Question: hello. need help on these questions..using only fomular or financial calculator. not to using excel sheet ya. thank you 1. The Wentworth Art School is

hello. need help on these questions..using only fomular or financial calculator. not to using excel sheet ya. thank you

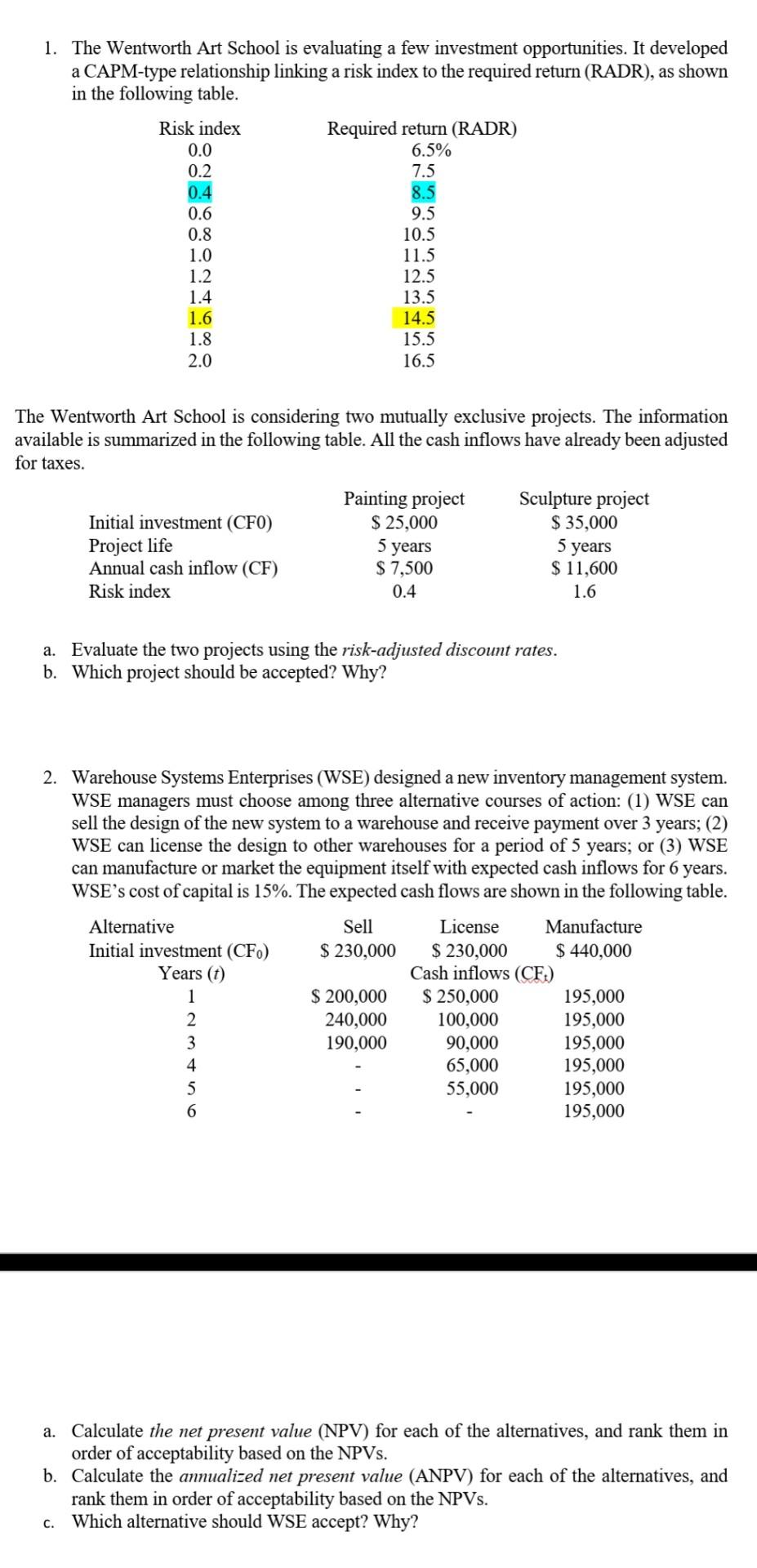

1. The Wentworth Art School is evaluating a few investment opportunities. It developed a CAPM-type relationship linking a risk index to the required return (RADR), as shown in the following table. The Wentworth Art School is considering two mutually exclusive projects. The information available is summarized in the following table. All the cash inflows have already been adjusted for taxes. a. Evaluate the two projects using the risk-adjusted discount rates. b. Which project should be accepted? Why? 2. Warehouse Systems Enterprises (WSE) designed a new inventory management system. WSE managers must choose among three alternative courses of action: (1) WSE can sell the design of the new system to a warehouse and receive payment over 3 years; (2) WSE can license the design to other warehouses for a period of 5 years; or (3) WSE can manufacture or market the equipment itself with expected cash inflows for 6 years. WSE's cost of capital is 15%. The expected cash flows are shown in the following table. a. Calculate the net present value (NPV) for each of the alternatives, and rank them in order of acceptability based on the NPVs. b. Calculate the annualized net present value (ANPV) for each of the alternatives, and rank them in order of acceptability based on the NPVs. c. Which alternative should WSE accept? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts