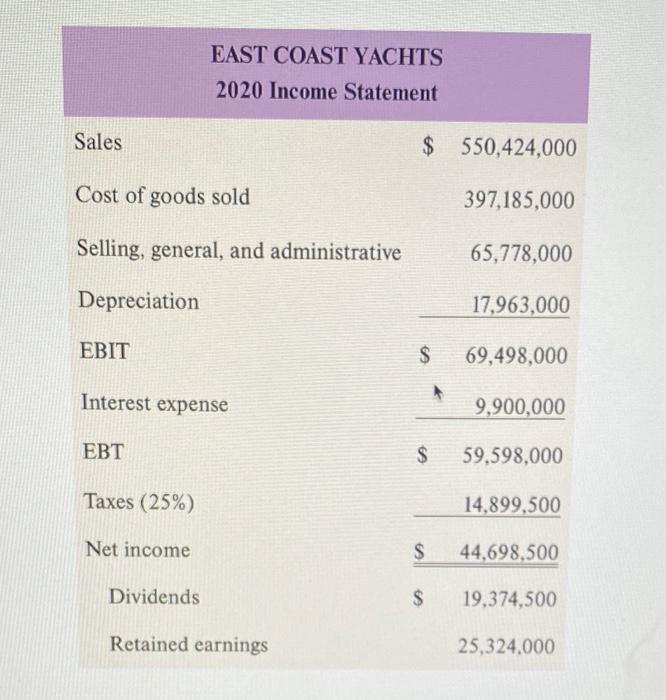

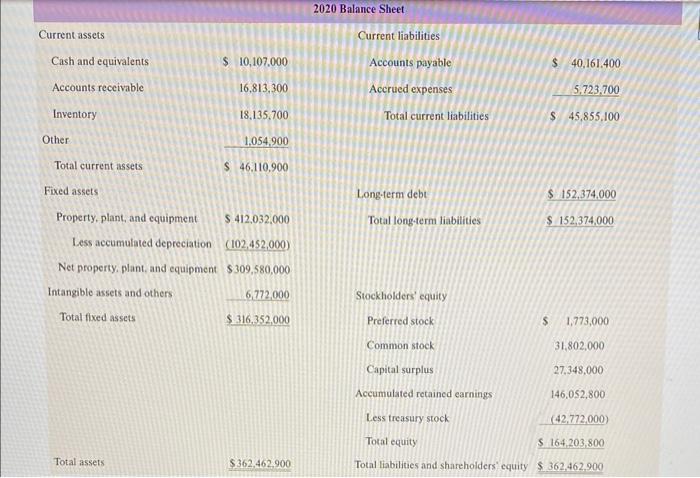

4. Calculate the sustainable growth rate for East Coast Yachts. Calculate external funds needed (EFN) and prepare pro forma income statements and balance sheets assuming growth at precisely this rate. Recalculate the ratios in the previous question. What do you observe? EAST COAST YACHTS 2020 Income Statement \begin{tabular}{lcc} Sales & $550,424,000 \\ Cost of goods sold & 397,185,000 \\ Selling, general, and administrative & 65,778,000 \\ Depreciation & 17,963,000 \\ \hline EBIT & $69,498,000 \\ Interest expense & $9,900,000 \\ \hline EBT & $59,598,000 \\ \hline Taxes (25\%) & 14,899,500 \\ \hline Net income & $44,698,500 \\ \hline Dividends & $19,374,500 \\ Retained earnings & 25,324,000 \end{tabular} 2020 Balance Sheet. Current assets Current liabilities Cash and equivalents $10,107.000 Accounts payable $40,161.400 Accounts receivable Fixed assets Long.term debt Total longterm liabilities $152,374,000 152,374,000 \begin{tabular}{r|l|} Property,plant,andequipmentLessaccumulateddepreciation$412,032,000(102,452,000) \end{tabular} Net property, plant, and equipment $309,580,000 Intangible assets and others 6,772,000 Stockholders' equity \begin{tabular}{l|l} Total fixed assets & $316,352,000 \\ Preferred stock \\ Common stock \\ Capital surplus \end{tabular} Accumulated retained earnings 146,052,800 Less treasury stock (42,772,000) Total equity S 164,203,800 Total assets $362,462,900 Total liabilities and shareholders' equity $362,462,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts