Question: Hello :) I'm working on this question now, and so far I couldn't get my valid opinion. Can you please give me some ideas or

Hello :)

I'm working on this question now, and so far I couldn't get my valid opinion.

Can you please give me some ideas or guidelines for it?

Thank you for your help!

- Critically evaluate the ethical consideration related with the line of business of Kimco. How can those considerations affect the financial decisions making of the company?

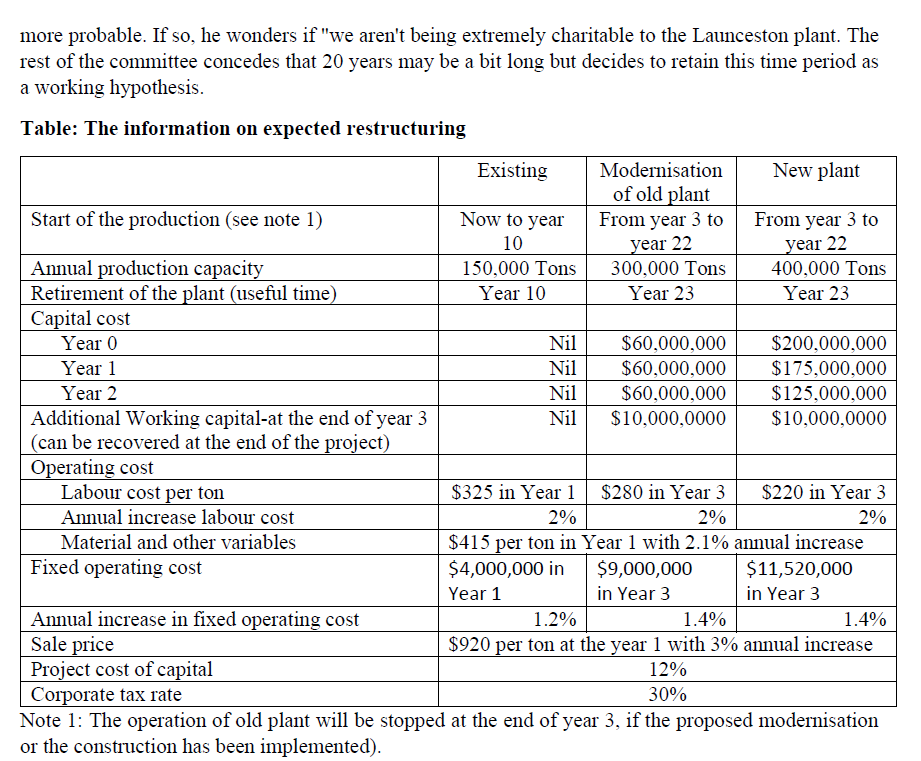

Kimco Ltd; Modernisation or Relocation J ereld Kim founded Kimco LTD, a rm that is currently one of the largest producers of paper and pulp with annual sales of AUD 200 Million. Kim located his rst plant in a rural town in Tasmania. partly to create jobs for the many unemployed workers in the area. The rm has always been active in the affairs of the community and donates generously to local civic and charitable organizations. Kimco also takes special pride in promoting a family atmosphere among its employees. Personnel experts believe that these policies are largely responsible for the enviable productivity record of Kimco's workers. During the last 50 years Kimco had an impressive record of growth in earnings and sales. But as the company grew, the top-level management of the company was reluctant to decentralize and delegate authority to the lower business units. Randy Cole who was appointed as the CEO of the company commenced to decentralise the company operation. One major change involved the company's capital budgeting procedtu'es. Kimco didn't have a formal mechanism for capital projects. Randy appointed a six-person capital expenditures committee (CEC) that would decide on projects costing more than $200,000. Smaller expenditures would be decided at the regional and local levels. At present (2020) the CEC is considering two alternatives for achieving a much-needed increase in the fum's production capacity. One option involves modemising the existing plant in Launceston. Tasmania. If the plant is not renovated soon. production would drop to 150,000 tons per year for the next ten years. The other alternative is to build a new mill at Devonport, Tasmania. For this purpose. Kimco expects to use a land slot which purchased 10 years ago for $30 million. Currently this land has been used as a storage facility which was constructed ve years ago for cost of $5.0 million dollar. The current market value (Year 0 (2020)) of the land is $40 million. The land value (mice) of this area record 2.5% annual growth. ENIPLOYEE CONCERNS Some CEC members are worried about the impact on employee morale if the factory is relocated. "Apparently," says Smith, "there is considerable opposition to closing down the old factory, judging 'om the inaccurate gtu'es we received." It is noted, however, that the move will "most certainly" not cost any-one a job, but will, in fact, create new positions, including some relatively high-paying managerial ones. Nonetheless, it was obvious that the proposed relocation would impose costs on the employees. Many would either have to relocate to Devonport or face a ZOO-kilometre round trip daily commute. Smith wondered if it "was fair and appropriate" to ask the employees to bear such costs, especially considering the remarkable loyalty the Launceston employees had shown to the company. She notes that a large proportion of the employees have worked for Kimco for more than 10 years. "One thing is clear," remarks a subdued Randy. \"If we choose to relocate the plant, it is important that it does not appear to be some type of ivory-tower decision that would be inconsistent with the management philosophy we promoted all these years. Smith, I am sensitive to the issues you bring up. Employee morale and employee loyalty are very important considerations. Maybe we could work something out-you know, like some type of moving allowance or separation package for those who do not wish to relocate.\" Randy also reminded the committee that Devonport was the closest suitable site to Launceston should the company move. Old plant in Launceston, With the reduced capacity (150,000 tons per year) the old machine can be used for another 10 years. There will be no salvage value of the old plan in 10 years. If the company decide to cease the operation of the old plant in three years, the salvage value of the old will be $25 Million at the end of year 3. The old plant value has been already fully depreciated for the taxation purposes. Alternative 1: Modernising the existing plant. At the beginning of the next three years (Year 0 to Year 2), the company needs to spend $60 million annually as the cost of modernisation of the existing plant. The modernisation, which is expected to complete at the end of year 3, will extend the life of the old plant for another 20 years (year 3 to 22). Any expenses incurred for the modernisation can be written off during the next 20-year period for the taxation purpose. The salvage value of the modernised plant at the end of year 22 (after using 20 years of operation) will be $5 Million. During the period of modernisation (from year 1 to year 3), the production level will be limited to 150,000 ton per year. It is expected the modernisation will increase the production capacity up to 300,000 ton per year 'om the end of year 3 to year 22 (for the next 20- year period). Modernisation will help to improve the labour productivity and thereby lower the labour cost. The annual xed operating cost will be $9.0 million at the end of year three. The xed operating cost will be increased by 1.4% per year. The table given below has been provided more information on all alternatives. The gures on modernising the existing facility at Launceston are more controversial, however. Information on this project was originally sent by the management of the Launceston plant and is also presented in the table. The controversy centres on the estimated tonnage per year of the plant and its per unit variable cost. Smith politely pointed out that it would be "extremely difficult for an old facility like the one at Launceston to achieve output of 300,000 tons per year. As an alternative to this concern, the new CEO, Randy emphasis the need of relocating the plant into a new location Alternative 2: New plant in Devonport. Miskin Smith, a member of the CEC, was responsible for estimating the cost and yearly cash ows 'om building the new paper mill at Devonport. According to Miskin, new plant aims to get the maximum possible benets from emerging technologies. If the company proceeds with the new plant, the production facility in Launceston will cease to operate. The remaining of the plant will be sold at the end of year 3 when the new plant is ready for the manufacturing. Any employees, who are not ready to relocate to the new plant will be compensated. It needs $30 Million one off payment at the year 3. It will take Year 0 to Year 2 to construct the new plant. The scheduled expenses during these years have been given in the table below. The construction cost of the new plant can be written off for the taxation during its operating life of 20 years starting with the Year 3 (Y ear 3 to Year 22). The salvage value of the new plant at the end of its useful life will be $75 million. The land can be sold in 22 years on the forecasted market value (see paragraph 3). MORE CONTROVERSY Both projects are assumed to last 20 years. This is a relatively long-time ho1izon for a capital budgeting project, but the company feels a paper mill is unlikely to become technologically obsolete since paper production techniques have changed very little in the last century. At least one CEC member, however, thinks that a 20-year period is too long for the "modernise-the-old" option. Past experience, he argues, indicates that revitalizing an existing facility will rarely extend its life that much, and 10 years seems more probable. If so, he wonders if "we aren't being extremely charitable to the Launceston plant. The rest of the committee concedes that 20 years may be a bit long but decides to retain this time period as a working hypothesis. Table: The information on expected restructuring Existing Modernisation New plant of old plant Start of the production (see note 1) Now to year From year 3 to From year 3 to 10 year 22 year 22 Annual production capacity 150,000 Tons 300,000 Tons 400,000 Tons Retirement of the plant (useful time) Year 10 Year 23 Year 23 Capital cost Year 0 Nil $60,000,000 $200,000,000 Year 1 Nil $60,000,000 $175,000,000 Year 2 Nil $60,000,000 $125,000,000 Additional Working capital-at the end of year 3 Nil $10,000,0000 $10,000,0000 (can be recovered at the end of the project) Operating cost Labour cost per ton $325 in Year 1 $280 in Year 3 $220 in Year 3 Annual increase labour cost 2% 2% 2% Material and other variables $415 per ton in Year 1 with 2.1% annual increase Fixed operating cost $4,000,000 in $9,000,000 $11,520,000 Year 1 in Year 3 in Year 3 Annual increase in fixed operating cost 1.2% 1.4% 1.4% Sale price $920 per ton at the year 1 with 3% annual increase Project cost of capital 12% Corporate tax rate 30% Note 1: The operation of old plant will be stopped at the end of year 3, if the proposed modernisation or the construction has been implemented)