Question: Hello, I'm looking for help on the following question in the 1st picture below. In the 2nd picture is my answer to the question that

Hello,

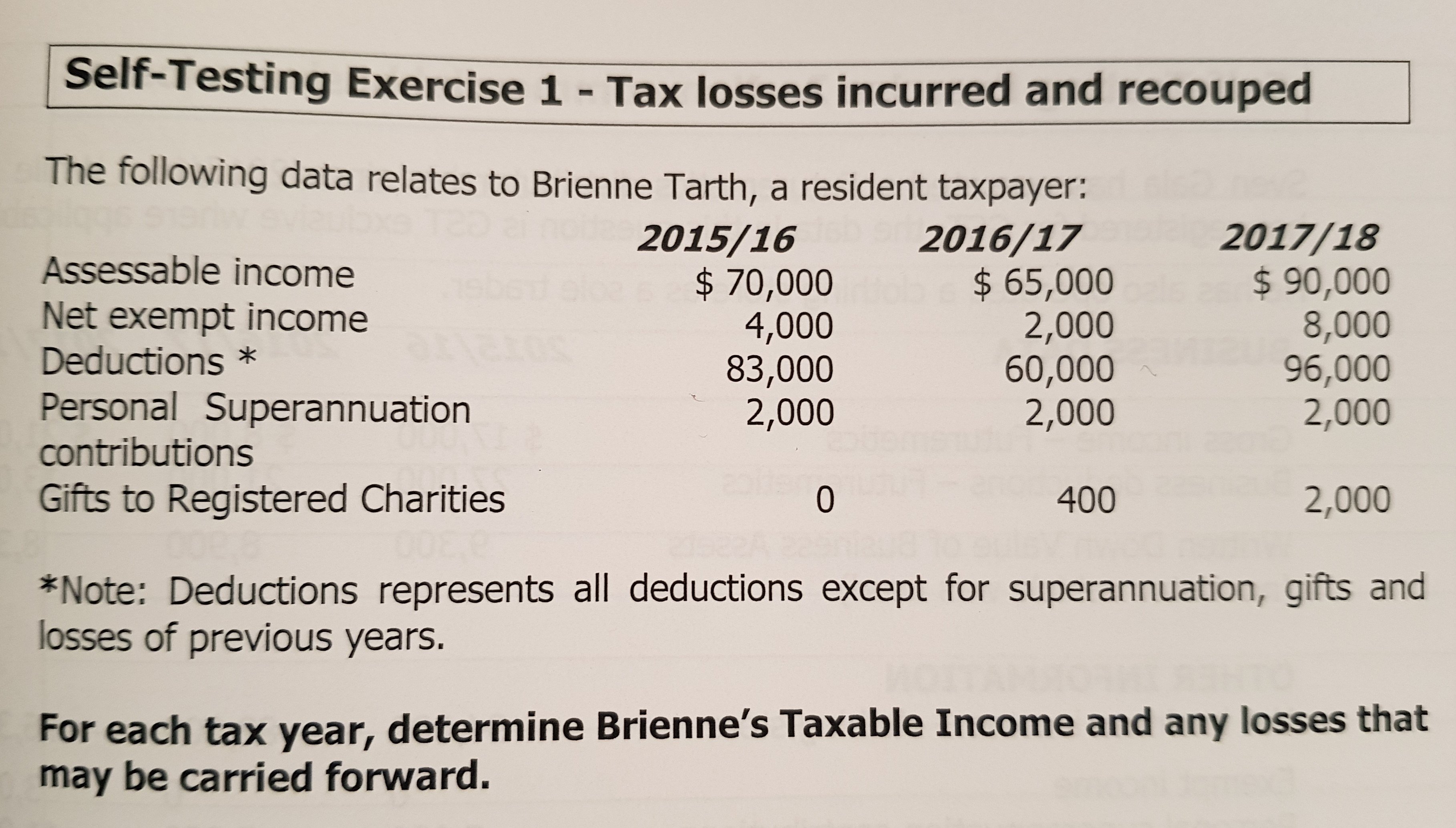

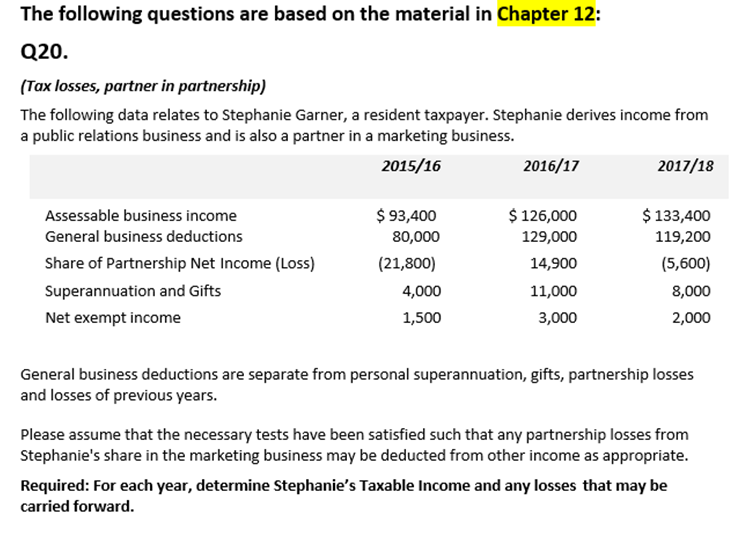

I'm looking for help on the following question in the 1st picture below.

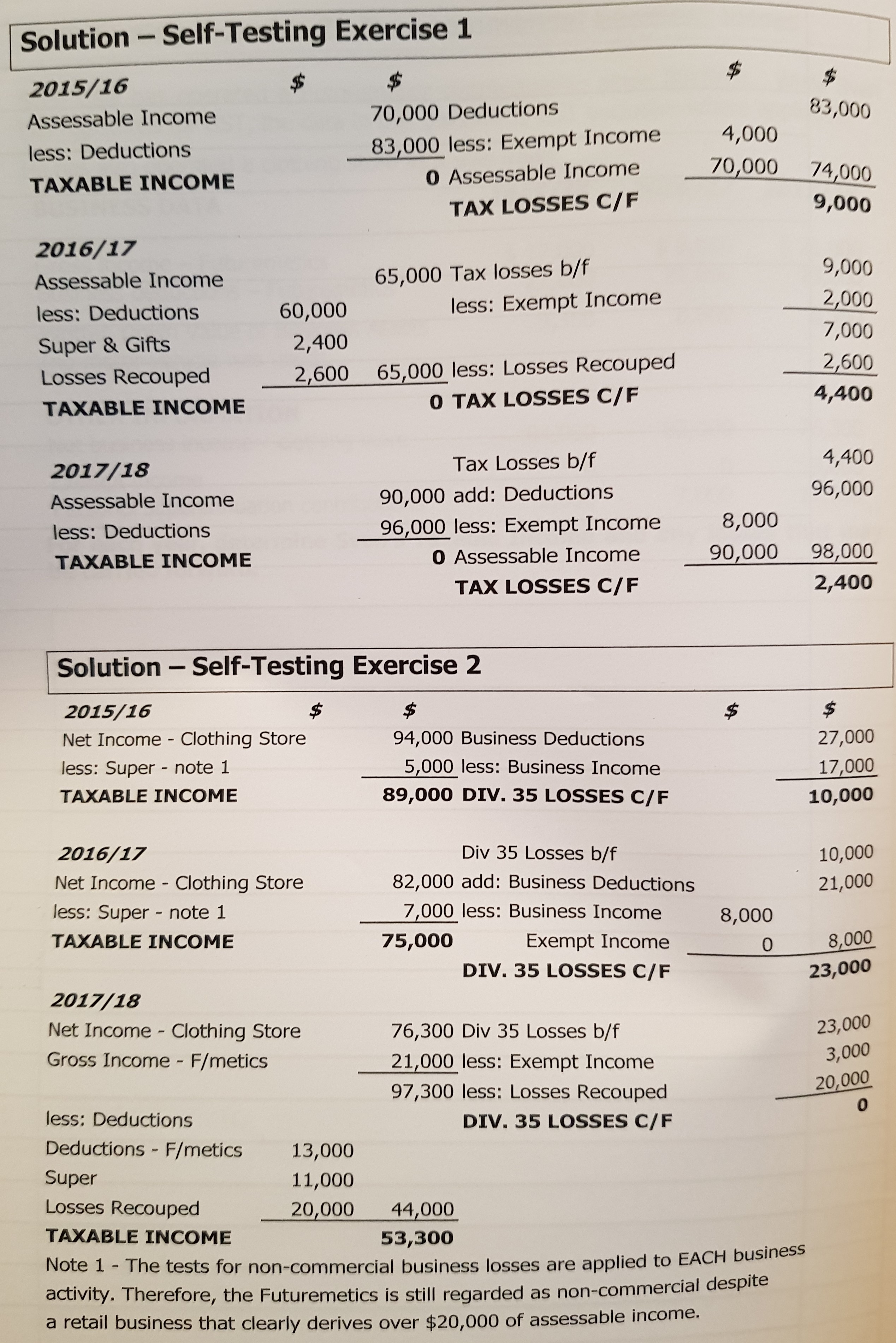

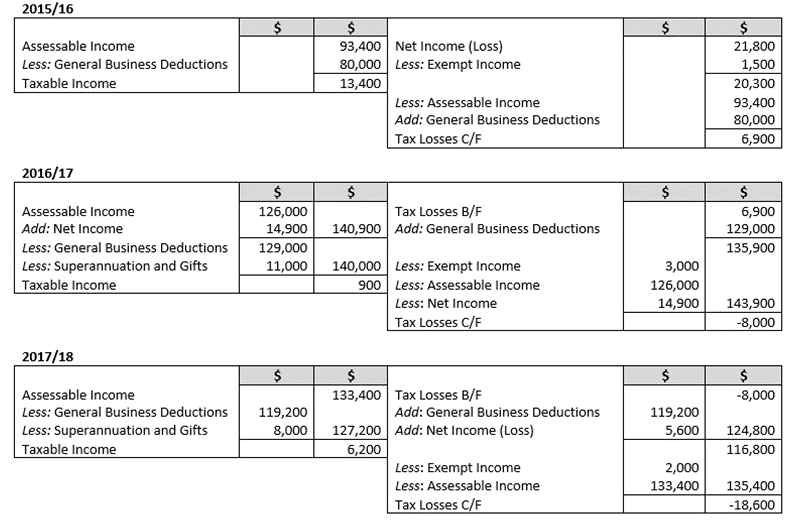

In the 2nd picture is my answer to the question that I originally submitted on my assignment but my attempt at the question was incorrect.

In the feedback on my assignment my trainer told me to review the Tax Losses C/F for 2016/17 and Tax Losses C/F for 2017/18.

I emailed and asked where I was going wrong and was asked to review Self Test Exercise 1 and follow the approach for 2016/17 for the Tax Losses C/F column used in the exercise to do the Tax Losses C/F I need to review in my assignment.

I included the Self Test Exercise 1 in pictures 3 and 4.

I'm still not quite understanding what I am doing incorrectly and how to fix it, could someone please help me correct where I am going wrong?

If you need anything more just ask.

Thank You

Self-Testing Exercise 1 - Tax losses incurred and recouped The following data relates to Brienne Tarth, a resident taxpayer: 2015/16 2016/17 2017/18 Assessable income $ 70,000 $ 65,000 $ 90,000 Net exempt income 4,000 2,000 8,000 Deductions * 83,000 60,000 96,000 Personal Superannuateon 2,000 2,000 2,000 contributions Gifts to Registered Charities O 400 2,000 *Note: Deductions represents all deductions except for superannuateon, gifts and losses of previous years. For each tax year, determine Brienne's Taxable Income and any losses that may be carried forward.Solution - Self-Testing Exercise 1 2015/16 $5 $ $ Assessable Income 70,000 Deductions 83,000 4,000 less: Deductions 83,000 less: Exempt Income TAXABLE INCOME 0 Assessable Income 70,000 74,000 TAX LOSSES C/F 9,000 2016/17 Assessable Income 65,000 Tax losses b/f 9,000 less: Deductions 60,000 less: Exempt Income 2,000 Super & Gifts 2,400 7,000 Losses Recouped 2,600 65,000 less: Losses Recouped 2,600 TAXABLE INCOME O TAX LOSSES C/F 4,400 2017/18 Tax Losses b/f 4,400 Assessable Income 90,000 add: Deductions 96,000 less: Deductions 96,000 less: Exempt Income 8,000 TAXABLE INCOME 0 Assessable Income 90,000 98,000 TAX LOSSES C/F 2,400 Solution - Self-Testing Exercise 2 2015/16 $ $ $ Net Income - Clothing Store 94,000 Business Deductions 27,000 less: Super - note 1 5,000 less: Business Income 17,000 TAXABLE INCOME 89,000 DIV. 35 LOSSES C/F 10,000 2016/17 Div 35 Losses b/f 10,000 Net Income - Clothing Store 82,000 add: Business Deductions 21,000 less: Super - note 1 7,000 less: Business Income 8,000 TAXABLE INCOME 75,000 Exempt Income 0 8,000 DIV. 35 LOSSES C/F 23,000 2017/18 Net Income - Clothing Store 76,300 Div 35 Losses b/f 23,000 Gross Income - F/metics 21,000 less: Exempt Income 3,000 97,300 less: Losses Recouped 20,000 less: Deductions 0 DIV. 35 LOSSES C/F Deductions - F/metics 13,000 Super 11,000 Losses Recouped 20,000 44,000 TAXABLE INCOME 53,300 Note 1 - The tests for non-commercial business losses are applied to EACH business activity. Therefore, the Futuremetics is still regarded as non-commercial despite a retail business that clearly derives over $20,000 of assessable income.2015/16 S S S S Assessable Income 93,400 Net Income (Loss) 21,800 Less: General Business Deductions 80,000 Less: Exempt Income 1,500 Taxable Income 13,400 20,300 Less: Assessable Income 93,400 Add: General Business Deductions 80,000 Tax Losses C/F 6,900 2016/17 $ $ Assessable Income 126,000 Tax Losses B/F 6,900 Add: Net Income 14,900 140,900 Add: General Business Deductions 129,000 Less: General Business Deductions 129,000 135,900 Less: Superannuateon and Gifts 11,000 140,000 Less: Exempt Income 3,000 Taxable Income 900 Less: Assessable Income 126,000 Less: Net Income 14,900 143,900 Tax Losses C/F -8,000 2017/18 $ S Assessable Income 133,400 Tax Losses B/F -8,000 Less: General Business Deductions 119,200 Add: General Business Deductions 119,200 Less: Superannuateon and Gifts 8,000 127,200 Add: Net Income (Loss) 5,600 124,800 Taxable Income 6,200 116,800 Less: Exempt Income 2,000 Less: Assessable Income 133,400 135,400 Tax Losses C/F -18,600The following questions are based on the material in Chapter 12: (120. [Tax losses, permer in partnership} The following data relates to Stephanie Garner, a resident taxpayer. Stephanie derives income from a public relations business and is also a partner in a marketing business. 2015(16 2015!\" 2M If\" Assessable business income 5'. 93,400 5 125mm 5 133,400 General business deductions 30,000 125mm 119,200 Share of Partnership Net Income [Loss] [21,800] 14,500 {5,600} Superannuation and Gifts 4,0130 11,030 8,900 Net exempt income 1,500 BAMBI 2,000 General business deductions are separate from personal superannuation, gifts, partnership losses and losses of previous years. Please assume that the necessary tests have been satised such that any partnership losses from Stephanie's share in the marketing business mail:r be deducted from other inoome as appropriate. Required: For each year, detennine Stephanie's Taxable Income and am losses that may be carried forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts