Question: Hello, need help with this. Thank you! E17.23 ( LO4 ) (Impairment) Elaina Company has the following investment as of December 31, 2022: Investment in

Hello, need help with this. Thank you!

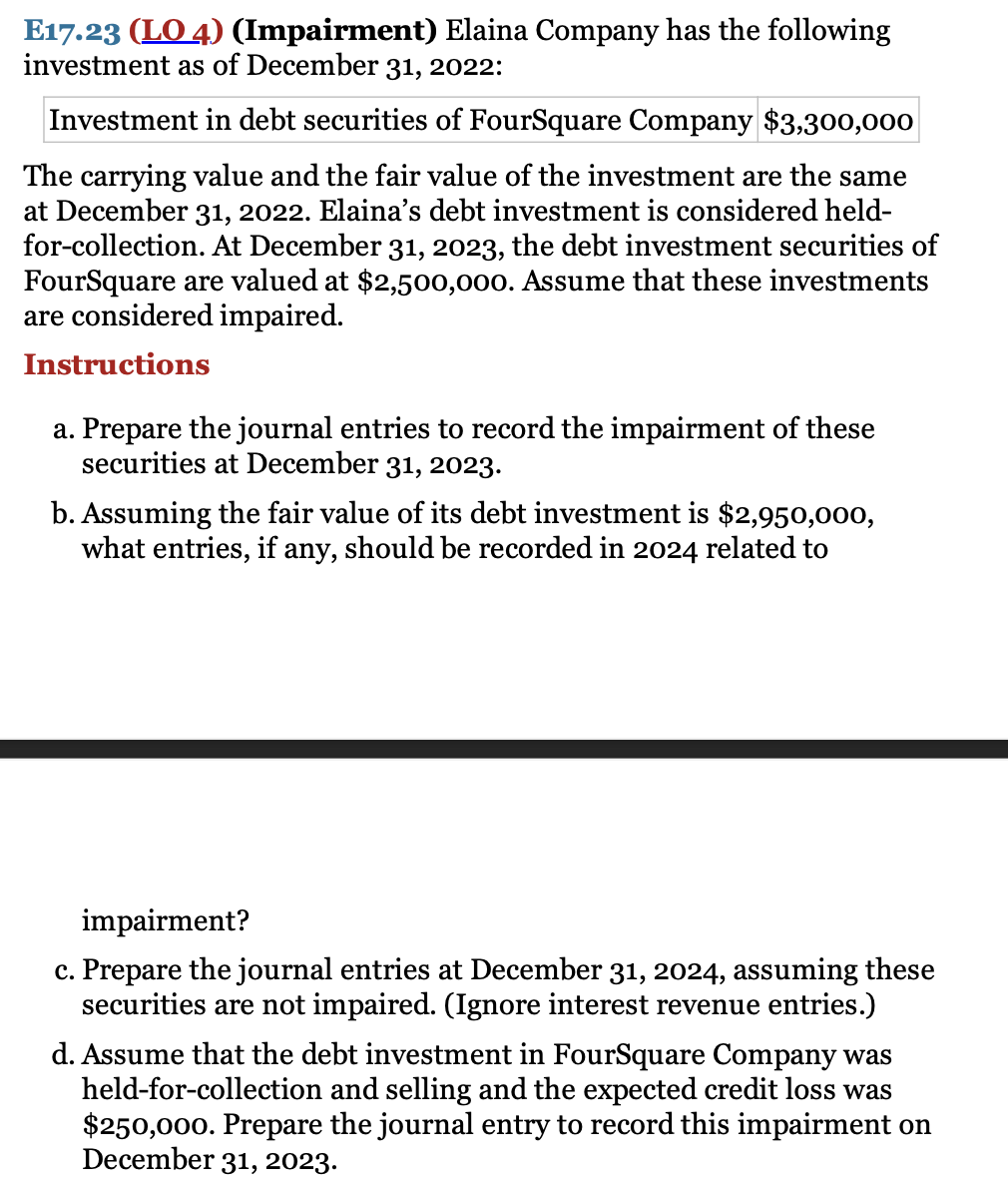

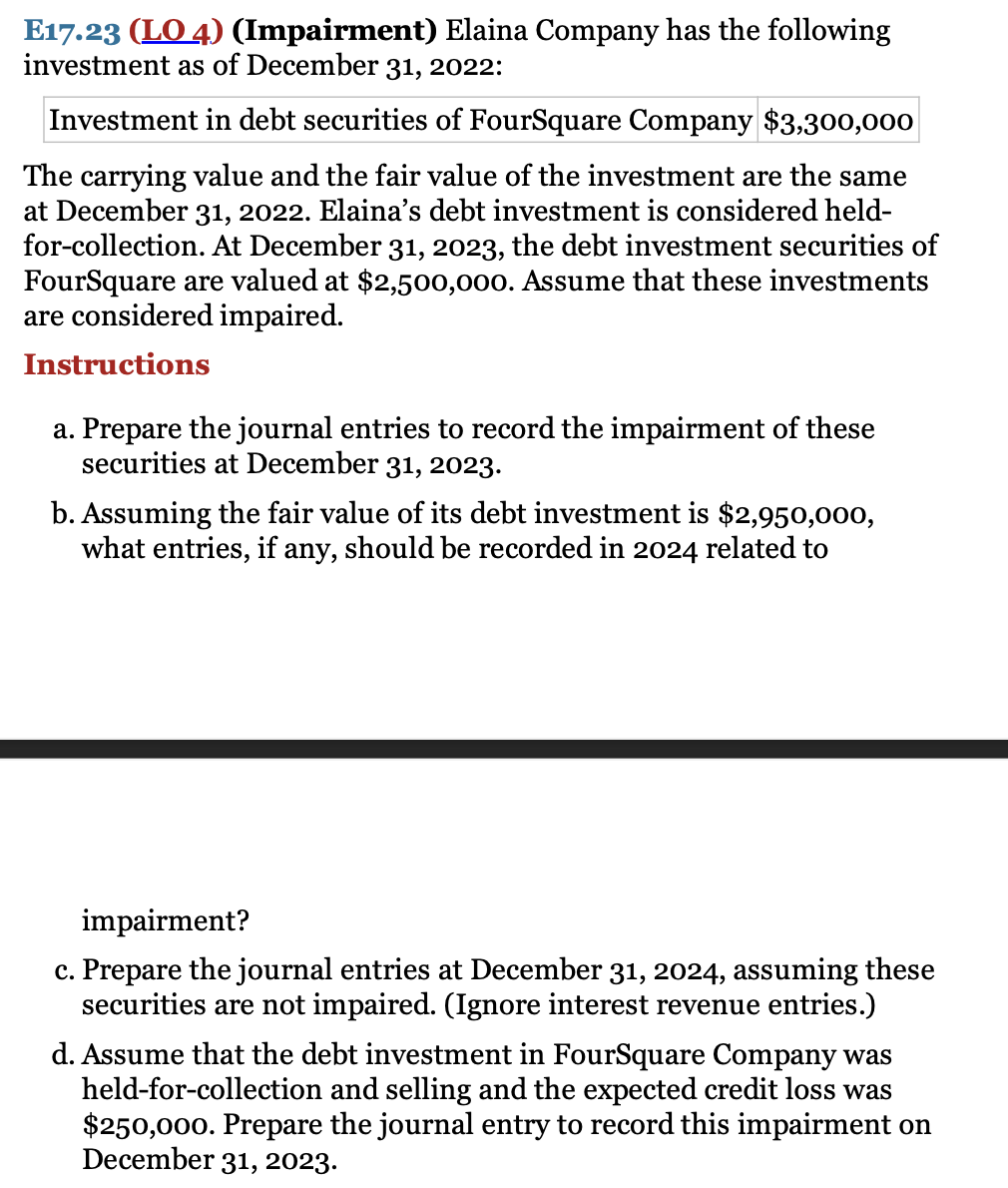

E17.23 ( LO4 ) (Impairment) Elaina Company has the following investment as of December 31, 2022: Investment in debt securities of FourSquare Company $3,300,000 The carrying value and the fair value of the investment are the same at December 31, 2022. Elaina's debt investment is considered heldfor-collection. At December 31, 2023, the debt investment securities of FourSquare are valued at $2,500,000. Assume that these investments are considered impaired. Instructions a. Prepare the journal entries to record the impairment of these securities at December 31, 2023. b. Assuming the fair value of its debt investment is $2,950,000, what entries, if any, should be recorded in 2024 related to impairment? c. Prepare the journal entries at December 31, 2024, assuming these securities are not impaired. (Ignore interest revenue entries.) d. Assume that the debt investment in FourSquare Company was held-for-collection and selling and the expected credit loss was $250,000. Prepare the journal entry to record this impairment on December 31, 2023. E17.23 ( LO4 ) (Impairment) Elaina Company has the following investment as of December 31, 2022: Investment in debt securities of FourSquare Company $3,300,000 The carrying value and the fair value of the investment are the same at December 31, 2022. Elaina's debt investment is considered heldfor-collection. At December 31, 2023, the debt investment securities of FourSquare are valued at $2,500,000. Assume that these investments are considered impaired. Instructions a. Prepare the journal entries to record the impairment of these securities at December 31, 2023. b. Assuming the fair value of its debt investment is $2,950,000, what entries, if any, should be recorded in 2024 related to impairment? c. Prepare the journal entries at December 31, 2024, assuming these securities are not impaired. (Ignore interest revenue entries.) d. Assume that the debt investment in FourSquare Company was held-for-collection and selling and the expected credit loss was $250,000. Prepare the journal entry to record this impairment on December 31, 2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts