Question: Hello. Need help with the attached problems Jaguar, Inc. maintains a debt-equity ratio of.60 and follows a residual dividend policy. The company has after-tax earnings

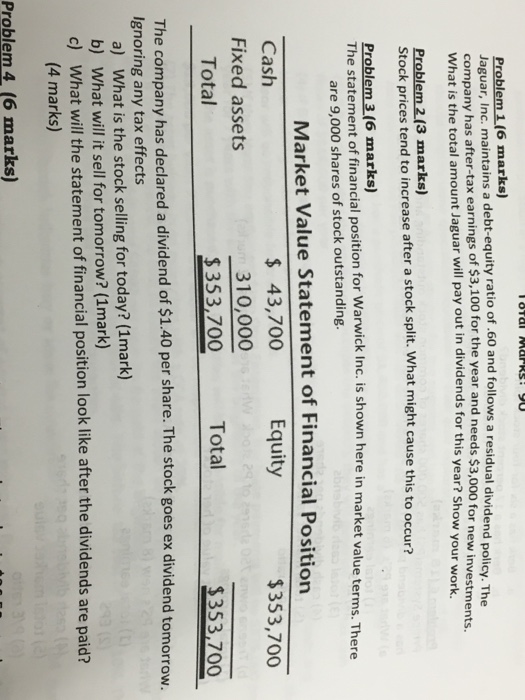

Jaguar, Inc. maintains a debt-equity ratio of.60 and follows a residual dividend policy. The company has after-tax earnings of $3,100 for the year and needs $3,000 for new investments. What is the total amount Jaguar will pay out in dividends for this year? Show your work. Stock prices tend to increase after a stock split. What might cause this to occur? The statement of financial position for Warwick Inc. is shown here in market value terms. There are 9,000 shares of stock outstanding. The company has declared a dividend of $1.40 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects a) What is the stock selling for today? b) What will it sell for tomorrow? c) What will the statement of financial position look like after the dividends are paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts