Question: Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you! provide the answer TO EACH

Hello! please answer all parts to the question clearly please its sometimes hard to understand the experts please thank you!

provide the answer TO EACH QUESTION CLEARLY please!!!

PLEASE CLEARLY LABLE THE ANSWER & SHOW ALL WORK.

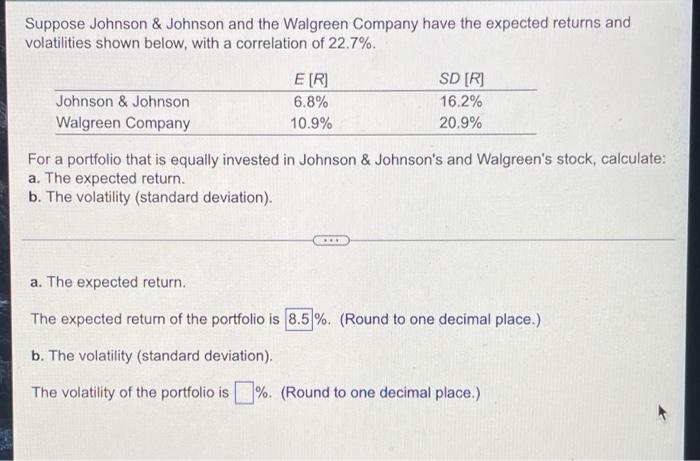

Suppose Johnson & Johnson and the Walgreen Company have the expected returns and volatilities shown below, with a correlation of 22.7%. E [R] SD [R] Johnson & Johnson 6.8% 16.2% Walgreen Company 10.9% 20.9% For a portfolio that is equally invested in Johnson & Johnson's and Walgreen's stock, calculate: a. The expected return. b. The volatility (standard deviation). a. The expected return. The expected return of the portfolio is 8.5%. (Round to one decimal place.) b. The volatility (standard deviation). The volatility of the portfolio is%. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts