Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you!

provide the answer TO EACH QUESTION CLEARLY please!!!

PLEASE CLEARLY LABLE THE ANSWER & SHOW ALL WORK.

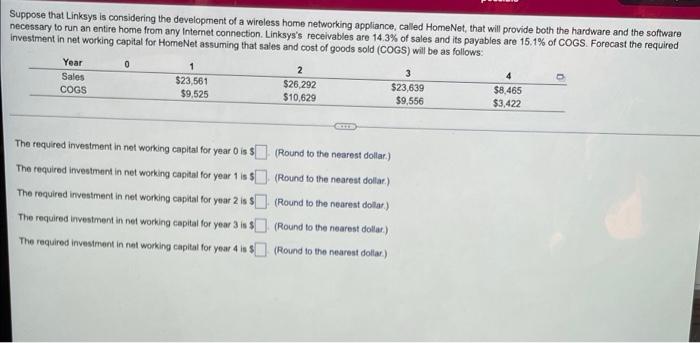

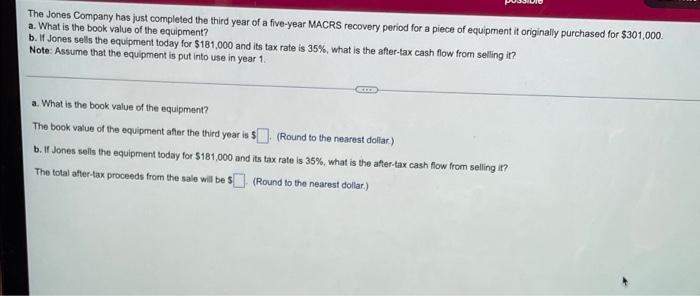

Suppose that Linksys is considering the development of a wireless home networking appliance, called HomeNet, that will provide both the hardware and the software necessary to run an entire home from any Internet connection. Linksys's receivables are 14.3% of sales and its payables are 15.1% of COGS. Forecast the required investment in net working capital for HomeNet assuming that sales and cost of goods sold (COGS) will be as follows: Year 1 2 3 4 $23,639 $8,465 Sales COGS $23,561 $9,525 $26,292 $10,629 $9,556 $3,422 EXIT (Round to the nearest dollar) (Round to the nearest dollar). The required investment in net working capital for year 0 is S The required investment in net working capital for year 1 is $ The required investment in net working capital for year 2 is $ The required investment in net working capital for year 3 is $ The required investment in net working capital for year 4 is $ (Round to the nearest dollar) (Round to the nearest dollar) (Round to the nearest dollar) The Jones Company has just completed the third year of a five-year MACRS recovery period for a piece of equipment it originally purchased for $301,000. a. What is the book value of the equipment? b. If Jones sells the equipment today for $181,000 and its tax rate is 35%, what is the after-tax cash flow from selling it? Note: Assume that the equipment is put into use in year 1. KIB a. What is the book value of the equipment? The book value of the equipment after the third year is $. (Round to the nearest dollar) b. If Jones sells the equipment today for $181,000 and its tax rate is 35%, what is the after-tax cash flow from selling it? The total after-tax proceeds from the sale will be $ (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts