Question: Hello, may I know why the answer is C? Also in the ans explanation, where does the term (N-1)/N comes from and what is the

Hello, may I know why the answer is C? Also in the ans explanation, where does the term (N-1)/N comes from and what is the relation between its value being one and the variance required to find in the question?

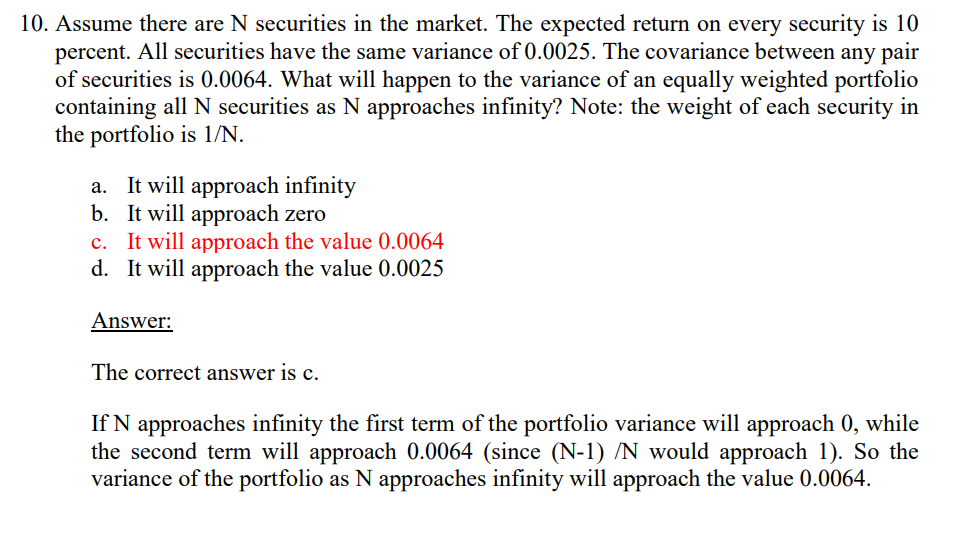

10. Assume there are N securities in the market. The expected return on every security is 10 percent. All securities have the same variance of 0.0025. The covariance between any pair of securities is 0.0064. What will happen to the variance of an equally weighted portfolio containing all N securities as N approaches infinity? Note: the weight of each security in the portfolio is 1/N. a. It will approach infinity b. It will approach zero It will approach the value 0.0064 d. It will approach the value 0.0025 c. Answer: The correct answer is c. If N approaches infinity the first term of the portfolio variance will approach 0, while the second term will approach 0.0064 (since (N-1) /N would approach 1). So the variance of the portfolio as N approaches infinity will approach the value 0.0064

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts