Question: hello, ive been stuck on this question. cant seem to come close. thanks for the help Calculate the Target Corporation's Cash Conversion Cycle for fiscal

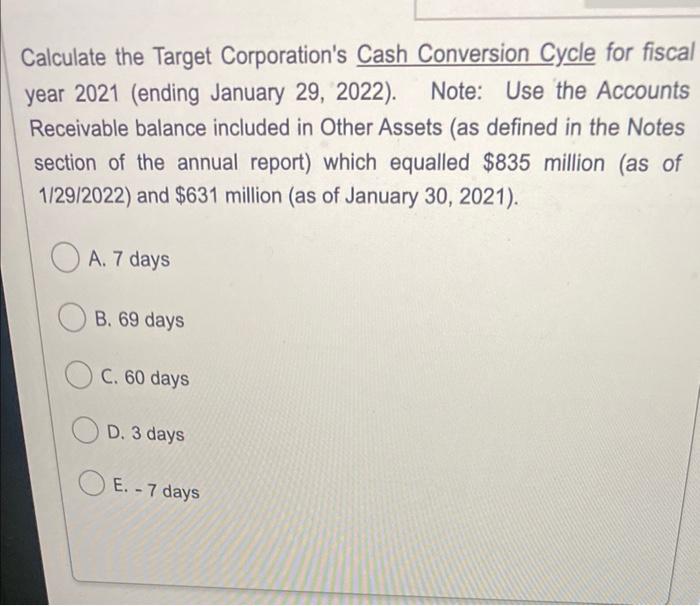

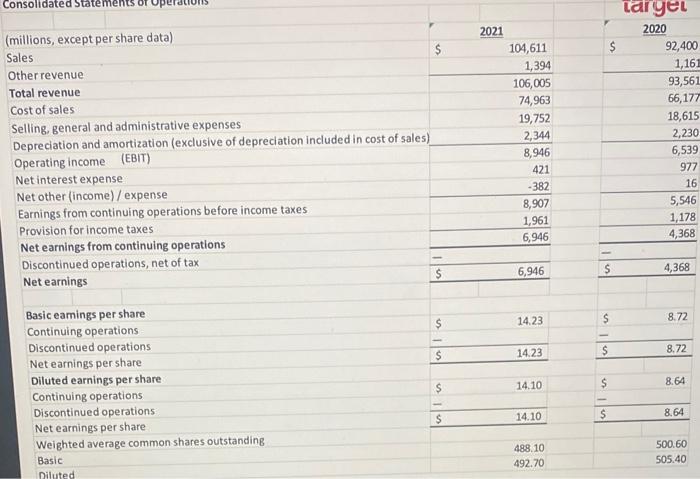

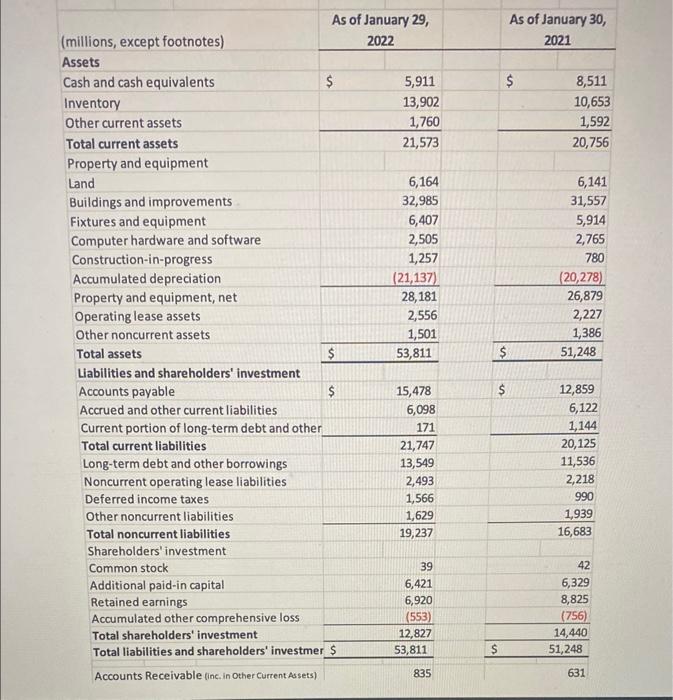

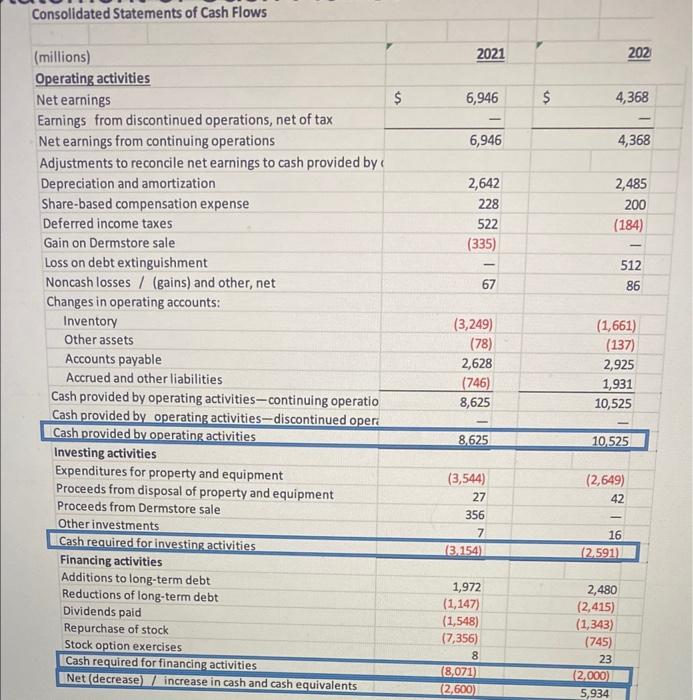

Calculate the Target Corporation's Cash Conversion Cycle for fiscal year 2021 (ending January 29, 2022). Note: Use the Accounts Receivable balance included in Other Assets (as defined in the Notes section of the annual report) which equalled $835 million (as of 1/29/2022 ) and $631 million (as of January 30, 2021). A. 7 days B. 69 days C. 60 days D. 3 days E. -7 days Consolidated Statements of Cash Flows (millions) 2021 202 Operating activities Net earnings Earnings from discontinued operations, net of tax Net earnings from continuing operations 6,946 4,368 Adjustments to reconcile net earnings to cash provided by c Depreciation and amortization Share-based compensation expense Deferred income taxes Gain on Dermstore sale Loss on debt extinguishment Noncash losses / (gains) and other, net $6,946 $,368 - 4,368 Changes in operating accounts: Inventory Other assets Accounts payable Accrued and other liabilities Cash provided by operating activities - continuing operatio Cash provided by operating activities-discontinued operi Cash provided by operating activities Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment 2,642 Proceeds from Dermstore sale Other investments Cash required for investing activities Financing activities Additions to long-term debt Reductions of long-term debt Dividends paid Repurchase of stock Stock option exercises Cash required for financing activities Net (decrease) / increase in cash and cash equivalents 8,625 10,525 512 67 86 (184) (335) (3,249) (1,661) (78) (137) 2,628 2,925 (746) 8,625 1,931 1,93110,52510,525 (3,544) (2,649) 27 42 356 7 (3.154) 16 (2.591) 1,972 2,480 (1,147) (2,415) (1,548) (1,343) (7,356) (745) 8 (8,071) 23 (2,600) (2,000) 5,934

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts