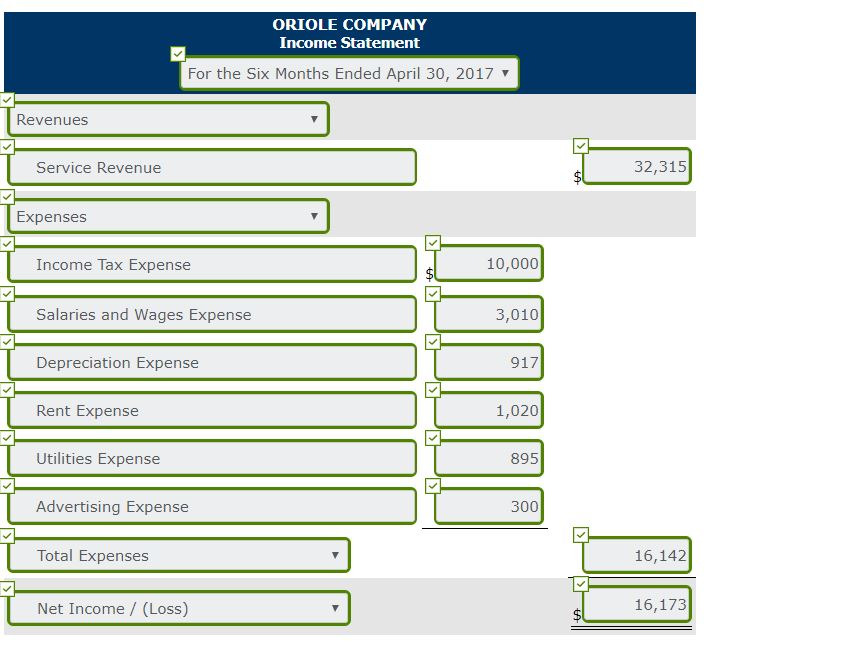

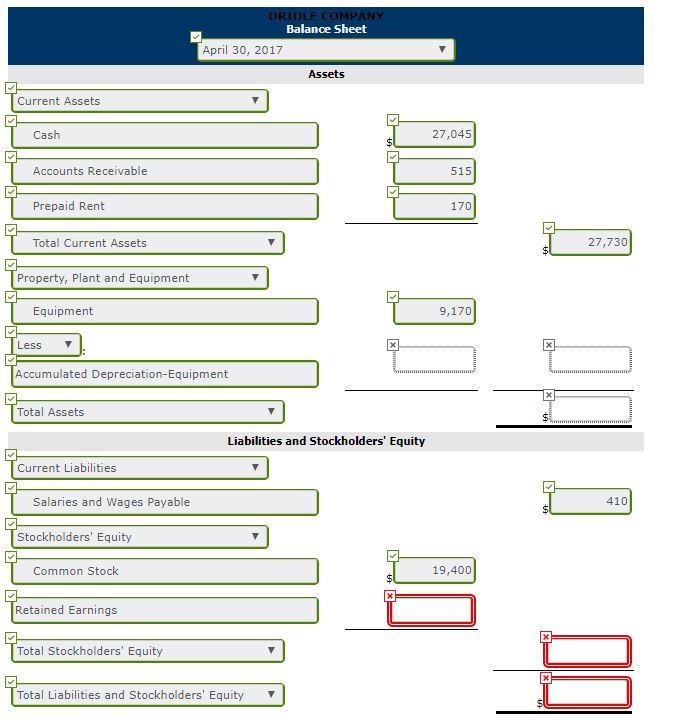

Question: Hello need help with boxes that aren't green! I don't know how to find Retained Earnings Question 1 Oriole Company, a ski tuning and repair

Hello need help with boxes that aren't green! I don't know how to find Retained Earnings

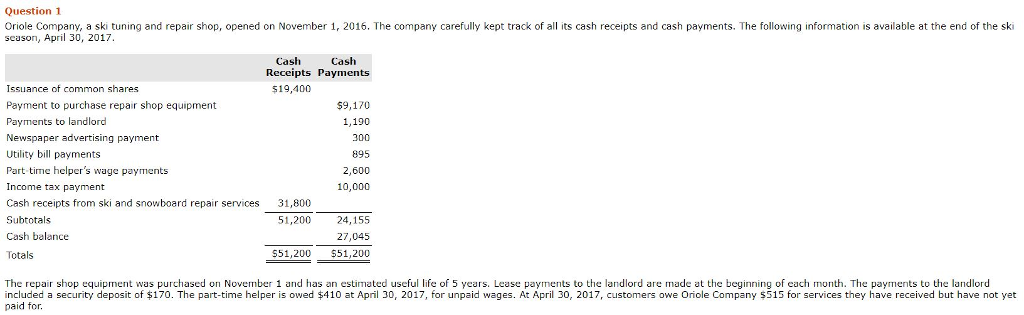

Question 1 Oriole Company, a ski tuning and repair shop, opened on November 1, 2016. The company carefully kept track of all its cash reoeipts and cash payments. The following information is available at the end of the ski season, April 30, 2017 Cash Cash Receipts Payments Issuance of common shares Payment to purchase repair shop equipment Payments to landlord Newspaper advertising payment Utility bill payments Part time helper's wage payments Income tax payment Cash receipts from ski and snowboard repair services Subtotals Cash balance Totals $19,400 $9,170 1,190 2,600 10,000 31,800 51,200 24,155 27,045 551,200 551,200 The repair shop equipment was purchased on November 1 and has an estimated useful life of 5 years. Lease payments to the landlord are made t the beginning of each month. The payments to the landlord paid for. included a security deposit of $170. The part-time helper is owed $410 at April 30, 2017, for unpaid wages. At April 30, 2017, customers owe Oriole Company $515 for services they have received but have not yet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts