Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you!

provide the answer TO EACH QUESTION CLEARLY please!!!

PLEASE CLEARLY LABLE THE ANSWER & SHOW ALL WORK.

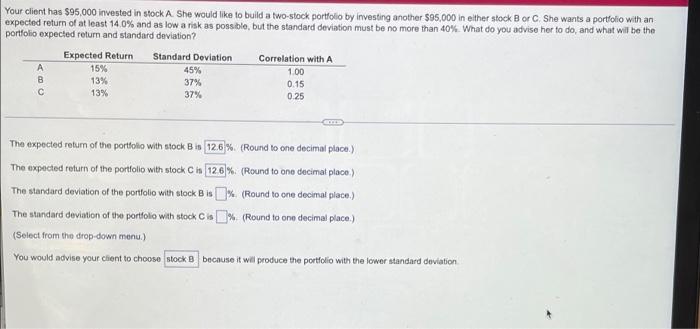

question 1

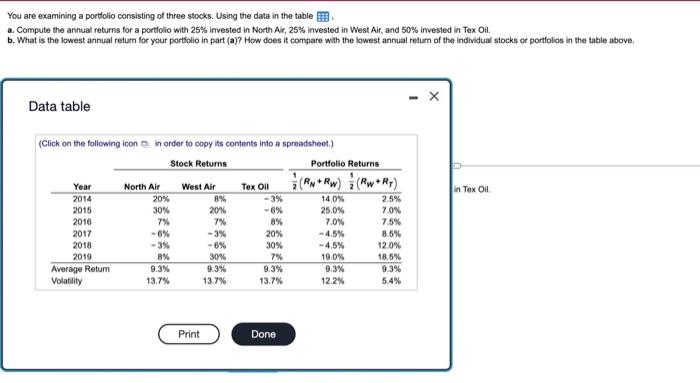

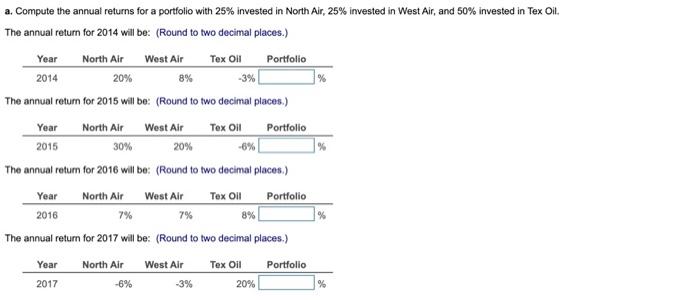

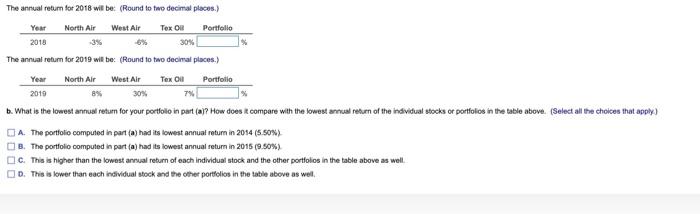

Your client has $95.000 invested in stock A She would like to build a two-stock portfolio by investing another $85,000 in either stock B or C She wants a portfolio with an expected return of at least 140% and as low a risk as possible, but the standard deviation must be no more than 40%. What do you advise her to do, and what will be the portfolio expected return and standard deviation Expected Return Standard Deviation Correlation with A A 15% 45% 1.00 B 13% 37% 0.15 13% 37% 0.25 The expected return of the portfolio with stock Bis 126% (Round to one decimal place.) The expected return of the portfolio with stock C in 126% (Round to one decimal place) % The standard deviation of the portfolio with stock Bis % (Round to one decimal place.) The standard deviation of the portfolio with stock is % (Round to one decimal place.) (Select from the drop-down menu.) You would advise your client to choose stock 8 because it will produce the portfolio with the lower standard deviation You are examining a portfolio consisting of three stocks. Using the data in the table. a. Compute the annual returns for a portfolio with 25% invested in North Air, 25% invested in West Air, and 50% invested in Tex Oil 6. What is the lowest annual return for your portfolio in part (a)? How does it compare with the lowest annual return of the individual stocks or portfolios in the table above. Data table in Tex Oil (Click on the following icon in order to copy its contents into a spreadsheet.) Stock Returns Portfolio Returns Year North Air West Air Tex Oil 2014 20% 8% -3% 14.0% 2.5% 2015 30% 20% -0% 25.0% 7.0% 2016 7% 7% 8% 7.0% 7.5% 2017 - 6% -3% 20% - 4.5% 8.5% 2018 -3% -0% 30% -4.5% 12 0% 2019 8% 30% 7% 19.0% 18.6% Average Return 9.3% 9.3% 9.3% 9.3% 9.3% Volatility 13.7% 13.7% 13.7% 12.2% 5.4% Print Done 8% % a. Compute the annual returns for a portfolio with 25% invested in North Air, 25% invested in West Air, and 50% invested in Tex Oil. The annual return for 2014 will be: (Round to two decimal places.) Year North Air West Air Tex Portfolio 2014 20% -3% The annual return for 2015 will be: (Round to two decimal places.) Year North Air West Air Tex Oil Portfolio 2015 30% 20% % The annual return for 2016 will be: (Round to two decimal places.) Year North Air West Air Tex Oil Portfolio 2016 7% 7% 8% The annual return for 2017 will be: (Round to two decimal places.) % Year North Air Tex Oil Portfolio West Air -3% 2017 -6% 20% % The annual return for 2018 will be: (Round to two decimal places. Year North Air West Air Tex O Portfolio 2018 -3% 6% 30% The annual return for 2019 will be: (Round to two decimal places. Year North Air West Air Tex On Portfolio 2010 8% 30% 7 b. What is the lowest annual return for your portfolio in part (ay? How does it compare with the lowest annual return of the individual stocks or portfolios in the table above. (Select all the choices that apply) A. The portfolio computed in part() had its lowest annual return in 2014 (5.50%) B. The portfolio computed in part(a) had its lowest annual retum in 2015 (9.50%) c. This is higher than the lowest annual return of each individual stock and the other portfolios in the table above as well D. This is lower than each individual stock and the other portfolios in the table above as well

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts