Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

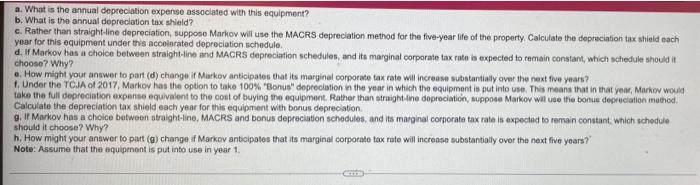

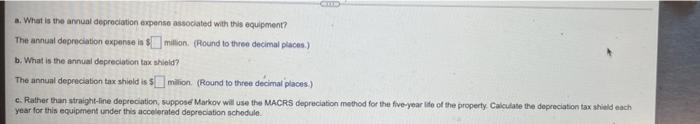

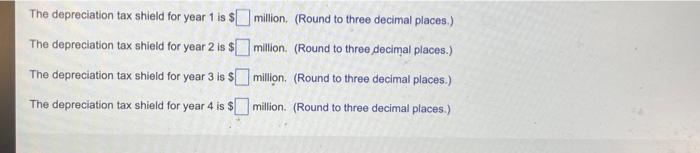

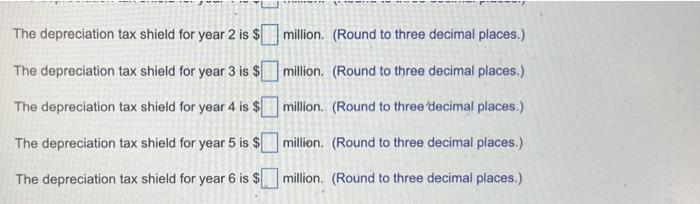

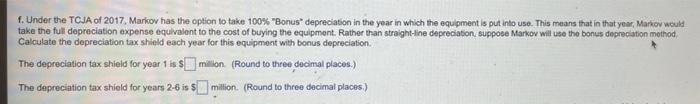

Markov Manufacturing recently spent $11.6 million to purchase some equipment used in the manufacture of disk drives. The firm expects that this equipment will have a unetul ite of five years, and its marginal corporate tax rate is 21%. The company plans to use straight line depreciation a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield? e. Rather than straight-line depreciation, suppore Markov will use the MACRS depreciation method for the fiveyear life of the property. Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule d. 1 Markov has a choice between straight line and MACRS depreciation schedules, and its marginal corporate tax rate is expected to main constant, which schedule should a choose? Why? .. How might your answer to part (d) change i Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years? 1. Under the TCJA of 2017. Markov has the option to take 100% Bonus depreciation in the year in which the equipment is put into use. This means that in that year, Markov would take the full depreciation expense equivalent to the cost of buying the equipment. Rather than straight-line depreciation, suppose Markov will use the bonus depreciatic method Calculate the depreciation tax shield each year for this equipment with bonus depreciation 9. Markov has a choice between straight-line, MACRS and bonus depreciation schedules, and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why? a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield? c. Rather than straight-line depreciation suppose Markov will use the MACRS depreciation method for the five-year life of the property Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule d. Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax rate was expected to remain constant, which schedule should it choose? Why? a. How might your answer to part (d) change i Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years? 1. Under the TCJA of 2017, Markov has the option to take 100% Bonus" depreciation in the year in which the equipment is put into use. This means that in that you, Markow would take the full depreciation expense equivalent to the cost of buying the equipment. Rather than straight line depreciation, suppose Markov will use the bonus depreciation method Calculate the depreciation tax shield each year for this equipment with bonus depreciation g. If Markov has a choice between straight-line, MACRS and bonus depreciation schedules, and its marginal corporate tax rate is expected to remain constant, which schedule should it choose? Why? h. How might your answer to part (e) change if Markov anticipates that its marginal corporate tax rate will increase substantially over the next five years? Note: Assume that the equipment is put into use in year 1. GI a. What is the annual depreciation expense associated with this equipment? The annual depreciation expense is $million (Round to three decimal places) b. What is the annual depreciation tax shield? The annual depreciation tax shield is 5 milion (Round to three decimal places) c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the five-year life of the property Calculate the depreciation tax shid each year for this equipment under this accelerated depreciation schedule The depreciation tax shield for year 1 is $ million (Round to three decimal places.) The depreciation tax shield for year 2 is $ million (Round to three decimal places.) The depreciation tax shield for year 3 is $ million. (Round to three decimal places.) The depreciation tax shield for year 4 is million (Round to three decimal places.) The depreciation tax shield for year 2 is $ million. (Round to three decimal places.) The depreciation tax shield for year 3 is $ million. (Round to three decimal places.) The depreciation tax shield for year 4 is $ million. (Round to three decimal places.) The depreciation tax shield for year 5 is $ million (Round to three decimal places.) The depreciation tax shield for year 6 is $ million (Round to three decimal places.) f. Under the TCJA of 2017. Marico has the option to take 100% Bonus depreciation in the year in which the equipment is put into use. This means that in that year, Markov would take the full depreciation expense equivalent to the cost of buying the equipment. Rather than straight-line depreciation suppose Markov will use the bonus depreciation method Calculate the depreciation tax shield each year for this equipment with bonus depreciation The depreciation tax shield for year 1 is million (Round to three decimal places.) 1 The depreciation tax shield for years 2-6 is $ million (Round to three decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts