Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you!

provide the answer TO EACH QUESTION CLEARLY please!!!

PLEASE CLEARLY LABLE THE ANSWER & SHOW ALL WORK.

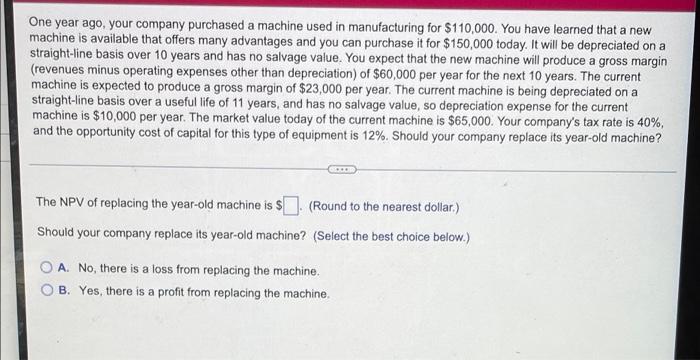

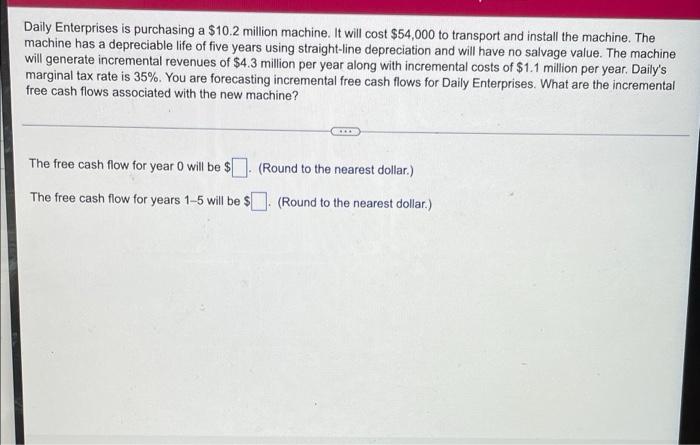

One year ago, your company purchased a machine used in manufacturing for $110,000. You have learned that a new machine is available that offers many advantages and you can purchase it for $150,000 today. It will be depreciated on a straight-line basis over 10 years and has no salvage value. You expect that the new machine will produce a gross margin (revenues minus operating expenses other than depreciation) of $60,000 per year for the next 10 years. The current machine is expected to produce a gross margin of $23,000 per year. The current machine is being depreciated on a straight-line basis over a useful life of 11 years, and has no salvage value, so depreciation expense for the current machine is $10,000 per year. The market value today of the current machine is $65,000. Your company's tax rate is 40%, and the opportunity cost of capital for this type of equipment is 12%. Should your company replace its year-old machine? The NPV of replacing the year-old machine is $. (Round to the nearest dollar.) Should your company replace its year-old machine? (Select the best choice below.) O A No, there is a loss from replacing the machine B. Yes, there is a profit from replacing the machine. Daily Enterprises is purchasing a $10.2 million machine. It will cost $54,000 to transport and install the machine. The machine has a depreciable life of five years using straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.3 million per year along with incremental costs of $1.1 million per year. Daily's marginal tax rate is 35%. You are forecasting incremental free cash flows for Daily Enterprises. What are the incremental free cash flows associated with the new machine? The free cash flow for year 0 will be $ - (Round to the nearest dollar.) The free cash flow for years 1-5 will be $(Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts