Question: hello may i have help on this one The is Problem Solving. All the answers are expressed at 2 digits after decimal point. All the

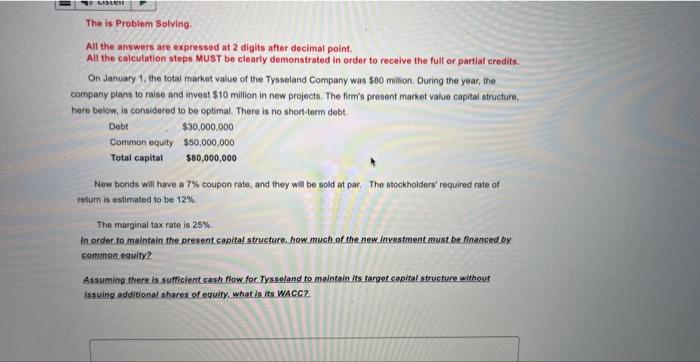

The is Problem Solving. All the answers are expressed at 2 digits after decimal point. All the calculation steps MUST be clearly demonstrated in order to receive the full or partial credits. On January 1 , the total rearket value of the Tysseland Company was $80 million. During the year, the company plant to raise and invest $10 million in new projects. The firm's present market value capital structure, here bolow, is considered to be optimal. There is no short-term debt. New bonds will have a 7% coupon rate, and they will be sold at par, The stockholders' required rate of retum is estimated to be 12%. The marginal tax rate is 25%. In order fo maintain the presen capital structure, how much of the new investment must be financed by common equity? Assuming there is sufficient cash flow for Tysseland to maintain ifs target capifal sfrucftare without issuing additional shares of equity, what is its WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts